EUR/GBP has been quite non-volatile with recent bullish gains which is expected to push the price much higher in the coming days. GBP has been struggling in the context of the recent trade jitters and the Brexit situation. Interestingly, positive economic reports does not provide EUR with support.

Recently, UK CPI report was published as expected with a 2.5% increase from the previous value of 2.4% and PPI input also increased to 0.5% from the previous value of 0.3% which was expected to decrease to 0.1%. Today, UK Retail Sales report was published with an increase to 0.7% from the previous negative value of -0.5% which did not quite help the currency to win back losses yet.

On the other hand, despite the worse-than-expected data today, EUR gained momentum. Today, German WPI report was published with a decrease to 0.0% which was expected to be unchanged at 0.5% and Trade Balance decreased to 16.7B from the previous figure of 16.9 which was expected to increase to 17.0B.

Meanwhile, the market seems to be quite biased on the EUR side despite the back to back worse economic figures on the same day. While GBP is struggling to gain momentum, any further positive EUR economic report is expected to inject more bullish pressure in the pair in the near future.

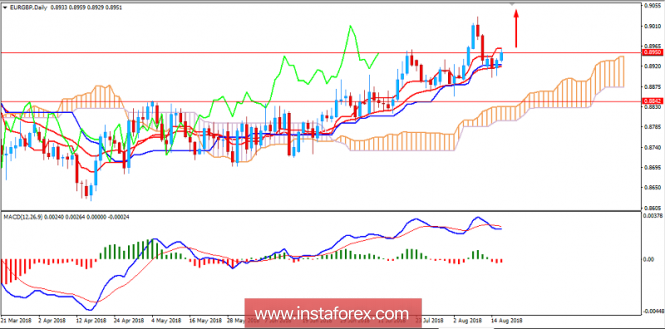

Now let us look at the technical view. The price is currently residing at the edge of breaking above 0.8950 area with confluence of 20 EMA, Tenkan and Kijun line. The Chikou Span is also indicating an upward momentum having Price Line as support is expected to inject further bullish momentum in the market. A daily close above 0.8950 is expected to inject further impulsive bullish pressure in the market in the future. As the price remains above 0.8850 area, the bullish bias is expected to continue with a target towards 0.9300 resistance area in the coming days.

SUPPORT: 0.8850

RESISTANCE: 0.8950, 0.9300

BIAS: BULLISH

MOMENTUM: IMPULSIVE and NON-VOLATILE