AUD/USD has recently broken below the 0.7300 support area with a daily close, which is currently pushing higher towards the area for a retest before progressing lower with the trend in the future. As of the recent mixed economic reports, AUD lost momentum against USD in the process which is expected to lead to further downward pressures in the future.

Recently, AUD Wage Price Index report has been published with a slight increase to 0.6% as expected from the previous value of 0.5%. Today, AUD Employment Change report has been published with a significant decrease to -3.9k from the previous figure of 58.2k and Unemployment Rate has decreased to 5.3% which was expected to be unchanged at 5.4%. Despite the mixed economic reports while the bias is more dovish, AUD is currently gaining certain momentum which is expected to be quite short-term in the process.

On the other hand, USD having better Retail Sales reports is expected to extend its gains further in the coming days. Recently, USD Retail Sales report has been published with an increase to 0.5% from the previous value of 0.2% which was expected to decrease to 0.1% and Core Retail Sales also has increased to 0.6% from the previous value of 0.2% which was expected to be at 0.3%. Today, USD Building Permits report is going to be published which is expected to increase to 1.31M from the previous figure of 1.29M, Housing Starts is expected to increase to 1.27M from the previous figure of 1.17M and Philly Fed Manufacturing Index is expected to decrease to 21.9 from the previous figure of 25.7.

As of the current scenario, USD is currently quite optimistic and hawkish with the economic reports to be published whereas AUD is quite indecisive with the mixed economic reports. As the upcoming economic reports publish on the USD, further gain on the USD side is expected which may lead to further gain on the bearish side of the market in this pair.

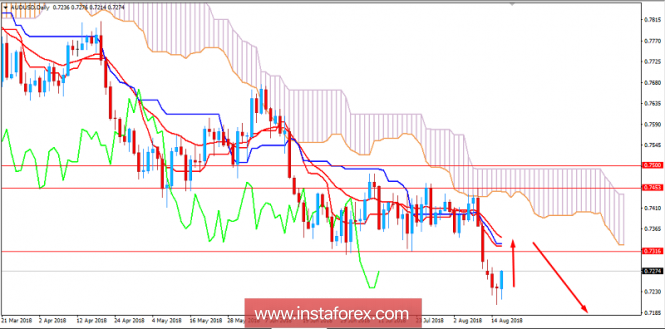

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains after the indecisive daily candle closed yesterday. Currently, the price is expected to push higher towards the 0.73 area where the dynamic levels like 20 EMA, Tenkan and Kijun line rests, which is expected to lead to further bearish momentum upon rejection with confluence and result to further downward pressure with target towards the 0.7050 area in the future. As the price remains below the 0.75 area, the bearish bias is expected to continue.

SUPPORT: 0.7050

RESISTANCE: 0.7300, 0.7500

BIAS: BEARISH

MOMENTUM: VOLATILE