AUD/JPY is currently quite impulsive with bullish gains after having a breakout below 80.50 area with a daily close recently. AUD has been dominated by JPY in many ways. However, having mixed economic reports today with a decrease in Australia's unemployment rate, certain gain on the AUD side is being observed.

AUD has been trading quite mixed amid the recent economic reports which enabled JPY to be ahead in a consistent basis. Recently, AUD Wage Price Index report was published with a slight increase to 0.6% as expected from the previous value of 0.5%. Today, AUD Employment Change report was published with a significant decrease to -3.9k from the previous figure of 58.2k and Unemployment Rate declined to 5.3% which was expected to be unchanged at 5.4%. Despite the mixed economic reports, AUD is currently gaining certain momentum which is expected to be quite short-lived in the process.

On the JPY side, it has been quite solid with the recent economic reports which helped the currency to gain on a consistent basis against AUD so far. Recently, Japan's Revised Industrial Production report was published with an increase to -1.8% which was expected to be unchanged at -2.1%. The positive economic report helped JPY to sustain the momentum. But JPY weakened immediately because of the worse-than-expected reading today. Today, Japan's Trade Balance report was published with a significant decrease to -0.05T from the previous figure of 0.08T which was expected to be at 0.02T.

Meanwhile, JPY is expected lose further momentum against AUD in the process while the upward momentum is expected to be a medium-term process. As AUD has been underperforming for certain period and having Employment Change shooting drastically lower today, AUD gains are expected to temporary. In the long term, JPY is expected to regain momentum and recover earlier losses.

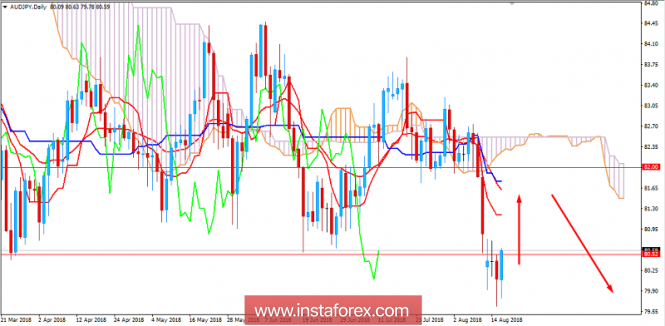

Now let us look at the technical view. The price is currently trying to break above 80.50 area with an impulsive bullish pressure which if makes a daily close above the area is expected to inject further impulsive bullish pressure in the pair. As the price is currently residing quite apart from the dynamic level of 20 EMA, certain bullish pressure is expected to follow but any rejection off the 82.00 area with confluence of the dynamic levels of 20 EMA, Tenkan and Kijun line. The price is expected to push below 80.50 area in the future. As the price remains below 82.00 area, the bearish bias is expected to continue further.

SUPPORT: 75.00

RESISTANCE: 80.50, 82.00

BIAS: BEARISH

MOMENTUM: VOLATILE