CHF/JPY has been quite impulsive and non-volatile amid recent bullish momentum which led the price to break above 113.00 area with a daily close. CHF has been the dominant currency in the pair recently, whereas JPY is currently pushing forward for regaining certain momentum in the process.

JPY has been quite positive in light of recent economic reports like Retail Sales which was published with better than expected result at 1.5% which was expected to decrease to 1.3% from the previous value of 1.7%. Today Tokyo Core CPI report was published with a slight increase to 0.9% which was expected to be unchanged at 0.8% but Unemployment Rate report was published with an increase to 2.5% which was also expected to be unchanged at 2.4%. Moreover, today Japan's Prelim Industrial Production performed worse than expected at -0.1% which was expected to increase to 0.3% from the previous value of -1.8%.

On the other hand, this week Credit Suisse Economic Expectations report was published with a decrease to -14.3 from the previous figure of -4.0 and KOF Economic Barometer report was also published with a decrease to 100.3 from the previous figure of 101.7 which was expected to be at 101.2. The disappointing economic report stopped the impulsive pressure in the process, but it is expected to be short-lived.

As for the current scenario, CHF is expected to weaken for a certain period of time before pushing high again with impulsive pressure it had recently, whereas JPY amid better economic reports is expected regain certain grounds in the process leading to short-term bearish momentum in the pair for the coming days.

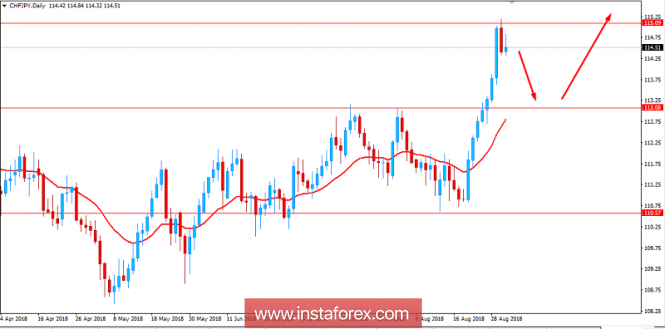

Now let us look at the technical view. The price is currently residing below 115.00 area after an impulsive bullish rejection off the area with a daily close. As the price is also residing quite far from the mean average of 20 EMA, it is expected to retrace towards 113.00 again to retest it as support before pushing higher with an aim of breaking above 115.00 area in the future. As the price remains above 113.00 area with a daily close, the bullish bias is expected to continue further.

SUPPORT: 110.50, 113.00.

RESISTANCE: 115.00, 116.50

BIAS: BULLISH

MOMENTUM: VOLATILE