Dear colleagues.

For the currency pair Euro / Dollar, we continue to monitor the upward structure from August 23 and the upward movement is expected after the passage at the price of the noise range of 1.1719 - 1.1746. For a Pound / Dollar currency pair, the continuation of the upward movement is possible after passing through the noise range of 1.3045 - 1.3068. For the currency pair Dollar / Franc, we continue to move downwards after the passage of the range of 0.9683 - 0.9667 and we consider the movement upward as a correction. For the currency pair Dollar / Yen, the price is in correction and forms the potential for the downward movement from August 29. For the currency pair Euro / Yen, the price is in the correction area from the upward structure and forms the potential for the bottom of August 29. For the Pound / Yen currency pair, the price is in the correction zone from the upward trend and the continuation of the upward movement is expected after the breakdown of 145.71.

Forecast for August 31:

Analytical review of currency pairs in the scale of H1:

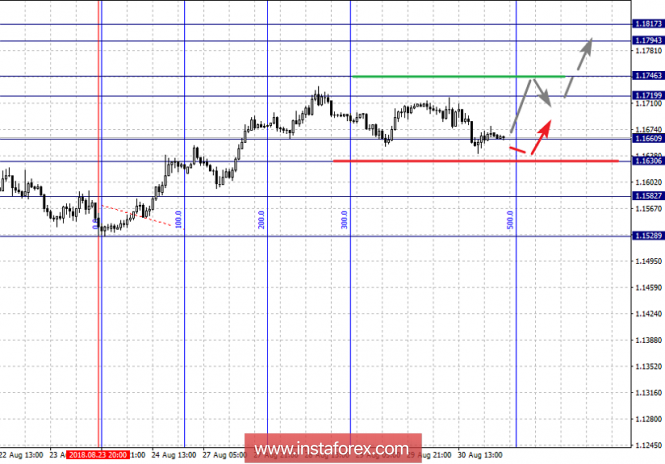

For the EUR / USD currency pair, the key levels on the scale of H1 are: 1.1817, 1.1794, 1.1746, 1.1719, 1.1660, 1.1630, 1.1582 and 1.1528. Here, we continue to follow the local upward structure of August 23. At the moment, the price is in correction. The short-term upward movement is expected in the corridor of 1.1719 - 1.1746 and the breakdown of the last value should be accompanied by a pronounced movement to the level of 1.1794. The potential value for the top is the level of 1.1817, after which we expect consolidation.

The short-term downward movement is possible in the corridor of 1.1660-1.1630 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1582 and this level is the support for the top.

The main trend is the local structure of August 23.

Trading recommendations:

Buy 1.1720 Take profit: 1.1744

Buy 1.1747 Take profit: 1.1792

Sell: 1.1660 Take profit: 1.1632

Sell: 1.1628 Take profit: 1.1585

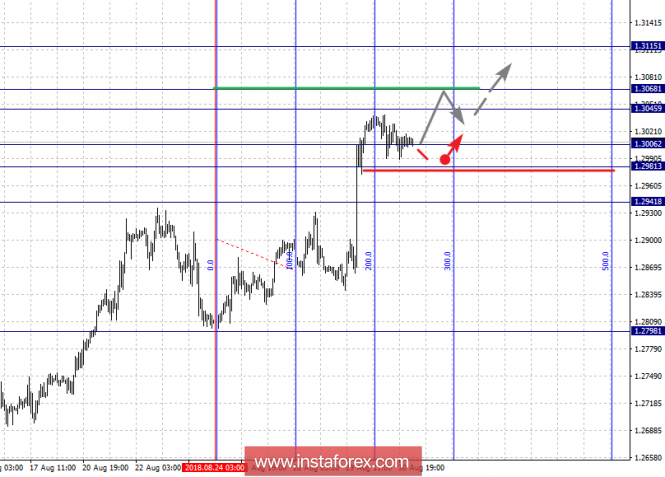

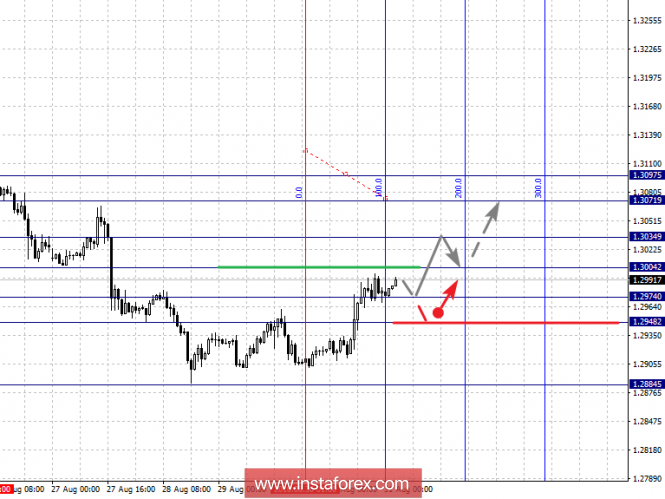

For the Pound / Dollar currency pair, the key levels on the H1 scale are: 1.3115, 1.3068, 1.3045, 1.3006, 1.2981 and 1.2941. Here, we follow the local upward structure of August 24. The continued upward movement is expected after passing through the noise range of 1.3045 - 1.3068. In this case, the target is 1.3115, from this level we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 1.3006 - 1.2981 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2941 and this level is the key support for the top.

The main trend is a local structure for the top of August 24.

Trading recommendations:

Buy: 1.3068 Take profit: 1.3113

Buy: Take profit:

Sell: 1.3005 Take profit: 1.2982

Sell: 1.2979 Take profit: 1.2941

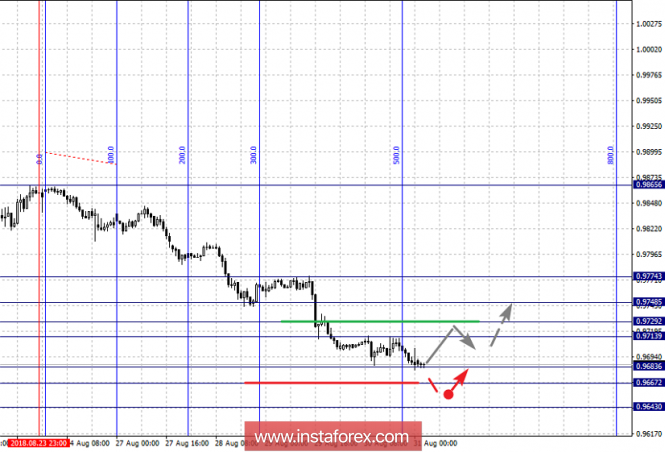

For the currency pair Dollar / Franc, the key levels on the scale of H1 are: 0.9774, 0.9748, 0.9729, 0.9713, 0.9683, 0.9667 and 0.9643. Here, we continue to follow the local top-down cycle of August 23. The short-term downtrend is possible in the range of 0.9683 - 0.9667 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9643, from this level we expect the movement to correction.

The short-term upward movement is possible in the corridor of 0.9713 - 0.9729 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9748 and the breakdown of which will in turn allow to count on the formation of the potential for the top. Here, the target is 0.9774.

The main trend is the local structure for the bottom of August 23.

Trading recommendations:

Buy: 0.9713 Take profit: 0.9726

Buy: 0.9731 Take profit: 0.9748

Sell: 0.9665 Take profit: 0.9645

Sell: Take profit:

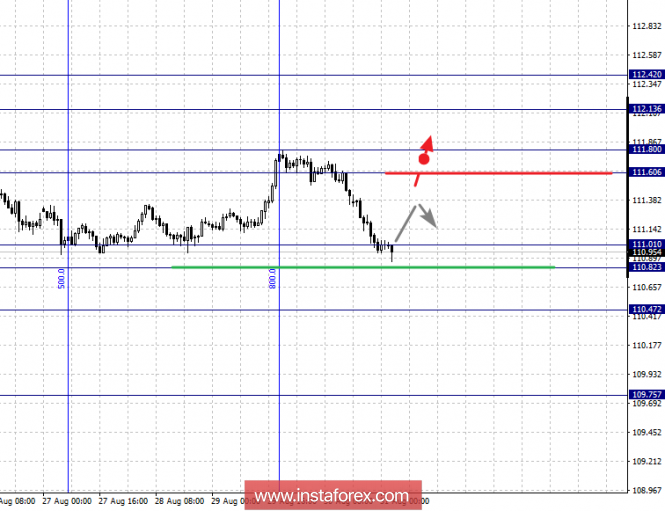

For the Dollar / Yen currency pair, the key levels on a scale of H1 are: 112.42, 112.13, 111.80, 111.60, 111.01, 110.82 and 110.47. Here, the price forms the potential for the bottom of August 29 in the correction of the ascending structure. The short-term upward movement is expected in the corridor of 111.60 - 111.80 and the breakdown of the last value will lead to a pronounced movement. In this case, the target is 112.13. We consider the level of 112.42 to be a potential value for the top, after which we expect consolidation, as well as a pullback to the bottom.

The short-term downward movement is possible in the corridor of 111.01 - 110.82 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 110.47 and this level is the key support for the upward structure.

The main trend: the upward structure of August 21, the correction stage.

Trading recommendations:

Buy: 111.60 Take profit: 111.80

Buy: 111.83 Take profit: 112.12

Sell: 111.00 Take profit: 110.83

Sell: 110.80 Take profit: 110.50

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3097, 1.3071, 1.3034, 1.3004, 1.2974, 1.2948 and 1.2884. Here, we follow the formation of the upward potential of August 30. The short-term ascendant is expected in the corridor of 1.3004 - 1.3034 and the breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3071. The potential value for the top is the level of 1.3097, after which we expect consolidation, as well as a pullback to the bottom.

The short-term downward movement is possible in the corridor of 1.2974 - 1.2948 and the breakdown of the last value will have to the development of a downward movement. Here, the target is 1.2884.

The main trend is the formation of the upward structure of August 30.

Trading recommendations:

Buy: 1.3004 Take profit: 1.3032

Buy: 1.3036 Take profit: 1.3070

Sell: 1.2973 Take profit: 1.2950

Sell: 1.2945 Take profit: 1.2895

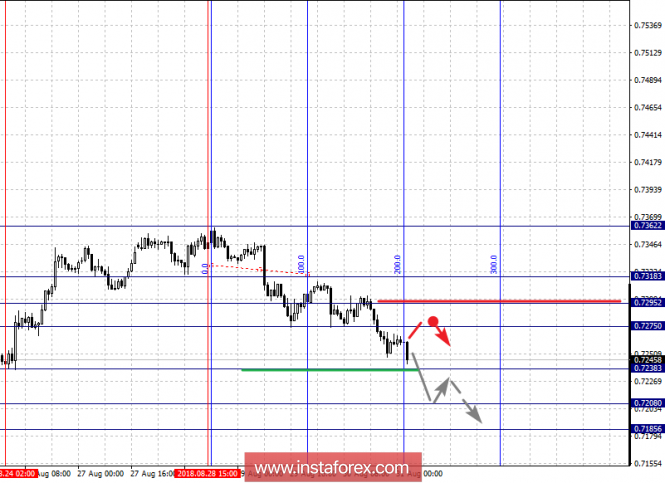

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7318, 0.7295, 0.7275, 0.7238, 0.7208 and 0.7185. Here, we follow the formation of the potential for the bottom of August 28. The continued downward movement is expected after the breakdown of 0.7238. In this case, the target is 0.7208, while the potential value for the downward movement is still the level of 0.7185, after which we expect consolidation.

The main trend is the formation of a downward structure from August 28.

Trading recommendations:

Buy: 0.7275 Take profit: 0.7293

Buy: 0.7297 Take profit: 0.7316

Sell: 0.7236 Take profit: 0.7210

Sell: 0.7206 Take profit: 0.7186

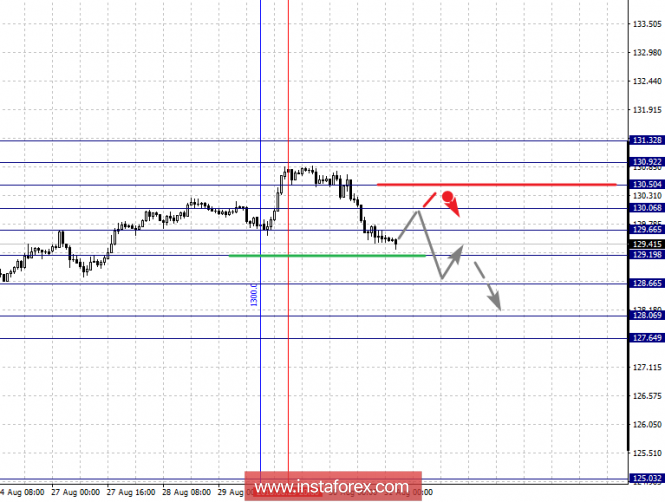

For the currency pair Euro / Yen, the key levels on the scale of H1 are: 131.32, 130.92, 130.50, 130.06, 129.66, 129.19, 128.66, 128.06 and 127.64. Here, the price is in correction from the upward structure and forms the potential for the bottom of August 29. The continuation of the movement downwards is expected after the breakdown of 129.19. In this case, the target is 128.66 and near this level is the consolidation. The breakdown level of 128.64 should be accompanied by a pronounced downward movement. Here, the target is 128.06. The potential value for the bottom is the level of 127.64, near which we expect the consolidated movement.

The short-term upward movement is possible in the corridor of 129.66 - 130.06 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 130.50 and this level is the key resistance for the subsequent development of the upward trend.

The main trend is the correction and capacity building for the bottom of August 29.

Trading recommendations:

Buy: 129.66 Take profit: 130.00

Buy: 130.08 Take profit: 130.50

Sell: 129.17 Take profit: 128.70

Sell: 128.62 Take profit: 128.09

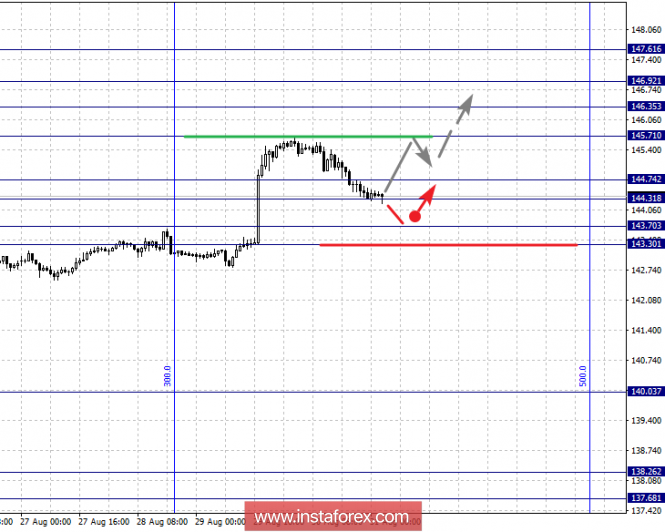

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 147.61, 146.92, 146.35, 145.71, 144.74, 144.31, 143.70 and 143.30. Here, we follow the development of the upward structure of August 15, the current price is in correction. The continuation of the upward movement is expected after the breakdown of 145.71. Here, the target is 146.35 and the breakdown of which will lead to a short-term upward movement in the range of 146.35 - 146.92. Hence, the probability of a turn downwards is high. The potential value for the top is the level of 147.61, upon reaching which we expect a pullback downwards.

The consolidated traffic is possible in the corridor of 144.74 - 144.31 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 143.70 and the range of 143.70 - 143.30 is the key support for the top.

The main trend is the medium-term ascending structure from August 15, the correction stage.

Trading recommendations:

Buy: 145.71 Take profit: 146.35

Buy: 146.39 Take profit: 146.90

Sell: Take profit:

Sell: 144.26 Take profit: 143.80

The material has been provided by InstaForex Company - www.instaforex.com