Positive rumors about the prospects of Brexit helped to recover not only the pound. The European currency also became the beneficiary of the situation, halting the decline in a pair with the dollar. But at this point, you should be very careful in choosing the direction of trade.

Firstly, the information noise around Brexit looks too unreliable, although some hopes for a deal before the end of this year still appeared. Secondly, tomorrow, EUR / USD traders will switch to important macroeconomic statistics, where the key role is played by European inflation. Also tomorrow, ECB Vice President Louis Gindons will make a speech, which will comment on the current situation in the economy of the eurozone.

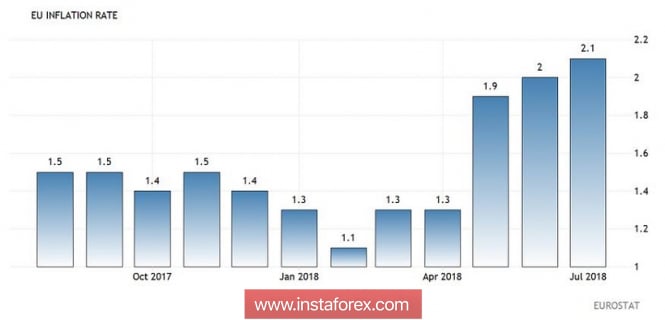

But the focus will, naturally, the dynamics of inflation. According to preliminary forecasts, in July, the consumer price index will rise to 2.1%, that is, to the June level. This is the strongest rate of inflationary growth since February last year. The core inflation index may also show a positive trend, reaching 1.1% (as in June).

If the indicators come out at the forecast level, the European currency will get an excuse for its growth, as such dynamics speak about certain prospects. First of all, the probability of completion of QE in December this year will remain at an extremely high level. Many traders believe that the issue of minimizing the incentive program is already decided and does not require discussion. However, it is not. Just this week, rumors appeared on the market that the Italian government could apply to the European Central Bank with a request to extend the QE to protect Italy's debt from "probable speculative actions". And although the country's vice-premier denied these intentions, experts do not exclude such a scenario. According to them, with speculative forays, the Italian government will have no other choice but to contact the ECB.

Also, we should not forget about the crisis in Turkey. Lira continues to lose its position versus the dollar, exacerbating the economic situation in the country. The fall of the currency continued after Germany denied the information that appeared that could provide financial assistance to Ankara. After that, the risk of default in the country again increased, reinforcing the flight of capital from the Turkish economy. At the moment, the credit rating of Turkey is lower than that of Greece, while bonds of the country's main banks are traded at a yield of twenty percent per annum. If the Turkish economy collapses, this will undoubtedly affect the European banking sector: according to experts, borrowers from Turkey owe a total of about $ 150 billion to European banks. Among the main creditors are Italian and French financial institutions. Given the sharp devaluation of the lira, the risk of "collapse" of the situation is great enough.

The factors listed above indicate that the option of extending QE can in no case be ruled out. Therefore, in this context, the growth of European inflation plays a big role. If the growth of the CPI does not survive the set pace and will begin to slow down by the end of this year, the probability of an extension of the stimulating program will increase. I'm not talking about raising the ECB rate: according to the majority of representatives of the regulator, this issue will be considered "not before the summer of 2019", provided the inflation is growing steadily. It is obvious that if inflation shows negative dynamics, then the issue of rate increase will be postponed for 2020. However, the determining factors will be not only macroeconomic data - regulator members will assess the consequences of Brexit, the level of political stability in the EU, the state of the Turkish economy, the trade relations between the US and China, the dynamics of the world economic growth and so on. But the growth of European inflation, in this case, plays a key role.

The publication of the consumer price index is not the only important release of Friday. We also learn about the state of the labor market in the European Union. This indicator is a traditional "ally" of the European currency. The unemployment rate in the EU has been gradually (but surely) going down since March 2017, declining from 9.4% to the current 8.3%. According to analysts' forecasts, in July the indicator will decrease by another one-tenth of a percent, that is, up to 8.2%. The data published today on the level of German unemployment (the figure remained at a record low of 5.2%) make it possible to say that the European unemployment tomorrow will also show positive dynamics.

Thus, the dynamics of the euro-dollar pair in the medium term largely depends on the release of tomorrow's data. If the European inflation confirms the hopes placed on it, then the pair is likely to not only gain a foothold in the 17th figure, but also test the resistance level 1.1760 (the upper line of the Bollinger Bands indicator on the daily chart). Otherwise, the price will return to the frame of the 16th figure, stuck in a sluggish flute.

The material has been provided by InstaForex Company - www.instaforex.com