Yesterday's session in Europe was better than expected at the beginning of the day. Admittedly, the indexes opened on small cons, but in the last two hours, they started a systematic upward move, which allowed DAX to close 0.8% more than yesterday. The other exchanges gained from symbolic + 0.03% (IBEX) to + 0.7% (FTSE Mib). Such results are typical for days when the euro loses against the dollar. Indeed, the exchange rate of the single currency, which yesterday had peaked at 1.1745, now fluctuates around 1.163. A negative impulse for other currencies, above all the euro, was given by the British pound, which weakened by over 150 pips. In the United Kingdom, the topic of monetary policy normalization seems to lie outside the area of investors' interest, who look primarily at the desperate struggle of Prime Minister T. May to stay in power and to get the majority of votes for his own Brexit solutions in the parliament. Her last remarks which were an attempt to calm the Eurosceptic factions of the Conservatives by promising to write a new Brexit plan caused aggressive resistance to her solutions from the opposite wing. Although within the Tories themselves it seems obviously weaker but is not afraid of cooperation with the Labor Party. The first demonstration of strength was won by this wing of the opposition to May voting on how to remain under the regulatory regime of the Union regarding medicines. The attempt to win the option of remaining in the customs union with the EU after Brexit was repelled allegedly only thanks to the threat of the prime minister that her loss in the vote would mean accelerated elections (after which the eurosceptic wing would surely have come to power in the party).

In conclusion, the political future of Great Britain seems to hang in the balance, but the impact of the pound on the behavior of the rest of the currencies should gradually decrease.

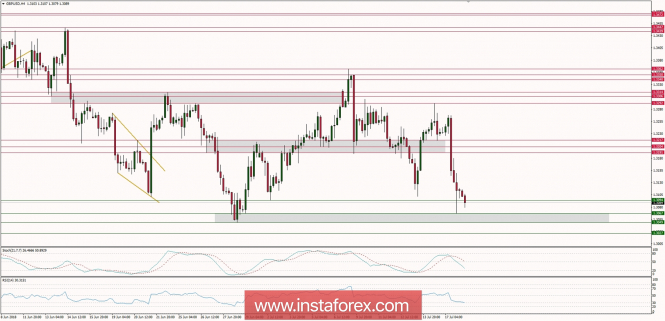

Let's now take a look at the GBP/USD technical picture at the H4 time frame. The market is closer and closer to the technical support at the level of 1.3067 as the bears are still pushing the prices lower. The lower range of the support is the level of 1.3049 and if this level is violated, then the price next target is seen at the level of 1.3024 and then 1.3000. The level of 1.3094 will now act as an intraday resistance for bulls.