Dear colleagues.

For the Euro/Dollar pair, the price forms the potential top of July 13, the dynamics are expected to increase after 15:00. For the Pound/Dollar pair, the price forms the potential top of July 13, while the development of the structure can be expected at 10:00 - 12:00 and the breakdown at the 1.3248 level is required. For the Dollar/Franc pair, the price is in the correction from the upward trend. For the Dollar/Yen pair, the continuation of the development of the upward structure from July 9 is expected after the passage at the noise range price of 112.73 - 112.93. For the Euro/Yen pair, we follow the local upward structure of July 11 at the 130.85 key support level. For the Pound/Yen pair, the development of the local upward structure is possible after the breakdown of 149.45.

The forecast for July 17:

Analytical review of currency pairs in the H1 scale:

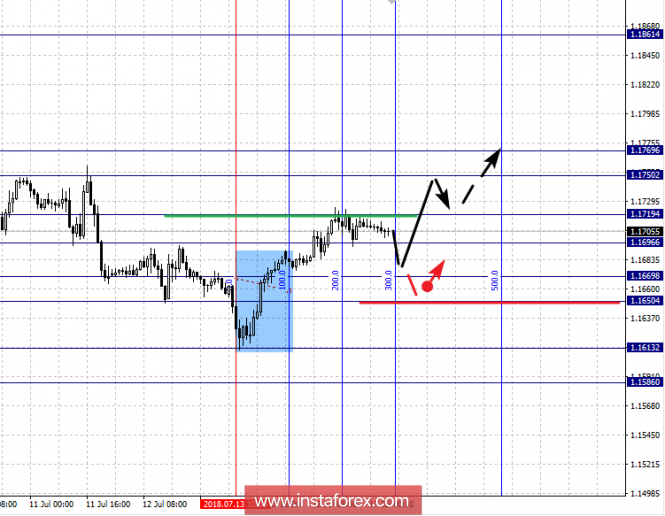

For the EUR/USD pair, the key levels on the H1 scale are: 1.1769, 1.1750, 1.1719, 1.1696, 1.1669, 1.1650, 1.1613 and 1.1586. Here, the price is in correction from the descending structure and forms the potential top of July 13. Consolidated traffic is expected in the corridor 1.1696-1.1719, while the breakdown of the last value should be accompanied by a pronounced upward movement with the target at 1.1750, in the corridor 1.1750 - 1.1769 consolidation.

Short-term downward movement is possible in the corridor 1.1669 - 1.1650, while the breakdown of the last value is projected to develop a downward structure with the target at 1.1613. We consider the 1.1586 level to be the potential value for the bottom as we expect a rollback to the top.

The main trend is the formation of the potential for the top of July 13.

Trading recommendations:

Buy: 1.1696 Take profit: 1.1716

Buy 1.1722 Take profit: 1.1750

Sell: 1.1667 Take profit: 1.1652

Sell: 1.1648 Take profit: 1.1615

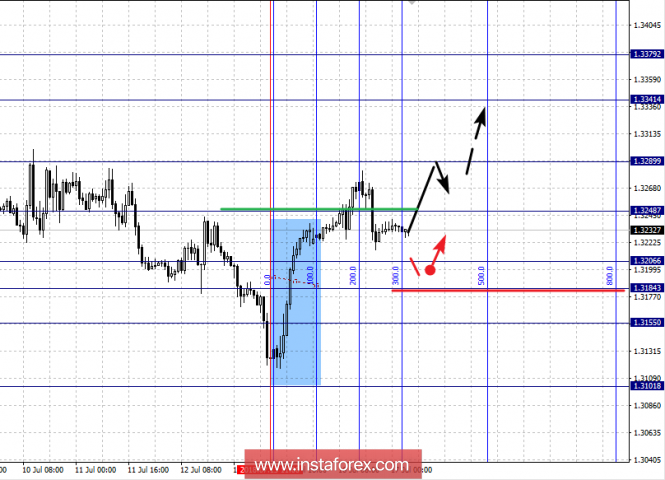

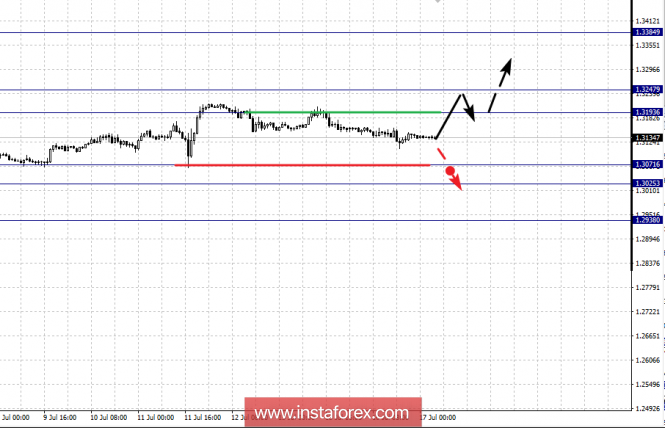

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3379, 1.3341, 1.3289, 1.3248, 1.3206, 1.3184 and 1.3155. Here, the price forms the potential upward movement of July 13. The continuation of the upward movement is expected after the breakdown of 1.3248, in this case the target is 1.3289 near consolidation level of the price. A break of 1.3290 should be accompanied by a pronounced upward movement with the target at 1.3341. The potential value for the top is the 1.3379 level, we expect a downward pullback upon reaching this region.

Short-term downward movement is possible in the corridor 1.3206 - 1.3184, the breakdown of the last value will lead to an in-depth correction with the target at 1.3155. The breakdown of this level will continue the downward structure, however, the downward structure from July 9 is no longer relevant when the price leaves the 13th zone.

The main trend is the formation of the potential for the top of July 13.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3287

Buy: 1.3292 Take profit: 1.3335

Sell: 1.3206 Take profit: 1.3186

Sell: 1.3182 Take profit: 1.3157

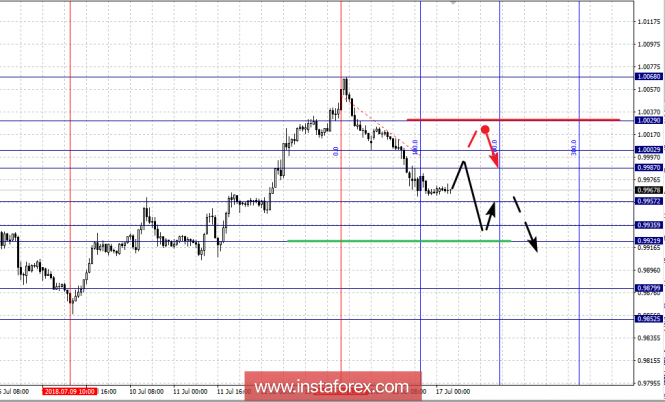

For the Dollar/Franc pair, the key levels on the H1 scale are: 1.0029, 1.0002, 0.9987, 0.9957, 0.9935, 0.9921, 0.9879 and 0.9852. Here, we follow the formation of the downward structure from July 13. The downward movement is expected to continue after the breakdown of 0.9957, in this case the target is 0.9935 near the consolidation level. Passage at the price of the noise range 0.9935 - 0.9921 should be accompanied by a determined movement to the 0.9879 level. The potential value for the bottom is the 0.9852 level, the probable date of reaching that area is July 18-19 and we expect an upward rollback upon reaching this level.

Short-term upward movement is possible in the range of 0.9987 - 1.0002, breakdown of the last value will lead to an in-depth correction with the target at 1.0029, this level is the key support for the downward structure.

The main trend is the formation of a downward structure from July 13.

Trading recommendations:

Buy: 0.9987 Take profit: 1.0000

Buy: 1.0004 Take profit: 1.0025

Sell: 0.9955 Take profit: 0.9937

Sell: 0.9918 Take profit: 0.9882

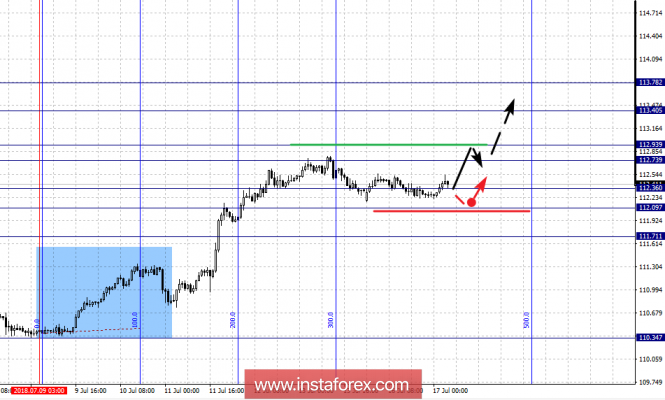

For the Dollar/Yen pair, the key levels on the scale are: 113.78, 113.40, 112.93, 112.73, 112.36, 112.09 and 111.71. Here, we follow the upward structure of July 9th. The continuation of the upward movement is expected after the passage at the noise range price of 112.73 - 112.93, in this case the target is 113.40 near the consolidation level. The potential value for the top is the level 113.78 (the probable date of reaching is July 16 - 18), hence, we expect a downward pullback upon reaching this level.

Short-term downward movement is possible in the corridor 112.36 - 112.09, the breakdown of the last value will lead to an in-depth correction and the target is 111.71, this level is the key support for the top.

The main trend: the upward structure of July 9.

Trading recommendations:

Buy: 112.95 Take profit: 113.40

Buy: 113.42 Take profit: 113.76

Sell: 112.34 Take profit: 112.12

Sell: 112.05 Take profit: 111.75

For the Canadian Dollar/US Dollar pair, the key levels on the H1 scale are: 1.3384, 1.3247, 1.3193, 1.3071, 1.3025 and 1.2938. Here, the situation remains in an equilibrium state. Short-term upward movement is expected in the corridor 1.3193 - 1.3247, the breakdown of the last value is expected to lead the formation of initial conditions to the upward cycle. Here, the potential target is 1.3384.

Short-term downward movement is possible in the corridor 1.3071 - 1.3025, the breakdown of the latter value will lead to the formation of a potential downward movement with the target at 1.2938.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3380

Buy: Take profit:

Sell: 1.3025 Take profit: 1.2940

Sell: Take profit:

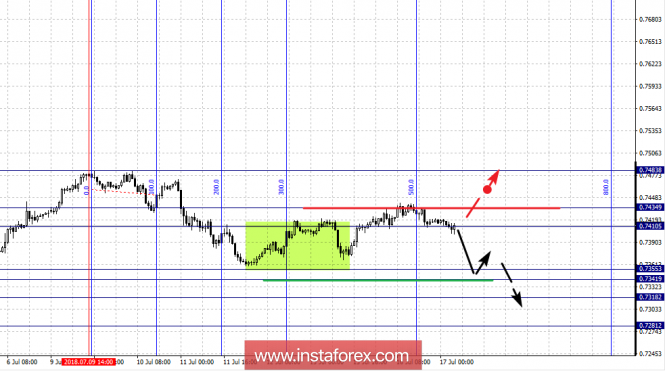

For the Australian Dollar/US Dollar pair, the key levels on the H1 scale are: 0.7434, 0.7410, 0.7355, 0.7341, 0.7318 and 0.7281. Here, we follow a small downward cycle from July 9, as the price is currently in correction. More dynamic development of the situation can be expected after 15:00. The downward movement is expected to continue after passing through the noise range of 0.7355 - 0.7341, and in this case the target is 0.7318. The potential value for the top is the 0.7281 level (the probable date of reaching is July 13).

Short-term upward movement is possible in the corridor 0.7410 - 0.7434, the breakdown of the last value will develop an ascending structure with the potential target at 0.7483.

The main trend is the downward cycle from July 9, the correction stage.

Trading recommendations:

Buy: 0.7436 Take profit: 0.7465

Buy: 0.7411 Take profit: 0.7432

Sell: 0.7340 Take profit: 0.7320

Sell: 0.7316 Take profit: 0.7284

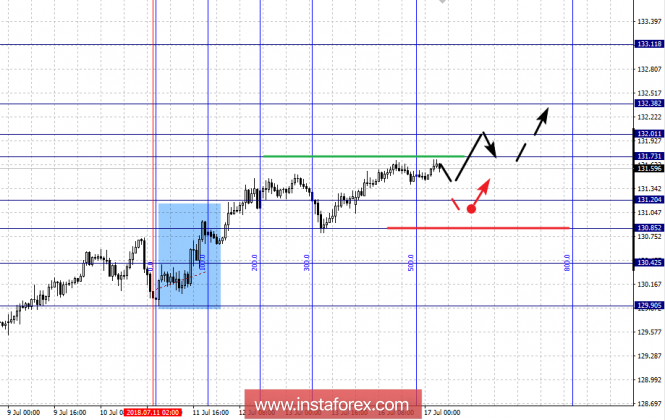

For the Euro/Yen pair, the key levels on the H1 scale are: 133.11, 132.38, 132.01, 131.73, 131.20, 130.85 and 130.42. Here, we follow the local upward structure of July 11. Short-term upward movement is expected in the corridor 131.73 - 132.01, the breakdown of the last value is expected to move to the 132.38 level, which is near the consolidation level. Hence, there is a high probability of withdrawal into correction. The potential value for the top is the 133.11 level and expected to reach on July 17 - 18, upon reaching this level we expect a downward pullback.

Short-term downward movement is possible in the corridor 131.20 - 130.85, the breakdown of the last value will lead to an in-depth correction with the target at 130.42, this level is the key support for the upward structure of July 11.

The main trend is a local structure for the top of 11 July.

Trading recommendations:

Buy: 131.73 Take profit: 131.00

Buy: 132.05 Take profit: 132.35

Sell: 131.15 Take profit: 130.90

Sell: 130.80 Take profit: 130.45

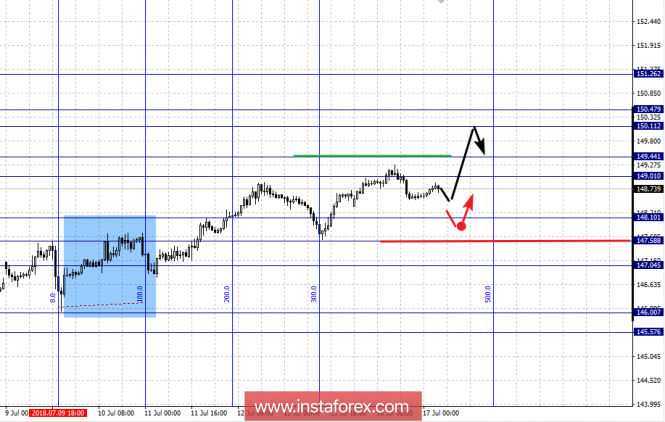

For the Pound/Yen pair, the key levels on the H1 scale are: 151.26, 150.47, 150.11, 149.44, 149.01, 148.10, 147.58 and 147.04. Here, we follow the formation of the local upward structure of July 9. The development of the upward structure of July 9 is expected to continue after the breakdown of 149.01, with the target at 149.44. There is a high probability to leave down from this corridor. A break at the 149.45 level should be accompanied by a determined movement upward with the target at 150.11, in the corridor 150.11 - 150.47 consolidation and a key turn down is expected from here. The potential value for the top is the 151.26 level and could possibly achieve on July 17 - 18.

Short-term downward movement is possible in the corridor 148.10 - 147.58, the breakdown of the last value will lead to an in-depth correction with the target at 147.04, this level is the key support for the upward structure.

The main trend is a local structure for the top of July 9.

Trading recommendations:

Buy: 149.01 Take profit: 149.40

Buy: 149.48 Take profit: 150.10

Sell: 148.10 Take profit: 147.60

Sell: 147.55 Take profit: 147.07

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com