EUR/AUD has been extremely corrective and volatile above 1.5750 area recently which is expected to push a bit lower before pushing higher with the trend in the coming days. Though EUR has been the dominant currency in the pair but recent worse economic reports and event increased the struggle to sustain the momentum in the process.

AUD has been quite positive and optimistic about the upcoming economic developments which may lead to certain gain on the AUD side in the coming days. The Employment sector has grown quite well along with the Business sector whereas Unemployment Rate is at the lowest. Moreover, the Trade War tension has not quite impacted the economic growth of the country as well. Today AUD MI Leading Index report was published with an increase to 0.0% from the previous value of -0.2% which did help AUD to sustain its momentum against the EUR gains and expected to push much lower in the coming days.

On the EUR side, today EURO Final CPI report is going to be published which is expected to be unchanged at 2.0% and Final Core CPI is expected to be unchanged at 1.0%.

As of the current scenario, the EURO is currently quite indecisive with the forecasts whereas AUD is proving to be quite promising with the upcoming developments. Though EUR has been struggling with the recent gains but still capable of pushing higher in the coming days if it manages to perform better than expected in the coming economic reports and events.

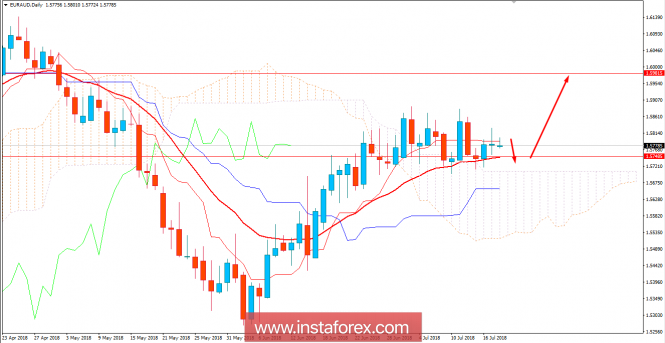

Now let us look at the technical view. The price is currently quite volatile and corrective having an indecision daily candle yesterday. Currently, it is expected to push lower towards 1.5750 where the Kumo Cloud support and Dynamic level of 20 EMA support are expected to hold the price and push higher towards 1.60 area in the coming days. As the price remains above 1.57 with a daily close, the bullish bias is expected to continue.

NEAR TERM SUPPORT: 1.5750

RESISTANCE: 1.60

BIAS: BULLISH

MOMENTUM: VOLATILE AND CORRECTIVE