USD/CAD is currently quite indecisive and volatile above 1.30 psychological level from where the bullish pressure is expected to continue further for a while. Though USD has found support from the recent economic reports, it failed to sustain strength further against CAD.

Ahead of the NFP report this week which is expected to be quite mixed, despite the recent positive Pending Home Sales report, USD failed to gain momentum which indicates the strength and market sentiment on this pair. Today, US Core PCE Price Index report is going to be published which is expected to decrease to 0.1% from the previous value of 0.2%, Employment Cost Index is expected to decrease to 0.7% from the previous value of 0.8%, Personal Spending is expected to increase to 0.4% from the previous value of 0.2%, Personal Income is expected to be unchanged at 0.4%, and Chicago PMI is expected to decrease to 61.9 from the previous figure of 64.1. Moreover, the most significant report of all, CB Consumer Confidence report is going to be published today as well which is expected to show a slight increase to 126.5 from the previous figure of 126.4.

On the other hand, today Canadian GDP report is going to be published which is expected to increase to 0.3% from the previous value of 0.1%, RMPI is expected to decrease to 2.7% from the previous value of 3.8%, and IPPI is also expected to decrease to 0.3% from the previous value of 1.0%.

Meanwhile, both currencies in the pair are quite indecisive ahead of economic reports. Before US nonfarm payrolls on Friday, certain volatility may strike the market, but USD is expected to have an upper hand over CAD in the long term.

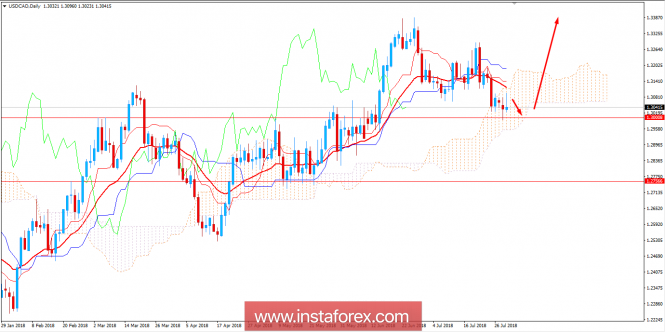

Now let us look at the technical view. The price is currently residing inside the Kumo Cloud support as well as the psychological level support of 1.30 area from where the price is expected to push higher as per the trend structural formation and momentum it had. As for the current price formation, as the price remains above 1.30 with a daily close, the bullish bias is expected to continue with a target towards 1.34 in the future.

SUPPORT: 1.30

RESISTANCE: 1.34

BIAS: BULLISH

MOMENTUM: VOLATILE AND CORRECTIVE