Dear colleagues.

For the EUR / USD pair, the continuation of the upward movement is expected after the breakdown of 1.1718. The level of 1.1633 is the key support. For the GBP / USD pair, we continue to monitor the upward structure of June 28. The continuation of the upward movement is expected after the breakdown at 1.3274. For the USD / CHF pair, follow the downward structure of June 28. For the USD / JPY pair, we follow the upward structure of June 26. The development of this level is expected after the breakdown of 111.10. For the EUR / JPY pair, the continuation of the upward movement from June 28 is expected after the breakdown of 129.90. For the GBP / JPY pair, the price forms an upward structure from June 28. The development of this level is expected after the breakdown of 146.70. Currently, the price is in the zone of initial conditions.

The forecast for July 6:

Analytical review of currency pairs in the scale of H1:

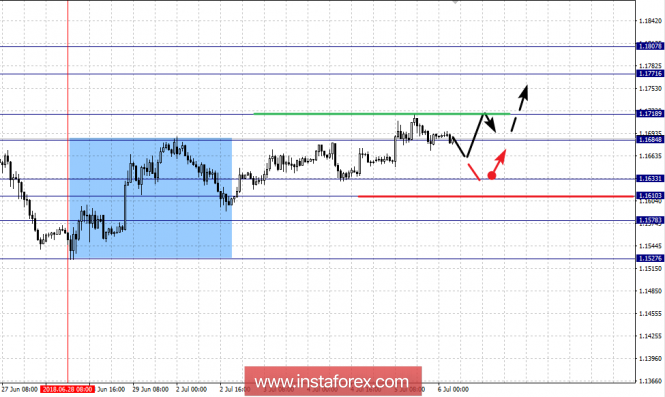

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1807, 1.1771, 1.1718, 1.1684, 1.1633, 1.1610 and 1.1578. Here, we continue to monitor the formation of the upward structure of June 28. The continuation of the upward movement is expected after the breakdown of 1.1684. In this case, the target is 1.1718. Near this level is the consolidation of the price. The breakdown at the level of 1.1718 should be accompanied by a pronounced upward movement. The target here is 1.1771. The potential value for the top is the level of 1.1807. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.1633-1.1610. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1578. This level is the key support for the upward structure.

The main trend is the initial conditions for the top of June 28.

Trading recommendations:

Buy: 1.1684 Take profit: 1.1715

Buy 1.1722 Take profit: 1.1770

Sell: 1.1631 Take profit: 1.1611

Sell: 1.1608 Take profit: 1.1580

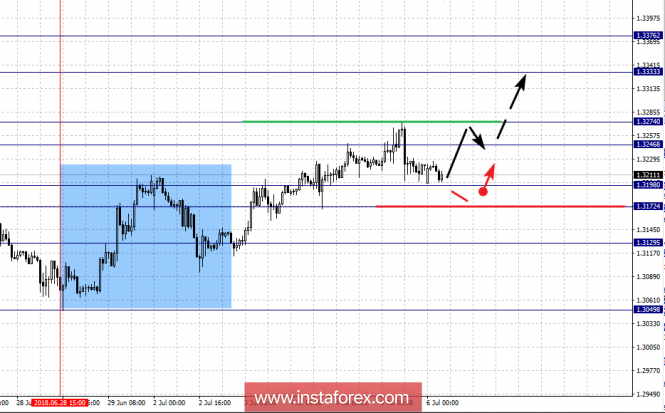

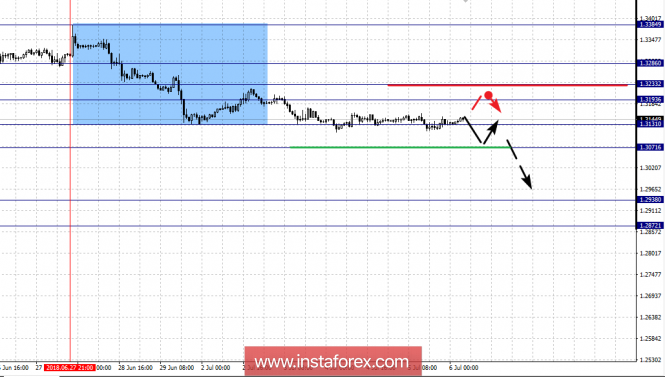

For the GBP / USD pair, the key levels on the H1 scale are 1.3376, 1.3333, 1.3274, 1.3246, 1.3198, 1.3172 and 1.3129. Here, we follow the upward structure of June 28. Short-term upward movement is expected in the area of 1.3246 - 1.3274. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3333. The potential value for the top is the level of 1.3376. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is expected in the range of 1.3198 - 1.3172. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3129. This level is the key support for the upward structure.

The main trend is the formation of the upward structure of June 28.

Trading recommendations:

Buy: 1.3246 Take profit: 1.3272

Buy: 1.3276 Take profit: 1.3333

Sell: 1.3197 Take profit: 1.3174

Sell: 1.3170 Take profit: 1.3133

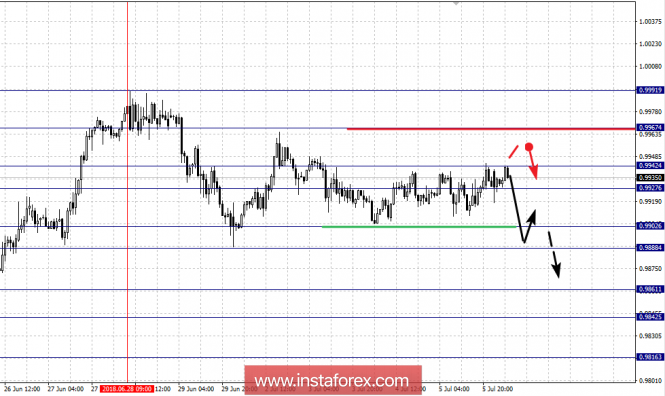

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9967, 0.9942, 0.9927, 0.9902, 0.9888, 0.9861, 0.9842 and 0.9816. Here, we continue to follow the downward structure of June 28. Passing by the price of the noise range at 0.9902 - 0.9888 should be accompanied by a pronounced movement. In this case, the target is 0.9861. In the area of 0.9861 - 0.9842 is the consolidation of the price. The potential value for the bottom is the level of 0.9816. Upon reaching this level, we expect a pullback upward.

Short-term upward movement is possible in the area of 0.9927 - 0.9942. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9967. This level is the key support for the downward structure.

The main trend is the formation of a downward structure from June 28.

Trading recommendations:

Buy: 0.9927 Take profit: 0.9940

Buy: 0.9944 Take profit: 0.9962

Sell: 0.9902 Take profit: 0.9890

Sell: 0.9888 Take profit: 0.9865

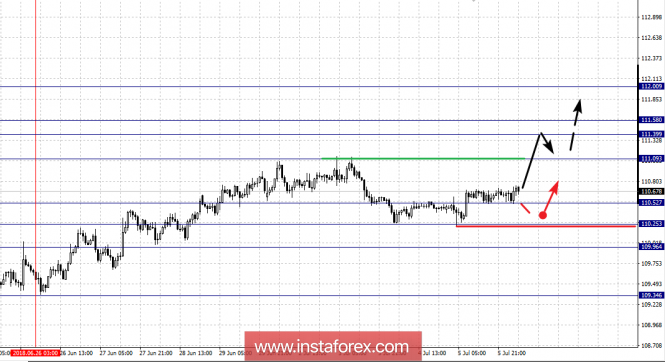

For the USD / JPY pair, the key levels on a scale are: 112.00, 111.58, 111.39, 111.09, 110.52, 110.25 and 109.96. Here, the price is in deep correction from the upwards structure on June 26. The continuation of the development of the upward cycle from June 26 is expected after the breakdown of 111.10. In this case, the target is 111.39. In the area of 111.39 - 111.58 is the consolidation of the price. The potential value for the top is the level 112.00. After reaching this level, we expect a pullback downwards.

Consolidated movement is possible in the area of 110.52 - 110.25. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first potential target is 109.96.

The main trend is the upward structure of June 26, the correction stage.

Trading recommendations:

Buy: 111.10 Take profit: 111.36

Buy: 111.60 Take profit: 112.00

Sell: 110.25 Take profit: 110.00

Sell: Take profit:

For the CAD / USD pair, the key levels on the H1 scale are: 1.3286, 1.3233, 1.3193, 1.3131, 1.3071, 1.2938 and 1.2872. Here, we follow the formation of a downward structure from June 27. Short-term downward movement is expected in the range of 1.3131 - 1.3071. The breakdown of the last value will lead to the development of a pronounced movement towards the bottom. Here, the target is 1.2938. The potential value for the bottom is the level of 1.2872. From this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.3193 - 1.3233. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3286. This level is the key support for the bottom.

The main trend is the formation of a downward structure from June 27.

Trading recommendations:

Buy: 1.3193 Take profit: 1.3231

Buy: 1.3235 Take profit: 1.3285

Sell: 1.3130 Take profit: 1.3073

Sell: 1.3068 Take profit: 1.2940

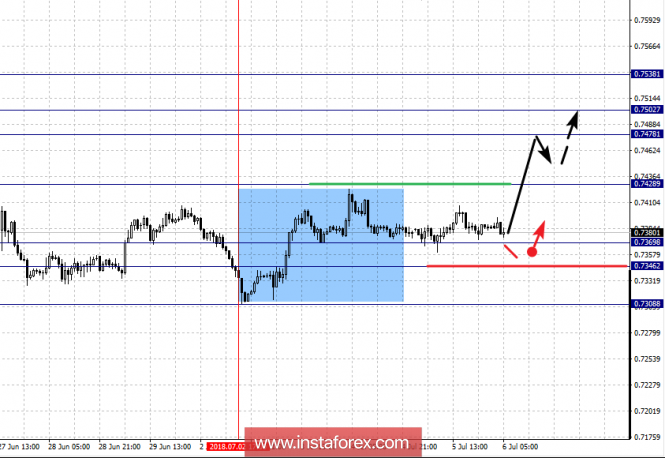

For the AUD / USD pair, the key H1 scale levels are: 0.7538, 0.7502, 0.7478, 0.7428, 0.7369, 0.7346 and 0.7308. Here, we follow the formation of the upwards structure of July 2. The continuation of the upward movement is expected after the breakdown of 0.7430. In this case, the target is 0.7478. In the area of 0.7478 - 0.7502 is the consolidation of the price. The potential value for the top is the level of 0.7538. After reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.7369 - 0.7346. The breakdown of the latter value lead to the development of a downward structure. Here, the target is 0.7308.

The main trend is the formation of the upwards structure of July 2.

Trading recommendations:

Buy: 0.7430 Take profit: 0.7475

Buy: 0.7479 Take profit: 0.7500

Sell: 0.7368 Take profit: 0.7348

Sell: 0.7344 Take profit: 0.7310

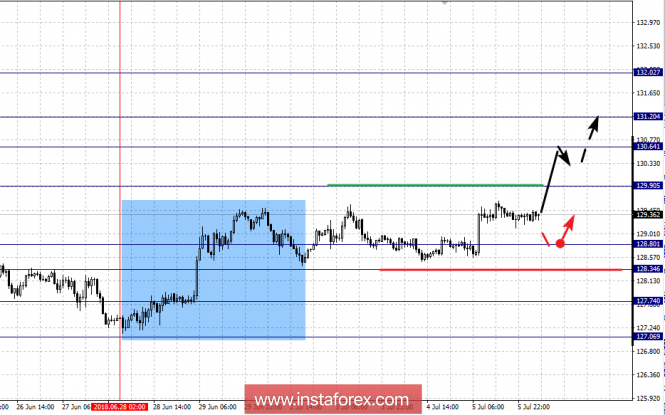

For the of EUR / JPY, the key levels on the scale of H1 are: 132.02, 131.20, 130.64, 129.90, 128.80, 128.34, 127.74 and 127.06. Here, the price has issued a pronounced structure for the upward movement of June 28. The continuation of the upward movement is expected after the breakdown of 129.90. In this case, the target is 130.64. In the area of 130.64 - 131.20 we expect short-term upward movement as well as the consolidation of the price. The potential value for the top is the level of 132.02. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 128.80 - 128.34. The breakdown of the last value will lead to in-depth correction. Here, the target is 127.74. This level is the key support for the upward structure of June 28.

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 129.90 Take profit: 130.60

Buy: 130.66 Take profit: 131.20

Sell: 128.80 Take profit: 128.38

Sell: 128.30 Take profit: 127.80

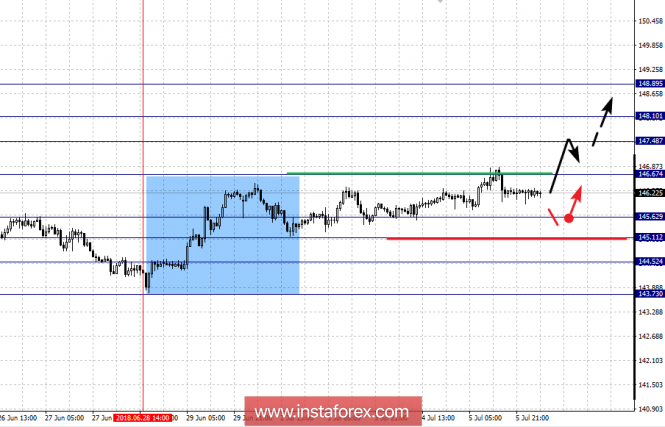

For the GBP / JPY pair, the key levels on the scale of H1 are: 148.80, 148.10, 147.48, 146.67, 145.62, 145.11 and 144.52. Here, the price forms an upward structure from June 28. The continuation of the upward movement is expected after the breakdown of 146.67. In this case, the target is 147.48. In the area of 147.48 - 148.10 is the consolidation of the price. The potential value for the top is the level of 148.89. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 145.62 - 145.11. The breakdown of the last value will lead to in-depth correction. Here, the target is 144.52. This level is the key support for the upward structure of June 28.

The main trend is the formation of the upward structure of June 28.

Trading recommendations:

Buy: 146.68 Take profit: 147.45

Buy: 147.50 Take profit: 148.10

Sell: 145.60 Take profit: 145.14

Sell: 145.10 Take profit: 144.55

The material has been provided by InstaForex Company - www.instaforex.com