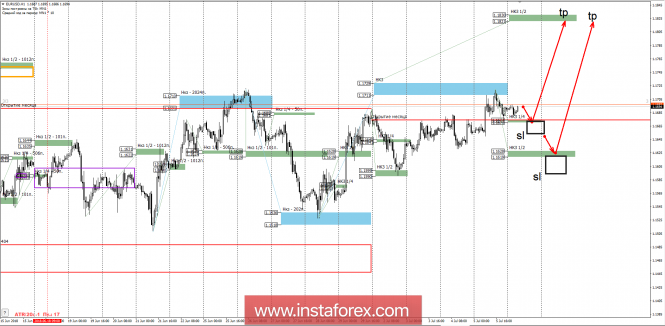

Yesterday there was a test of a weekly short circuit 1.1729-1.1711, which made it possible to realize the first phase of the upward momentum by 100%. Further growth will depend on whether the pair can gain a foothold above 1.1729.

The upward movement remains a priority despite the appearance of the proposal after the test of the weekly short-circuit 1.1729-1.1711. On the way down the first support is the control zone 1/4 1.1674-1.1670. Defining support is within control zone 1/2 1.1628-1.1619. While the pair is trading above this zone, the upward movement will remain impulsive. The most profitable buying prices are at the level of 1.1628, so the next growth target could become control zone 1/2 1.1830-1.1821, which makes the risk-to-profit ratio profitable.

The potential profit can be 150 and 200 points from the control zones. Given the fact that the size of the stop-loss should not exceed 25-35pp, the risk-to-profit ratio is 1 to 5 or higher. This makes buying profitable at a distance.

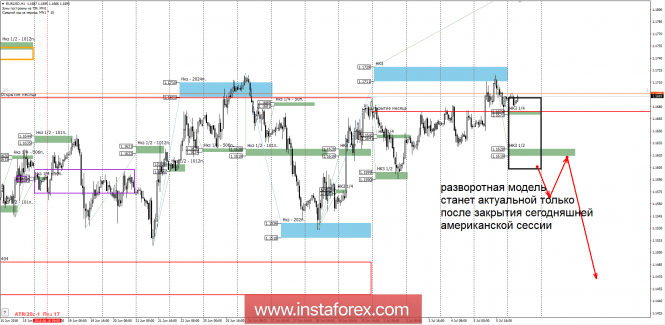

In order for the upward movement to be canceled, it will be necessary to absorb yesterday's growth and consolidate below the control zone 1/2 1.1628-1.1619. This will allow to consider selling at the beginning of next week. The medium-term goal of the fall will be the June lows, which will allow us to speak of a profitable risk-to-profit ratio for selling below the level of 1.1619. It is important to note that the current phase is a mid-term flight, which indicates the possibility of the occurrence of a large supply within a weekly short-term period of 1.1729-1.1711.

Daytime CP- daytime control zone. The zone formed by important data from the futures market, which change several times a year.

Weekly CP- weekly control zone. The zone formed by important futures market marks, which change several times a year.

Monthly CP-monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com