Eurozone

The euro has received several positive signals, which allow us to count on the corrective growth of EUR / USD in the next 24 hours. Business activity in the euro area is growing faster than forecasts, Markit informs that in June Germany's PMI in the manufacturing sector grew to 54.8p compared to 54.2p in May, service sector growth from 53.9p to 55.4p, in both cases, experts did not expect changes. The composite index for the euro area as a whole exceeded the forecast, moreover, in May, producer prices in the eurozone and production orders for Germany rose significantly above forecasts.

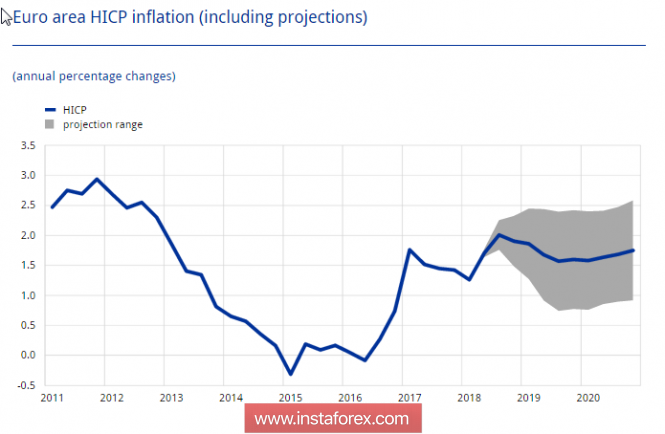

Investors are guided by long-term plans of the ECB, which look rather cautious. In a bulletin published in late June, the ECB again explained that after September 2018, it intends to reduce the volume of purchases of assets to 15 billion euros if it sees confirmation on the medium-term inflation forecast, thus giving an idea that if inflation is low, then there will be no reduction in purchases.

The forecast for inflation from the ECB is optimistic. In the current year, a level of 2% should be reached, after which there will be a small rollback.

Preliminary data for June show that inflation reached 2%, that is, the outlook is generally maintained. The decrease in unemployment allows counting, among other things, on an increase in the average wage, which, in the end, will support the growth of inflation.

Despite the fact that the markets are preparing for the introduction of new customs tariffs in the US and the response measures of China and the EU countries, the euro has a chance to improve its positions somewhat. During the day, a short-term impulse to the north is likely and the euro is anchored above resistance at 1.1720.

United Kingdom

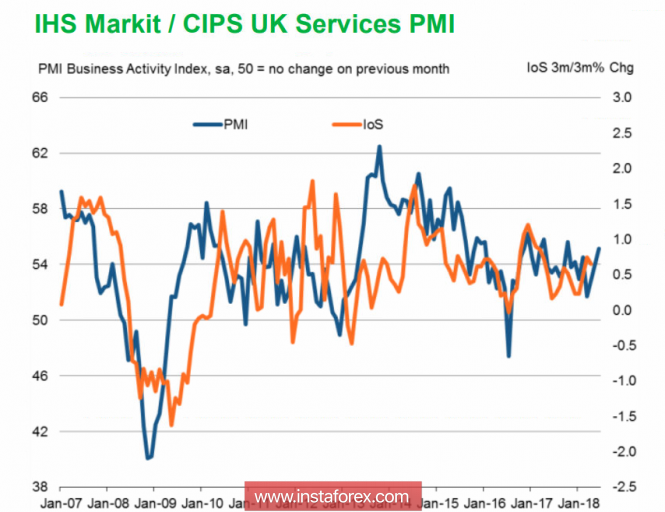

PMI Markit business indices showed strong growth in June, which was especially noticeable for the main sector of the British economy - the services sector. The 55.1p reached is the maximum since October 2017, which suggests that GDP growth in the 2nd quarter is 0.4%, compared with 0.2% in the first quarter.

Moreover, there has been a noticeable increase in business development costs, which, combined with rising oil prices and the expected increase in average wages, will once again support inflation. These factors significantly increase the chances that the Bank of England will raise the rate in August, which gives the pound a chance of corrective growth.

This data looks quite optimistic on the background of the recent fears that Brexit will lead to a steady outflow of capital from the Foggy Albion. Investments in long-term projects are still low, but the trend has become less pronounced, which adds a pound of confidence.

Today the pound has the opportunity to improve its position somewhat, we expect growth to 1.3312 and an attempt to gain a foothold above this level, which will mean a weakening of bearish sentiments and a shift to the lateral range.

Oil and ruble

A number of geopolitical factors support high oil prices, despite the recent decision by OPEC + to raise production levels, and contributes to the reduction of global reserves. Such factors include a significant reduction in production in Venezuela, an attempt by the US through the sanctions system to limit Iran's economic activity, the problem of supplies from Libya and the need to prepare infrastructure to increase production within OPEC +, which may take several months.

All these factors, like a number of others, contribute to maintaining high oil prices. The bullish scenario could be hindered by a sharp slowdown in the volume of world trade, which will also lead to a slowdown in global output. In the meantime, the most likely test is a rapid test of $ 80 / bbl. for Brent.

On Wednesday, the RF Ministry of Finance announced that, in accordance with the budget rule, reduces the volume of currency purchases. In June, the Ministry of Finance contributed to the weakening of the ruble, buying a record volume of currency over the past 2 years, and to a considerable extent contributed to the weakening of the Russian currency. Reducing the volume of purchases with a simultaneous stable level of oil prices will support the ruble, which may fall below 62 rubles per dollar. already in the next few days.

The material has been provided by InstaForex Company - www.instaforex.com