Dear colleagues.

For the EUR / USD pair, there is a high probability of movement towards correction and capacity building for the bottom. For the GBP / USD pair, the price is in deep correction from the upward structure and forms the potential for the bottom of July 9. For the USD / CHF pair, the range of 0.9927 - 0.9942 is the key support for the downward structure from June 28. For the USD / JPY pair, we expect the formation of a local structure for an upward trend after the breakdown of 111.10. The upward structure of June 26 is more relevant. For the EUR / JPY pair, the price is in the 8 vertical zone. The continuation of the upward movement is expected after the breakdown of 130.66. For the GBP / JPY pair, we expect the design of the local structure for the subsequent upward movement, which is possible after the breakdown of 147.50.

The forecast for July 10:

Analytical review of currency pairs in the scale of H1:

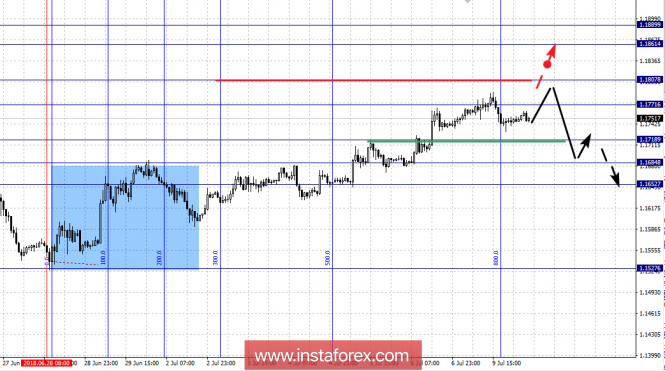

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1889, 1.1861, 1.1807, 1.1771, 1.1718, 1.1684 and 1.1652. Here, we follow the development of the upward cycle of June 28. The continuation of the upward movement is expected after the breakdown of 1.1771. In this case, the target is 1.1807. Near this level is the consolidation of the price.The break of the level of 1.1810 should be accompanied by a pronounced movement towards the level of 1.1861. The potential value for the top is the level of 1.1889, after which we expect consolidation in the area of 1.1861 - 1.1889, as well as a pullback to the bottom.

Short-term downward movement is possible in the area of 1.1718 - 1.1684. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1652. This level is the key support for the upward structure.

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 1.1771 Take profit: 1.1805

Buy 1.1812 Take profit: 1.1860

Sell: 1.1716 Take profit: 1.1690

Sell: 1.1682 Take profit: 1.1656

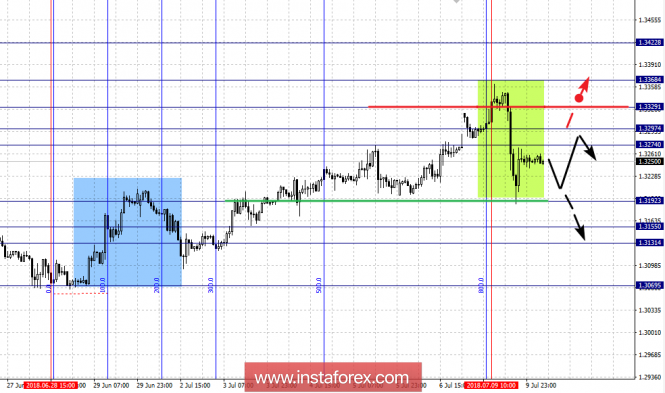

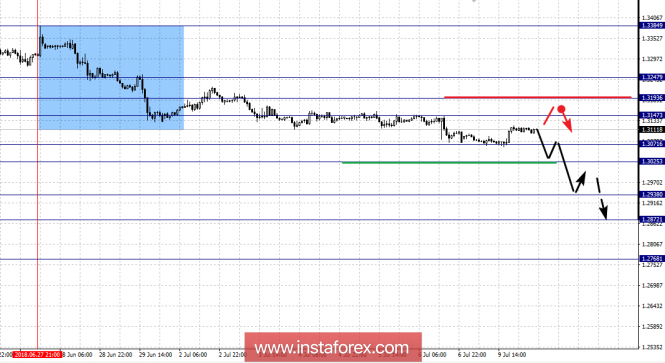

For the GBP / USD pair, the key levels on the scale of H1 are 1.3422, 1.3368, 1.3329, 1.3297, 1.3274, 1.3192, 1.3155, 1.3131 and 1.3069. Here, the price is in deep correction from the upward structure of June 28 and forms the potential for the bottom of July 9. The continuation of the upward movement is expected after the breakdown of 1.3330. Here, the first target is 1.3368. The potential value for the top is the level of 1.3422. Near this level, we expect the consolidation of the price.

The level of 1.3192 is the key resistance for the development of the downward structure from July 9. Its breakdown will allow us to count on the movement towards 1.3155. In the area of 1.3155 - 1.3131 is the consolidation of the price. The potential value for the bottom is the level of 1.3069. The movement towards this level is expected after the breakdown of 1.3130.

The main trend is the upward structure of June 28, a deep correction.

Trading recommendations:

Buy: 1.3298 Take profit: 1.3327

Buy: 1.3331 Take profit: 1.3366

Sell: 1.3190 Take profit: 1.3160

Sell: 1.3130 Take profit: 1.3074

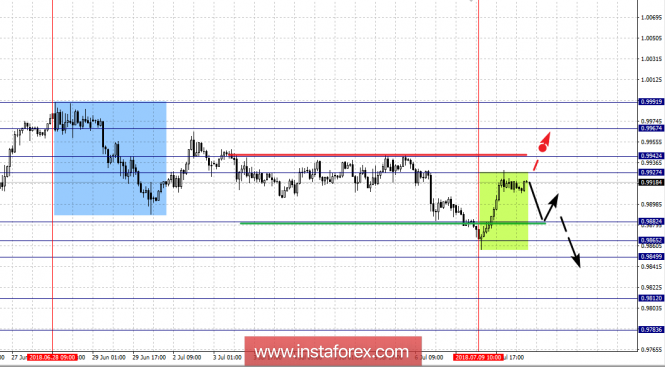

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9967, 0.9942, 0.9927, 0.9882, 0.9865, 0.9849, 0.9812 and 0.9783. Here, the range of 0.9927 - 0.9942 is the key support for the downward structure from June 28. Passing by the price will lead to the development of the upward potential from July 9. In this case, the first target is 0.9967.

Continued downward motion is expected after the breakdown of 0.9882. In this case, the target is 0.9865. In the area of 0.9865 - 0.9849 is the consolidation of the price. The breakdown of the last value should be accompanied by a pronounced downward movement towards the level of 0.9812. The potential value for the bottom is the level of 0.9783. Upon reaching this level, we expect a pullback upward.

The main trend is the downward structure of June 28, the stage of deep correction.

Trading recommendations:

Buy: 0.9943 Take profit: 0.9965

Buy: 0.9968 Take profit: 0.9990

Sell: 0.9880 Take profit: 0.9865

Sell: 0.9847 Take profit: 0.9814

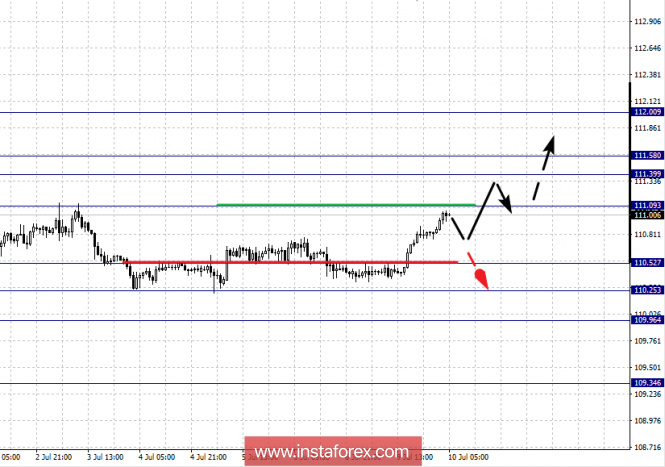

For the USD / JPY pair, the key levels on a scale are: 112.00, 111.58, 111.39, 111.09, 110.52, 110.25 and 109.96. Here, we continue to follow the upward structure of June 26. The continuation of the development of the upward cycle from June 26 is expected after the breakdown of 111.10. In this case, the target is 111.39. In the area of 111.39 - 111.58 is the consolidation of the price. The potential value for the top is the level 112.00. After reaching this level, we expect a pullback downwards.

Consolidated movement is possible in the area of 110.52 - 110.25. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first potential target is 109.96.

The main trend is the upward structure of June 26.

Trading recommendations:

Buy: 111.10 Take profit: 111.36

Buy: 111.60 Take profit: 112.00

Sell: 110.25 Take profit: 110.00

Sell: Take profit:

For the CAD / USD pair, the key levels on the H1 scale are: 1.3247, 1.3193, 1.3147, 1.3071, 1.3025, 1.2938, 1.2872 and 1.2768. Here, we follow the formation of a downward structure from June 27. Short-term downward movement is expected in the range of 1.3071 - 1.3025. The breakdown of the last value will lead to the development of a pronounced downward movement. Here, the target is 1.2398. In the area of 1.2938 - 1.2872, we expect a short-term downward movement. The potential value for the bottom is the level of 1.2768. The movement towards this level is expected after the breakdown of 1.2870.

Short-term upward movement is possible in the area of 1.3147 - 1.3193. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3247. This level is the key support for the bottom.

The main trend is the formation of a downward structure from June 27.

Trading recommendations:

Buy: 1.3148 Take profit: 1.3190

Buy: 1.3195 Take profit: 1.3245

Sell: 1.3025 Take profit: 1.2940

Sell: 1.2935 Take profit: 1.2875

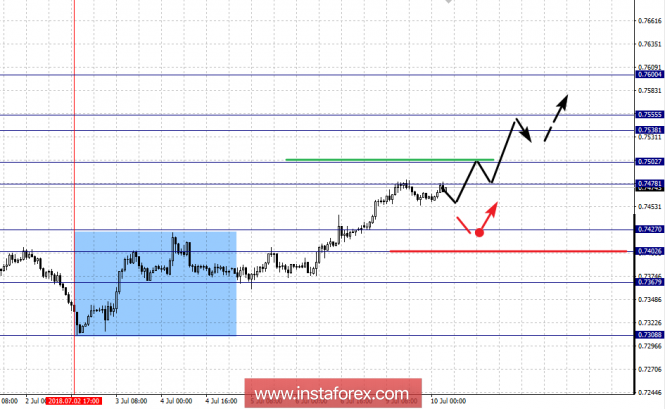

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7600, 0.7555, 0.7538, 0.7502, 0.7478, 0.7427, 0.7402 and 0.7367. Here, we follow the development of the upward structure of July 2. Short-term upward movement is possible in the area of 0.7478 - 0.7502. The breakdown of the last value will lead to a pronounced movement. Here, the target is 0.7538. In the area of 0.7538 - 0.7555 is the consolidation of the price. The potential value for the top is the level of 0.7600. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.7427 - 0.7402. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7367.

The main trend is the upward structure of July 2.

Trading recommendations:

Buy: 0.7478 Take profit: 0.7500

Buy: 0.7504 Take profit: 0.7536

Sell: 0.7425 Take profit: 0.7404

Sell: 0.7400 Take profit: 0.7370

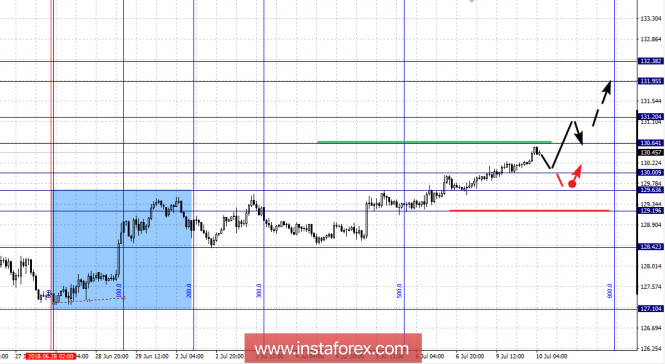

For the of EUR / JPY pair, the key levels on the scale of H1 are: 132.02, 131.20, 130.64, 129.90, 128.80, 128.34, 127.74 and 127.06. Here, we follow the development of the upward structure of June 28. At the moment, the price is in the final 8 zone (vertical scale) for this cycle. The continuation of the upward movement is expected after the breakdown of 129.90. In this case, the target is 130.64. In the area of 130.64 - 131.20, we expect short-term upward movement, as well as the consolidation of the price. The potential value for the top is the level of 132.02. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 128.80 - 128.34. The breakdown of the last value will lead to in-depth correction. Here, the target is 127.74. This level is the key support for the upward structure of June 28.

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 129.90 Take profit: 130.60

Buy: 130.66 Take profit: 131.20

Sell: 128.80 Take profit: 128.38

Sell: 128.30 Take profit: 127.80

For the GBP / JPY pair, the key levels on the scale of H1 are: 150.20, 149.24, 148.89, 148.10, 147.48, 146.67, 146.20, 145.57 and 144.52. Here, we follow the upward structure of June 28. At the moment, the price has passed the 8th zone of the vertical scale and we are expecting the formulation of local initial conditions for continuing the movement towards the top. Short-term upward movement is possible in the area of 147.48 - 148.10. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 148.89. In the area of 148.89 - 149.24 is the consolidation of the price. The potential value for the top is 150.20, but we expect the move to this level after the local structure is formalized.

Short-term downward movement is possible in the area of 146.67 - 146.20. The breakdown of the last value will lead to in-depth correction. Here, the target is 145.57. This level is the key support for the upward structure of June 28. Its breakdown will lead to a downward movement. In this case, the target is 144.52 .

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 147.50 Take profit: 148.10

Buy: 148.15 Take profit: 148.85

Sell: 146.65 Take profit: 146.22

Sell: 146.18 Take profit: 145.60

The material has been provided by InstaForex Company - www.instaforex.com