News that the US is introducing new duties on Chinese goods, led to a sharp drop in commodity currencies. In particular, the decline was observed in tandem with the Canadian and Australian Dollars.

As it became known, the White House yesterday announced the introduction of duties on goods from China worth $ 200 billion, while the presidential administration said that they hoped to continue trade negotiations with China. How, after the new more stringent measures on the part of the US will be negotiated, even difficult to imagine. The White House said that they will try not to impose new duties on consumer goods, but this is far from true.

As it became known, new duties are mostly designed for consumer goods. Tuna, salmon, tires, leashes for dogs, bags, baseball gloves, furniture, clothes, mattresses, electric lamps, telephone parts, flat TVs and a number of other goods fall under trade duties.

It also became known that the introduction of fees will occur two months later. The approximate date is August 20-23. This is not done to ensure that China has managed to come to an agreement with the US but to ensure that US companies are able to give feedback on the goods chosen for restrictions.

The Ministry of Commerce of China immediately announced that they will take measures in response to US duties on Chinese goods worth $ 200 billion. According to the Chinese authorities, the new US measures are completely unacceptable.

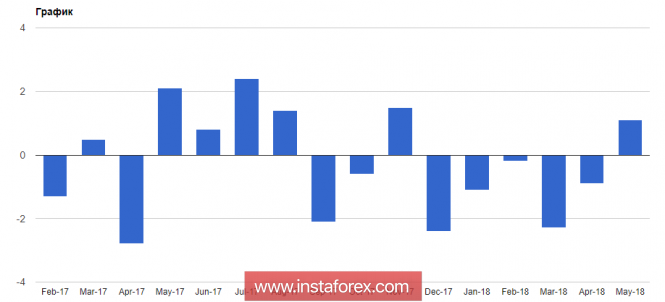

As I noted above, commodity currencies, including the Australian dollar, fell sharply against the US dollar.

Despite good data on the number of approved housing loans in Australia, there is no demand for the Australian dollar.

According to a report by the Australian Bureau of Statistics, the number of approved housing loans in Australia in May this year rose by 1.1% compared with April, while economists predicted a fall of 2%.

The Canadian dollar also fell sharply against the US dollar, despite good data on the number of bookmarks for new homes in Canada.

According to the report of the Mortgage and Housing Corporation of Canada, the number of bookmarks in June this year increased by 27.9%, to 248 138 units per year. Economists expected the growth of mortgages of new homes to 210,000 units per year.

The material has been provided by InstaForex Company - www.instaforex.com