Markets are calmer today after yesterday's risk aversion. Nikkei225 increases help in the recovery of JPY cross, but USD remains strong. The lack of the expected depreciation of the yuan is calming the Chinese and AUD markets. Higher than expected inventory drop by API helps in WTI increases.

The Asian part of the Wednesday session brings calmness without fresh evidence of the US-China trade crisis. USD / JPY rebounded to 110.20, which also helped on other crossings with JPY, mainly for risky AUD, NZD, CAD and NOK. But EUR / USD remains at 1.16, and GBP / USD cannot find strength and sits close to 1.3160.

The positive point of the day is the lower-than-expected USD/CNY fixing, which was feared as a signal of a drop in investors' confidence in Chinese assets. This allowed to stop the declines on the Chinese stock exchange and Shanghai Composite pulls out at + 0.3%. Japanese Nikkei225 grows 1.1%.

On Wednesday 20th of June, economic events come mainly from the US market and subsequent speeches at the Economic Symposium in Sintra. The publication, which investors should pay particular attention to, are US data on DOE oil inventories. Real estate news will come from the real estate market regarding home sales in the secondary market. In addition, the number of mortgage applications from the United States and the current account balance will be published. Wednesday is a day full of statements of the members of the European Central Bank. Villeroy, Lauteschlaeger, Knot and Coeure will speak. We can also expect a panel with the participation of central bank governors: Draghi, Powell, Kuroda and Lowe. Investors will probably continue to pay special attention to the development of dialogue between the administration of Donald Trump and the government of China.

EUR/USD analysis for 20/06/2018:

The last hours of trading in the currency market did not bring any more emotions. Theoretically, we remain in a risk-off type, but the last trading hours have brought a slight rebound in the debt prices and a drop in the yen valuation, which indicates a local revival of demand for more risky assets. In the background, we are speculating about the ECB, where yesterday's weakness in EUR may be explained by the somewhat dovish tone of M. Draghi's speech.

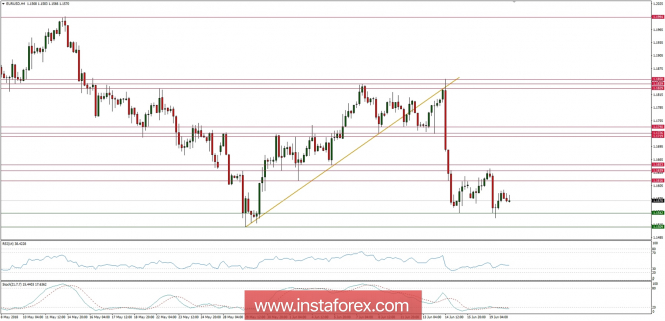

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The bulls were too weak to break through the technical resistance at the level of 1.1639 - 1.1653 and the price went down to test the support at the 1.1542 again. Nevertheless, the market conditions are oversold and the price is starting to diverge from the momentum, so there is still a chance for a bounce higher. However, as long as the price remains under 1.1653, the bears are in full control of the market as this is the key level for them.