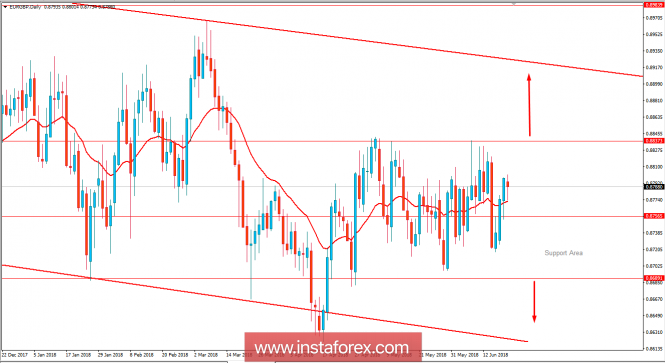

EUR/GBP as been trading in a volatile and corrective phase between 0.87 to 0.8850 area for a few months now. On the back of mixed results of recent economic reports from the eurozone and the UK, the pair is expected to trade without a clear bias until a breakout with a daily close occurs in the coming days.

Ahead of the UK Official Bank Rate report to be released tomorrow which is expected to be unchanged at 0.50%, GBP is likely to gain certain attention from market participants this week. On the other hand, the ECB failed to impress the market by its decision to put the key policy rate on hold till summer 2019 as stated by ECB President Draghi in his recent speech.

Today, the UK CBI Industrial Order Expectation report was published with an increase to 13 from the previous negative figure of -3 which was expected to be at 1. The positive result made no impact today on GBP, but stopped the impulsive bullish pressure in the pair for a while now. Moreover, on the EUR side, today German PPI report was published with an unchanged value of 0.5% which was expected to decrease to 0.4%.

As for the current scenario, the pair is expected to trade with higher volatility without definite pressure in the coming days until the UK or the eurozone comes up with solid fundamentals to create definite pressure and direction in the pair. Mixed economic data will only cause further correction and volatility in the pair.

Now let us look at the technical view. The price is currently quite indecisive, making a formation of spinning top candle pattern on the daily candle. After impulsive bullish pressure for last three days, certain indecision indicates further correction and injection of bearish pressure. A breakout above 0.8850 or below 0.87 with a daily close is expected to open definite trend pressure in the pair.