On Friday, a report on the US labor market for May was published. The report was unexpectedly strong. The number of new jobs increased by 223 thousand, which significantly exceeded the forecast of 188 thousand. The unemployment rate dropped to 3.8% against 3.9% a month earlier. The average hourly wage grew by 0.3%, exceeding April's 0.1%, and the expectations of experts.

Strong growth of the labor market was supposed to provoke a wave of dollar purchases but the market reacted surprisingly quietly, limiting itself to a short-term surge in volatility. There are several reasons for such a reaction, and the main one is connected with fears of a rapid approach of the recession in the USA.

The nearest expanded meeting of the FOMC is just over a week away and the markets are busy trying to predict its results. Regarding the growth rate, there is no doubt that the consolidated opinion of market participants, according to CME, is that the Fed will raise the rate by a quarter of percent, as previously predicted. The main question is how the forecast for the rate will change before the end of 2018 and in the future for 2019.

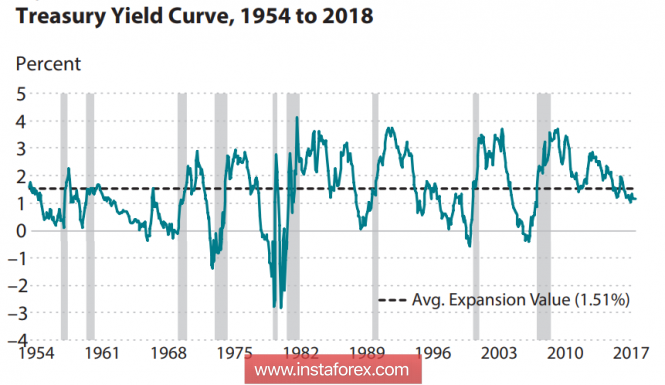

This question is important in order to understand whether there is a chance of recovering the yield curve above the long-term average. At the moment, the difference between the yields of 10-year and 3-month treasury securities is below the long-term average, which is 1.51%, and has a tendency to further decline. As practice shows, the inversion of the yield curve always occurs before the recession.

Moreover, and the unemployment rate may indicate an approaching decline, its decline to historically low values usually precedes the onset of a recession following a sharp increase. Historical studies show that the inversion of the yield curve and the reduction of unemployment to the minimums usually occur 8-16 months before the recession begins, which means that the economic downturn in the US may begin already in the first half of 2019.

Thus, markets can evaluate strong employment data in the opposite way, an increase in average wages will increase inflationary pressures and increase the likelihood of accelerating the growth rate of short-term interest rates of the Fed, which in turn will bring the recession to a close.

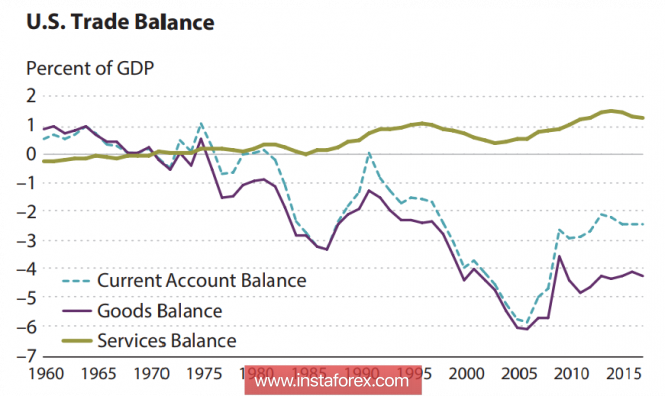

We have repeatedly pointed out that the Trump tax reform will contribute to a sharp increase in the budget deficit. Accelerating the growth rate of the Fed rate will also increase pressure on the budget, as the government's debt servicing costs will grow proportionally. Attempts by the government to eliminate the trade deficit may lead to the opposite result. The growth of tariffs will result in an increase in the cost of imports, which will reduce consumer activity of the population and again put pressure on the collection of taxes.

The trade war with China and the European Union will not stop the fall in employment in the US, or liquidate the trade deficit, but the welfare of American consumers will be reduced, guaranteed. The threat of losing the US to the status of a global trade leader is growing, as the sanctions policy and trade wars inevitably led to the de-dollarization of the world economy.

Thus, the dollar rally is clearly short-term. As soon as the first signs of economic slowdown appear, the dollar will reverse and fall against most competitors. These fears are taken into account by investors and will help to slow growth.

On Tuesday, one should pay attention to reports on business activity in May from Markit and ISM in the services sector. On Wednesday, the trade balance and data for the 1st quarter on labor productivity and wage growth will be published. They can influence the expectations of the FOMC meeting and, as a consequence, the volatility of the dollar.

In general, we must proceed from the fact that in the short term, the dollar may resume its growth, since the US economy is not threatened with the recession until before the end of the year, but the spread of yields will grow in its favor. For the next week, the prospects for the dollar are good, as is confirmed by the Friday report of the CFTC, which showed the growth of speculative positions in the dollar against the euro and the yen. Against the franc, the odds remain significant, which indicates a rather strong demand for risk and no fears of an early recession.

The material has been provided by InstaForex Company - www.instaforex.com