Last Friday, US data on Labor and Manufacturing PMI came out excellent but the euro lost just 32 points, which includes fix profits of fleeting purchases and partly on the conclusion of the coalition agreement in Spain that cancels summer re-elections and removes the risk of non-acceptance of the budget. Giuseppe Conte retains the post of Prime Minister, while Paolo Savona is approved by the Minister for Relations with the EU, and Matteo Salvini became the Minister of the Interior, as Giovanni Trivia take the post as the Minister of Finance.

The number of jobs outside the US agricultural sector in May grew by 223 thousand against the forecast of 189 thousand, but the April figure was revised down from 164 thousand to 159 thousand. The unemployment rate dropped to 2000 and 1969 levels to 3.8% . However, it mainly due to the decrease in the proportion of economically active population from 62.8% to 62.7%. Particularly, the increase in the wages to 0.3% against 0.1% pleased April. The business activity index in the manufacturing sector from the ISM Institute in May showed an increase from 57.3 to 58.7 with an expected rate of 58.3. Construction costs for April increased by 1.8% against the forecast of 0.8%. Manufacturing PMI from Markit in the final estimate for May was revised down from 56.6 to 56.4.

On the same day, the Manufacturing PMI of the euro area in the final assessment of May estimate remained unchanged at 55.5 points. Stock index S&P 500 increased by 1.08%.

Today, Spain is expected to have some improved data on employment as the number of unemployed for May is expected to decrease by 105 thousand versus -86 thousand in April. The investor confidence index in the eurozone Sentix may fall from 19.2 to 18.6, while the producer price index (PPI) for April is expected to grow by 0.2% after 0.1%.

In the United States, the volume of factory orders for April will be published with a forecast of -0.4% versus 1.6% in March.

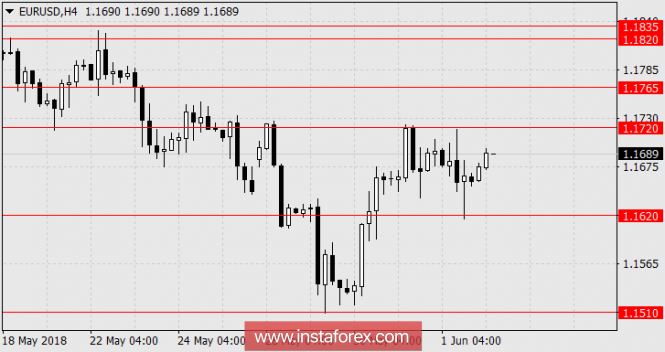

Tomorrow, the euro area is expected to grow by 0.5% in retail sales in April, while the ISM Non-Manufacturing PMI in May rose 57.9 from 56.8. We are waiting for a sideways trade in the range of 1.1620-1.1720.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com