The good data on the US economy, which came out on Friday in the afternoon, led only to a temporary increase in the US dollar, which was quickly won back. The euro and the pound managed to regain their positions by the close of the week and maintain their upside potential.

The good data on the labor market and the manufacturing sector, after which, it would seem, there should be a strong growth in the US dollar, only indicate a change in the sentiment of investors, which record profit on the US dollar in favor of risky assets. At the same time, a number of speculative players continue to count on a new wave of US dollar growth, putting on already won expectations of an increase in interest rates.

According to the report of the US Department of Labor, the unemployment rate in the United States has fallen again, which indicates a good labor market.

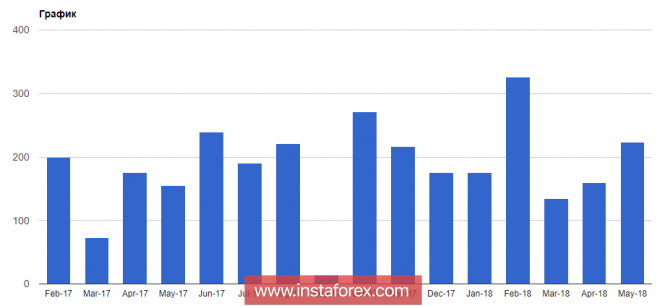

Thus, the number of jobs outside agriculture in May 2018 increased by 223,000, and the unemployment rate fell to 3.8% from 3.9%. There was also an increase in the average hourly earnings in the US in May by 2.7% compared to the same period last year.

Economists had expected that the number of jobs would show only a growth of 190,000, while unemployment would remain unchanged at 3.9%.

A good report on growth in activity in the manufacturing sector also provided only temporary support to the US dollar. According to the Institute of Supply Management ISM, the index of supply managers for the US manufacturing sector in May rose to 58.7 points from 57.3 points in April. Economists had expected that in May, the figure would be 58.1 points. Let me remind you that the index values above 50 indicate an increase in activity.

The construction costs in the US in April also increased, indicating the excellent condition of the construction sector.

According to the US Department of Commerce, construction costs in April this year rose 1.8% compared to the previous month and amounted to 1.310 trillion US dollars. Economists had expected that the monthly increase in spending in April would be 0.8%.

Fed representative Neel Kashkari commented on the report on the labor market on Friday, saying that, given the low unemployment, expects more rapid growth in wages in the US. Kashkari also continues to believe that there are unused labor resources in the US, which need to be addressed.

After the introduction by the US of duties on imports of steel and aluminum in relation to the EU countries, EU representatives immediately announced their intention to challenge these tariffs in the World Trade Organization. Also, retaliatory measures will be taken against American goods.

All this suggests that, as if European politicians did not try to avoid a trade war with the US, apparently, this will not work.

The material has been provided by InstaForex Company - www.instaforex.com