EUR / JPY pair

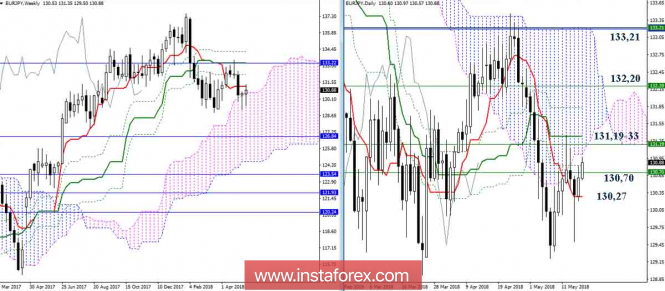

Despite the excessive depth of decline, players on the rise managed to maintain a daily short-term advantage on its side on Wednesday. As a result, we are witnessing a new testing of significant resistance levels (131.01-day Senkou Span A + 131.19 weekly Tenkan + 131.33 daily Kijun). Closure of the week above these resistance levels will allow considering the confirmation of rebound from supporting the weekly cloud (Senkou Span A 130.70) and will open new prospects for players to rise. The absence of a result, as well as, the return to the weekly cloud (130.70) and the Bulls' loss of the daily short-term advantage (130.37) can drastically change the situation and create the prerequisites for continuing the decline.

Junior time intervals are now fully adjusted to support the players to rise. The pair went into the bull zone against the clouds and formed upward targets for the breakdown of the H4 and H1 clouds. Under the current conditions, the continuation of the upswing will lead to the fulfillment of the first goal (N1), which will allow us to overcome the cascade of resistance of the upper half and go beyond the weekly Tenkan (131.19) and the daytime Kijun (131.33). Also, the target development for the breakdown of the H4 cloud implies a rise to the next resistance of the site 131.83 - 132.20 (daytime Fibo Kijun + weekly Fibo Kijun).

Changing the balance of power and cancelling the current benchmarks may decrease under the support of 130.70 (Senkou Span B N4 + Tenkan N4 + cross H1 + Senkou Span A weeks) and 130.27 (the lower boundary of the cloud H4 + the final boundaries of the cross H4 + cloud H1 + daytime Tenkan), which will overcome the cascade of resistance of the upper half and move beyond the weekly Tenkan (131.19) and daytime Kijun (131.33). They try to work out the target for the breakdown of the H4 cloud implies a rise to the next resistance of the site 131.83 - 132.20 (daytime Fibo Kijun + weekly Fibo Kijun).

Resistance: 131.01 - 131.19 - 131.33 - 131.51 - 131.83 - 132.20.

Supports: 130.70 - 130.27.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

The material has been provided by InstaForex Company - www.instaforex.com