Dear colleagues.

For the EUR / USD pair, the level of 1.1890 is the key support for the downward structure of May 14. For the GBP / USD pair, the downward structure from May 14 resumed its positions on the scale of H1. For the USD / CHF pair, the situation is in an equilibrium state. We expect the cancellation of the downward structure after the breakdown at 1.0042. For the USD / JPY pair, the continuation of the upward movement is expected after the breakdown of 110.96. The level of 110.31 is the key support. For the EUR / JPY pair, the situation has shifted in an upward direction. The development of this level is expected after the breakdown of 131.00. For the GBP / JPY pair, we have expanded the potential for the top to 152.15.

The forecast for May 18:

Analytical review of currency pairs in the scale of H1:

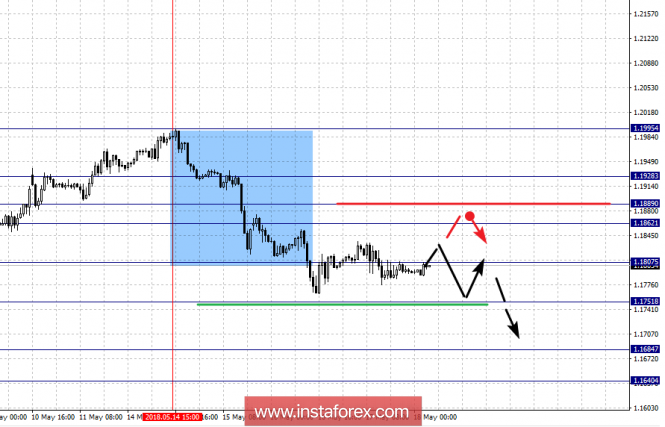

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1995, 1.1928, 1.1889, 1.1862, 1.1807, 1.1751, 1.1684 and 1.1640. Here, we continue to follow the downward structure of May 14. Short-term downward movement is expected in the area of 1.1807-1.1751. The breakdown of this level, in turn, should be accompanied by a pronounced movement towards the level of 1.1684. Near this level is the consolidation of the price. The potential value for the bottom is the level of 1.1640. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.1862 - 1.1889. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1928. This level is the key support for the downward structure from May 14.

The main trend is the local structure for the bottom of May 14.

Trading recommendations:

Buy: 1.1862 Take profit: 1.1887

Buy 1.1892 Take profit: 1.1925

Sell: 1.1805 Take profit: 1.1755

Sell: 1.1748 Take profit: 1.1688

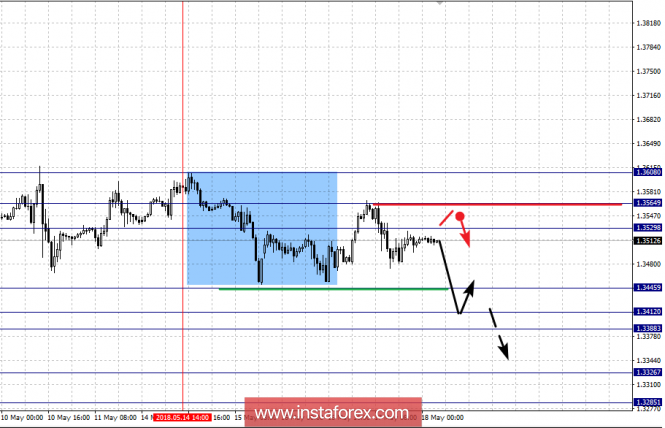

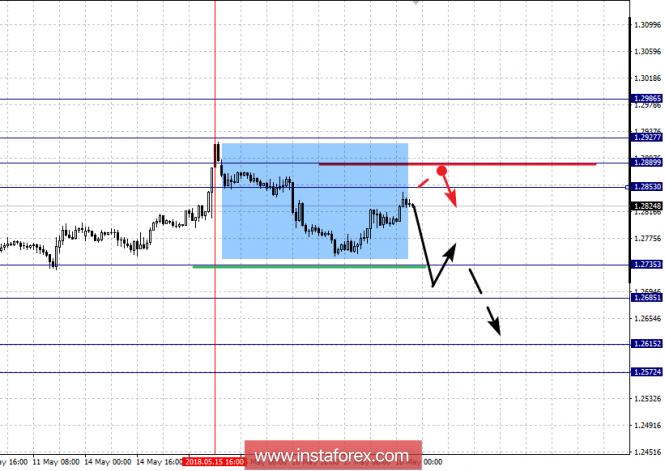

For the GBP / USD pair, the key levels on the H1 scale are 1.3608, 1.3564, 1.3529, 1.3445, 1.3412, 1.3388, 1.3326 and 1.3285. Here, the price is still in the field of initial conditions for the downward movement of May 14. The continuation of the development of the downward structure is expected after the breakdown of 1.3445. In this case, the target is 1.3412. Near this level is the consolidation of the price. Passing the price of the noise range of 1.3412 - 1.3388 should be accompanied by a pronounced movement towards the level of 1.3326. The potential value for the bottom is the level of 1.3285. After this level, we expect consolidation as well as a rollback to the top.

Consolidated movement is possible in the area of 1.3529 - 1.3564. The breakdown of the last value will lead to the formation of an upward structure. Here, the potential target is 1.3608.

The main trend is the formation of a local structure for the downward movement of May 14.

Trading recommendations:

Buy: Take profit:

Buy: 1.3565 Take profit: 1.3607

Sell: 1.3445 Take profit: 1.3412

Sell: 1.3386 Take profit: 1.3328

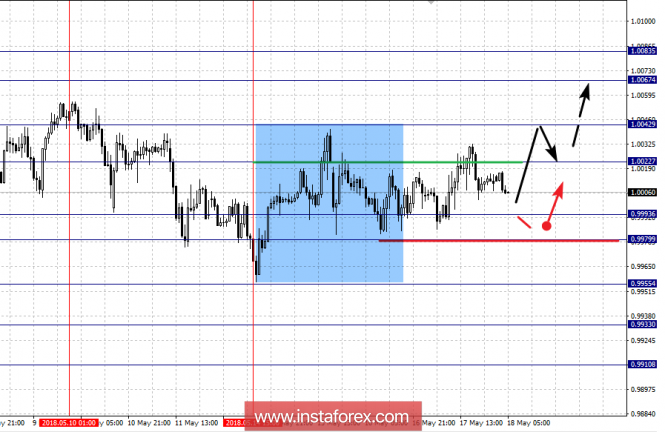

For the USD / CHF pair, the key levels on the scale of H1 are: 1.0083, 1.0067, 1.0042, 1.0022, 0.9993, 0.9979, 0.9955, 0.9933 and 0.9910. Here, the price is in an equilibrium state: the downward structure of May 10 and the formation of the potential for the top of May 14. The continuation of the development of the upward structure is expected after the breakdown of 1.0022. In this case, the target is 1.0042. Near this level is the consolidation of the price. The breakdown at 1.0042 will lead to the cancellation of the downward structure from May 10. In this case, the target is 1.0067. The potential value for the top is the level of 1.0083. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.9993 - 0.9979. The breakdown of the last value will lead to the development of the downward structure from May 10. In this case, the first target is 0.9955.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.0022 Take profit: 1.0040

Buy: 1.0044 Take profit: 1.0065

Sell: 0.9991 Take profit: 0.9980

Sell: 0.9977 Take profit: 0.9960

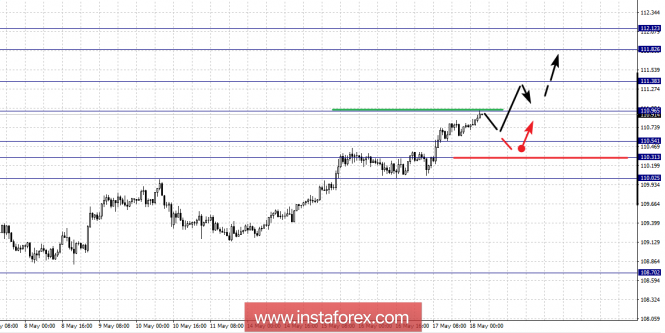

For the USD / JPY pair, the key levels on a scale are: 112.12, 111.82, 111.38, 110.96, 110.54, 110.31 and 110.02. Here, we follow the development of the upward structure of May 4. The continuation of the upward movement is expected after the breakdown of 110.96. In this case,, the first target is 111.38. Near this level is the consolidation of the price. The potential value for the top is the level of 111.82. Upon reaching this level, we expect consolidation in the area of 111.82 - 112.12, as well as a pullback downwards.

Short-term downward movement is possible in the area of 110.54 - 110.31. The breakdown of the last value will lead to in-depth correction. Here, the target is 110.02. This level is the key support for the top.

The main trend is the upward structure of May 4.

Trading recommendations:

Buy: 110.98 Take profit: 111.36

Buy: 111.40 Take profit: 111.80

Sell: 110.52 Take profit: 110.33

Sell: 110.28 Take profit: 110.04

For the CAD / USD pair, the key H1 scale levels are: 1.2986, 1.2927, 1.2889, 1.2853, 1.2735, 1.2685, 1.2615 and 1.2572. Here, the price has issued a local structure for the bottom of May 15. The continuation of the downward movement is expected after the breakdown of 1.2735. In this case, the target is 1.2685. In this area of 1.2685 - 1.2735 is the consolidation of the price. The breakdown of the level of 1.2685 should be accompanied by a pronounced movement towards the level of 1.2615. The potential value for the bottom is the level of 1.2572. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.2853 - 1.2889. The breakdown of the last value will lead to an upward structure. In this case, the target is 1.2927. The potential value for the upward trend so far is the level of 1.2986.

The main trend is the local structure of May 15.

Trading recommendations:

Buy: 12853 Take profit: 1.2886

Buy: 1.2890 Take profit: 1.2925

Sell: 1.2735 Take profit: 1.2690

Sell: 1.2682 Take profit: 1.2615

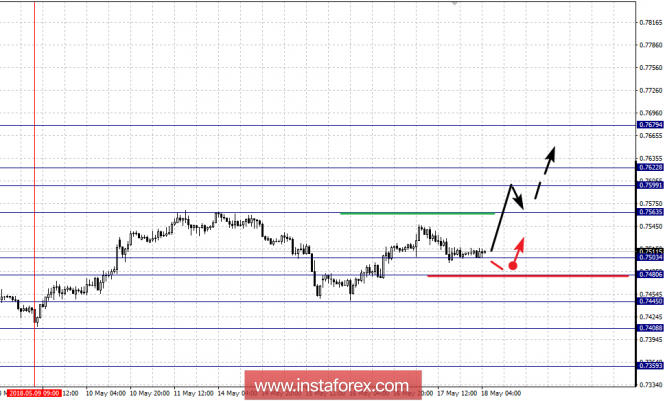

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7679, 0.7622, 0.7599, 0.7563, 0.7503, 0.7480, 0.7445, 0.7408 and 0.7359. Here, the resumption of the upward trend is expected after the breakdown of 0.7563. In this case, the first target is 0.7599. In this area of 0.7599 - 0.7622 is the consolidation of the price. The potential value for the top is the level of 0.7679. Upon reaching this level, we expect the consolidated movement as well as a possible pullback downwards.

Short-term downward movement is possible in the area of 0.7503 - 0.7480. The breakdown of the last value will lead to the development of the a downward trend. Here, the target is 0.7445. In the area of 0.7445 - 0.7408 we expect short-term movement towards the bottom. The potential value for the downward movement is the level of 0.7359. From this level, we expect a pullback to the top.

The main trend is the upward structure of May 9.

Trading recommendations:

Buy: 0.7563 Take profit: 0.7598

Buy: 0.7624 Take profit: 0.7676

Sell: 0.7503 Take profit: 0.7481

Sell: 0.7478 Take profit: 0.7447

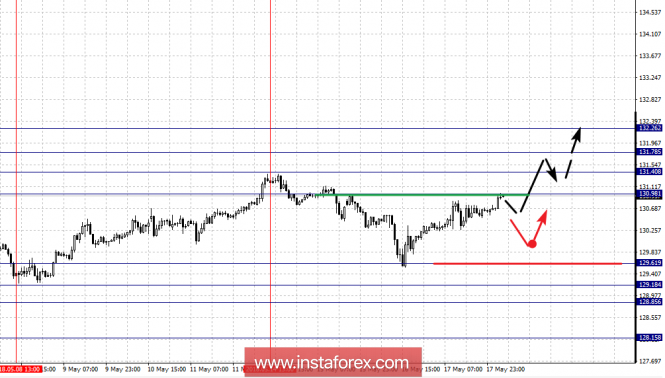

For the of EUR / JPY pair, the key levels on the scale of H1 are: 132.26, 131.78, 131.40, 130.98, 129.61, 129.18, 128.85 and 128.15. Here, the price entered the equilibrium situation. The continuation of the traffic to the top is possible after the breakdown of 130.98. In this case, the first target is 131.40. In the area of 131.40 - 131.78 is the consolidation of the price. The potential value for the upward structure is, for the time being, the level of 132.26.

The development of the downward movement from May 14 is expected after the breakdown of 129.61. Here, the first target is 129.18. In the area of 129.18 - 128.85 is the consolidation of the price. The potential value for the bottom is the level 128.15. From this level, we expect departure towards correction.

The main trend is the equilibrium situation: the formation of the potential for the bottom of May 14.

Trading recommendations:

Buy: 131.00 Take profit: 131.40

Buy: 131.42 Take profit: 131.75

Sell: 129.60 Take profit: 129.20

Sell: 128.85 Take profit: 128.20

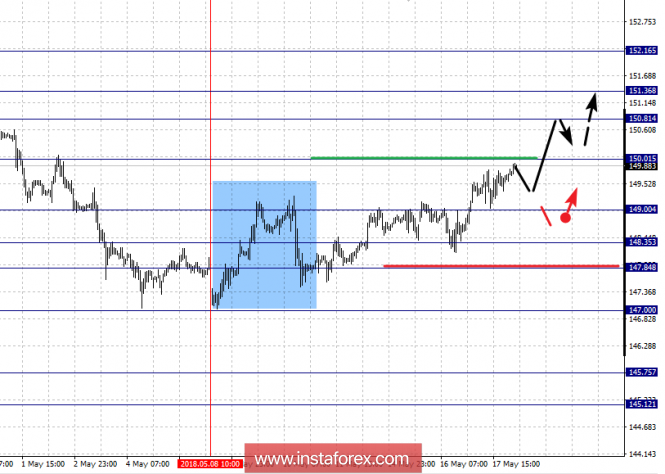

For the GBP / JPY pair, the key levels on the scale of H1 are: 152.16, 151.36, 150.81, 150.01, 149.00, 148.35, 147.84, 147.00, 145.75 and 145.12. Here, we follow the upward structure of May 8. The continuation of the upward movement is expected after the breakdown of 150.01. In this case, the target is 150.81. In the area of 150.81 - 151.36 is the consolidation of the price. The potential value for the top is the level 152.16. Upon reaching this level, we expect a departure towards correction.

We expect the departure towards the correction zone after the breakdown at 149.00. In this case, the target is 148.35. Short-term downward movement is possible in the area of 148.35 - 147.84. The breakdown of the last value will lead to the development of the a downward structure. In this case, the target is 147.00. Near this level is the consolidation of the price.

The main trend is the upward structure of May 8.

Trading recommendations:

Buy: 150.05 Take profit: 150.80

Buy: 150.84 Take profit: 151.30

Sell: 149.00 Take profit: 148.40

Sell: 147.80 Take profit: 147.00

The material has been provided by InstaForex Company - www.instaforex.com