In the first quarter, the British pound added 4 percent against the US dollar due to a reduction in political risks and an increase in the likelihood of a continuation of the cycle of normalization of the monetary policy of the Bank of England in May, above 80 percent. Slowing inflation from 3 percent to 2.7 percent and increasing wages to 2.8 percent can be expected to bolster the purchasing power of the population and the acceleration of GDP. As a result, the factor of underestimation can play on the side of the pound.

While the OECD claims that the economy of the United Kingdom will show the slowest growth rates among developed countries, a pleasant surprise is able to help the "bulls" in the GBP/USD to restore an upward trend. For example, you do not need to go far: at the end of 2016, Bloomberg experts gave modest estimates of the eurozone's GDP for 2017 at + 1.7%. In fact, the indicator was received positively with the 2.5% rally, which became one of the key drivers of strengthening the euro by 14%. As a clue to the future dynamics of the economy of the United Kingdom can serve as evidence from business activity. The statistics on purchasing managers' indices adds saturation to the economic calendar and pushes the pound for the most interesting currency of the first week of April.

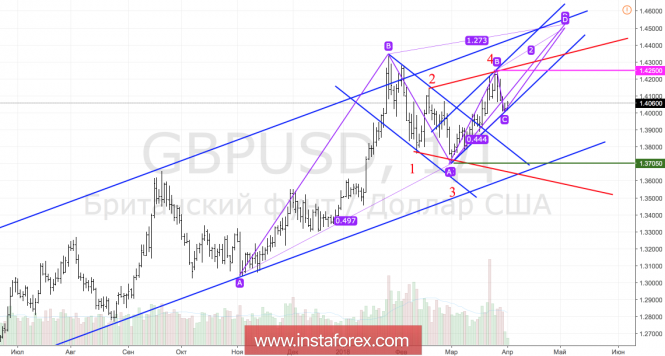

Dynamics of PMI in services and GDP in Britain

Source: Trading Economics.

Moderately negative PMI forecasts in production (54.7 versus 55.2 in February) and construction sectors (50.8 against 51.8), as well as in services sector (54 versus 54.5) may become a kind of rehearsal, what will happen to the pound for the rest of the year. Strong factual data inspire "Bulls" for GBP/USD to take advantage of.

Positive from macroeconomic statistics, coupled with the decision on the transition period for Britain until 2019, which should be interpreted as a reduction in political risks, untie the hands of the Bank of England. The Committee on Monetary Policy has plenty of "hawks" who were waiting for clues from Brussels. The futures market expects an increase in repo rates in May and November, the normalization cycle may continue in February 2019. Adjustments to this trajectory can be made by politics and the economy. In particular, "bears" for the sterling pound say that it is too early to speak about certainty with regard to Brexit and refer to volatility growth from 7.8% in October-December to 8.3% in January-March. ING, on the other hand, claims that the pound's violent response to a transitional report indicates its underestimation.

When predicting the future dynamics of GBP/USD, one should not forget about such a factor as trade wars. The exchange of import duties between the US and China worsens the global appetite for risk, which negatively affects the desire of investors to invest in financial markets in Britain and is a deterrent for sterling.

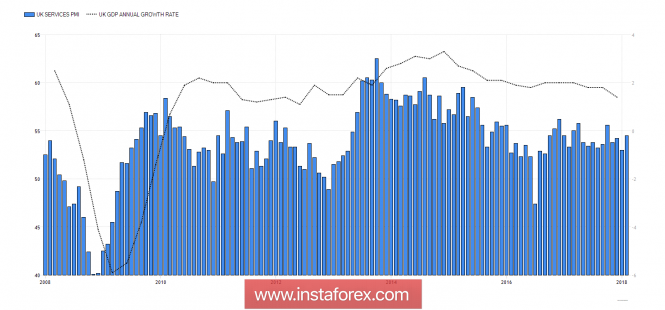

Technically, the necessary condition for the recovery of the "bullish" trend for GBP/USD is a breakthrough resistance at 1.425. In this case, the child pattern AB=CD with a target of 200% will be activated. While the pair's quotes are above 1.3705, the situation is controlled by buyers.

GBP/USD, daily chart