USD/JPY has been non-volatile with the bearish gains which lead the price below 105.50 area recently. After the recent Federal Funds Rate Hike, JPY gained the required push to continue the bearish pressure in the pair which is currently expected to proceed much lower with certain retracement along the way. This week is going to be very important for JPY having Unemployment Rate report going to be published which is expected to increase to 2.6% from the previous value of 2.4% and Prelim Industrial Production report is going to be published as well which is expected to increase to 5.1% from the previous negative value of -6.8%. Tomorrow, JPY SPPI report is going to be published which is expected to be unchanged at 0.7% and BOJ Core CPI is expected to decrease to 0.7% from the previous value of 0.8%. The forecasts of the JPY economic reports this week is not quite satisfactory but any positive shift in the economic reports may lead to impulsive gain on the JPY side. On the USD side, today FOMC Member Dudley and Mester is going to speak about the Interest Rate decision and Monetary Policies which is indeed quite important as of the recent Rate Hike affected the USD currency pretty well. As of the current scenario, USD is expected to gain some momentum as a shift in the market sentiment ahead of the impactful JPY economic reports are published. Any positive result of the upcoming JPY report may lead to impulsive gains on the bearish side of the pair unless USD comes up with better reports.

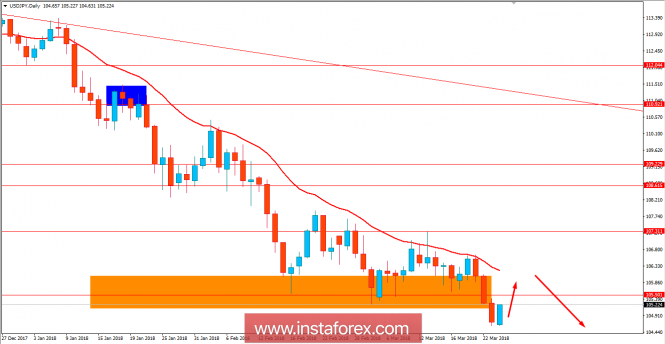

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains below 105.50 and it is expected to retrace towards the dynamic level of 20 EMA and after successfully rejecting off the dynamic level, it is expected to proceed lower towards 100.00 price area. As the price remains below 108.50 price area, the bearish bias is expected to continue further.