GBPUSD has been quite impulsive with the bearish gains recently which is expected to push the price much lower towards 1.3850-1.3950 support area in the coming days. Ahead of the upcoming GBP Current Account report which is expected to show a deficit of -23.7B from the previous figure of -22.8B and the Final GDP report which is expected to be unchanged at 0.4% this week, certain volatility is being observed in the market already. Today there were no economic reports or events on the GBP side, but on the USD side the S&P/CS Composite 20-HPI report was recently published which showed an increase to 6.4% on the expectation of unchanged value of 6.3%. Additionally, today the CB Consumer Confidence report is going to be published which is expected to increase to 131.2 from the previous figure of 130.8. Besides, the Richmond Manufacturing Index report is expected to decrease to 23 from the previous figure of 28 and FOMC Member Bostic is going to speak today which is expected to be quite neutral in nature. As of the current scenario, the market is expected to continue its correction and volatility throughout this week whereas USD is expected to gain some momentum against GBP ahead of the Current Account economic report to be published on Thursday. If the Thursday economic reports fail to meet the forecast, further bearish pressure is expected in this pair.

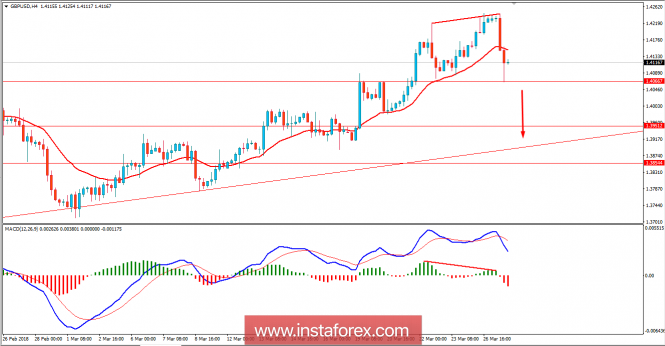

Now let us look at the technical view. The price is currently quite bearish in nature residing below the dynamic level of 20 EMA, having Bearish Divergence in place. The price is currently residing just above the important event level of 1.4060 from where, if it is broken below, further bearish momentum is expected to continue with target towards the support area of 1.3850-1.3950. As the price remains below 1.4250 resistance area, the bearish bias is expected to continue further.