GBP/USD has been quite volatile and corrective recently, forming a squeeze towards the resistance level of 1.3610. GBP has been the dominant currency in the pair but recently USD has been quite successful with its pressure to restrict further bullish momentum in this pair. This week GBP has been quite negative with the economic reports which affected the impulsive bullish pressure in the pair. Today, the UK Manufacturing Production report is going to be published which is expected to increase to 0.3% from the previous value of 0.1%. Besides, the Goods Trade Balance report is expected to show a slight increase in deficit to -10.9B from the previous figure of -10.8B. Furthemore, the Construction Output is expected to increase to 0.7% from the previous negative value of -1.7%. The Industrial Production is also expected to increase to 0.4% from the previous value of 0.0%. Additionally, the NIESR GDP Estimate is expected to show an increase from the previous value of 0.5%. On the other hand, despite having worse economic reports recently, USD managed to maintain momentum against GBP which is a signal that further bearish pressure is coming. Today, the US Import Price report is going to be published. It is expected to decrease to 0.4% from the previous value of 0.7%. The Final Wholesale Inventories report is expected to be unchanged at 0.7% and the Crude Oil Inventories is expected to show less deficit at -3.9M from the previous figure of -7.4M. As of the current scenario, the US economic reports are forecasted to have mixed result whereas GBP seems quite optimistic with the economic report results today. A good amount of volatility is expected to hit the market today. USD is likely to gain momentum over GBP, if the US economic reports come better than expected today or GBP fails to meet the expected result.

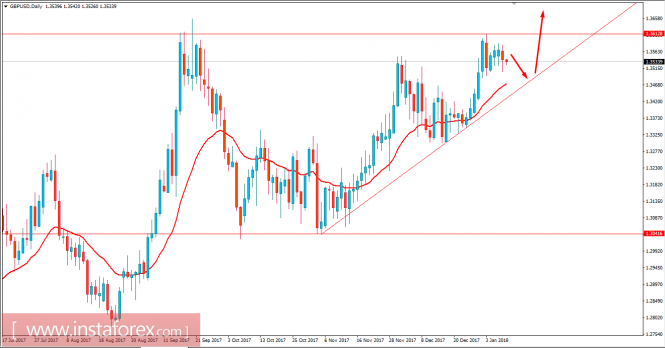

Now let us look at the technical view. The price is currently residing inside the corrective volatile structure just below the resistance level of 1.3610. As of the current scenario, the price is expected to move down towards the trend line support around 1.3450 area before showing some bullish intervention along the way. As the price remains above 1.33 support area, the bullish bias is expected to continue which might result in a break above 1.3610 with target towards 1.3850.