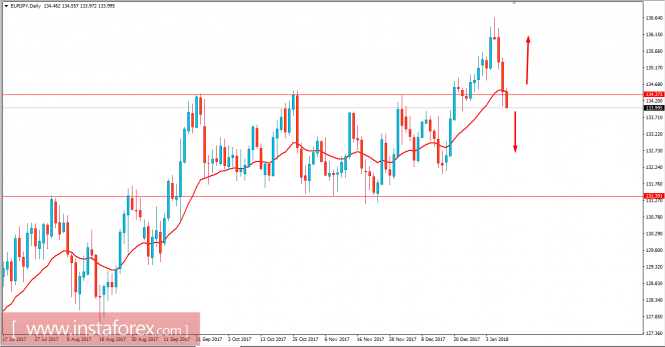

EUR/JPY has been quite impulsive with the bearish pressure recently which lead the price to fall back from the 136.70 price area to 134.00 support area. JPY has been quite impulsive with its gains recently due to positive economic reports published this week. Recently Japan's Average Cash Earnings report was published with a significant increase to 0.9% from the previous value of 0.2% which was expected to be at 0.6% and the Consumer Confidence report showed a slight decrease to 44.7 from the previous figure of 44.9 which was expected to increase to 45.1. The worse economic report did not have significant impact on the gains of JPY. Today JPY 10y Bond Auction report was published with an increase to 0.08|3.7 from the previous figure of 0.06|3.7. On the EUR side, today French Industrial Production report is going to be published which is expected to decrease to -0.4% from the previous value of 1.9% and German 10y Bond Auction is going to be held which previous was at 0.30|1.1. As of the current scenario, there will be no key economic reports or events in the Eurozone today to support EUR gains over JPY whereas tomorrow Japan's Leading Indicators report is going to be published which is expected to increase to 108.7 from the previous value of 106.5. If the upcoming economic reports are published better than expected, then JPY is likely to extend gains in the coming days.

Now let us look at the technical view. The price is currently residing below 134.00 support area and dynamic level of 20 EMA which indicates that the bears are the stronger party in the pair. A daily close above or below 134.50 will lead to further definite trend direction in this pair but as of now, the bearish bias is expected to continue as the price remains below 135 price area with a daily close.