AUD/USD has been quite corrective and volatile recently inside the range of 0.8050-0.8120 area. Ahead of the high impact economic reports of USD this week, the currency seemed to be quite weak against AUD today. Today, AUD CPI report was published unchanged at 0.6% which was expected to increase to 0.7%, Trimmed Mean CPI report also showed an unchanged report of 0.4% which was expected to increase to 0.5%, and Private Sector Credit decreased to 0.3% which was expected to be unchanged at 0.5%. On the other hand, ahead of the high impact economic reports to be published on Friday, today, USD ADP Non-Farm Employment Change report is going to be published which is expected to decrease to 186k from the previous figure of 250k, Employment Cost Index is expected to go down to 0.6% from the previous value of 0.7%, Chicago PMI report is expected to decrease to 64.2 from the previous figure of 67.6, Pending Home Sales report is expected to increase to 0.5% from the previous value of 0.2%, and Crude Oil Inventories is expected to grow to 0.1M from the previous figure of -1.1M. Moreover, FOMC Statement and Federal Funds Rate report is going to be published today which is expected to be unchanged at 1.50%. As of the current scenario, a good amount of volatility is expected to hit the market due to high impact economic reports to be published on the USD side, and despite having worse economic reports, AUD gained momentum which also tells a different story about the USD weakness currently. If the USD economic reports comes better than expected, a bearish pressure is expected to hit the pair in the coming days with a strong momentum.

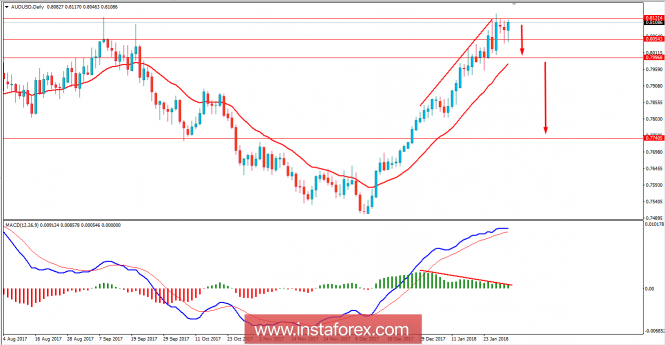

Now let us look at the technical view. The price is residing at the edge of the 0.8120 area from where it is expected to push lower towards 0.8050 and later towards 0.7750 in the future. Having Bearish Continuing Divergence in a non-volatile trend is indeed very interesting, and a break below 0.8050 will confirm impulsive bearish pressure later in the market. As the price remains below 0.8120 with a daily close, the bearish bias is expected to continue further.