The US Dollar is weaker overnight as there were rumors that Trump has decided that J. Powell will succeed J. Yellen as head of the Fed. EUR/USD reached a peak near 1.1670. Before the Bank of England decision, GBP?USD is approaching 1.33. USD/JPY is back at 114.00. AUD / USD is at 0.7720 (+0.5%) after better than expected real estate data. NZD/USD is approaching 0.6950 and continues the overnight rally after good labor market data.

On Thursday 2nd of November, the event calendar is busy with important news releases. The main event of the day is Bank of England interest rate decision, but before that, the set of PMI Manufacturing data from across the Eurozone will be released as well. Later during the day, the US will post Unemployment Claims and Continuing Claims data. There are some speeches scheduled as well: first will speak BOE Governor Mark Carney and then FOMC Member Jerome Powell and William Dudley.

GBP/USD analysis for 02/11/2017:

The Bank of England Interest Rate Decision, Inflation Report, Asset Purchase Facility and Monetary Policy Summary is scheduled at 12:00 am GMT. The market participants expect an interest rate hike from 0.25% to 0.50% without a change in asset purchases. This sharp swing in expectations is almost entirely the result of the step up in hawkish rhetoric proffered by the MPC rather than a response to UK economic data. Indeed, while UK CPI inflation has edged up to 3%, activity series is showing signs of weakening. The implication is that for many forecasters, the expectations of a rate rise on today's meeting is not necessarily consistent with what they think the BoE should do, but rather what the MPC now looks likely to do. Nevertheless, due to weakness in recent UK economic data, the Bank might not be able to follow on with another hike for some time. The dovish hike scenario suggests that upside potential for the British Pound on a policy move in November is likely to be limited.

Let's now take a look at the GBP/USD technical picture at the H4 time frame before the news is released. The price has managed to break out above the dashed black trading channel, but it was capped at the nearest resistance at the level of 1.3292. In a case of a rate hike, the market could go higher to hit the next technical resistance at the level of 1.3342. It is very important how the price will behave on this level because breakout higher opens the road towards the next technical resistance at the level of 1.3462. If the BoE will not deliver, then the impulsive drop towards the level of 1.3087 is the most likely scenario.

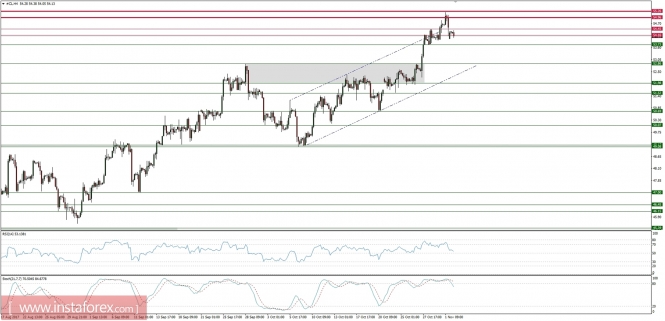

Market Snapshot: Crude Oil capped at $55.26

The price of Crude Oil was capped at the technical resistance at the level of $55.26 and now is slipping towards the technical support at the level of $53.77. AN interesting candlestick pattern can be observed in the daily time frame as well. The market conditions are overbought and now the momentum indicator is approaching its fifty level.

Market Snapshot: Gold capped at trend line

The price of Gold was capped at the golden trend line resistance around the level of $1,281. The market reversed slightly towards the old support at the level of $1,276 and now is trying to bounce again. Nevertheless, as long as the price stays below the golden trend line and below the 200 periods moving average, the outlook remains bearish.