Today, the US Federal Reserve will hold a regular meeting on monetary policy issues. Since the meeting is a "pass-through", which is not accompanied by the publication of macroeconomic forecasts and a press conference by the Fed chair. The markets do not expect any changes, while the probability of raising the rate is less than 3%, according to the CME data. Moreover, all possible intrigue will be centered around the text of the accompanying statements.

The Committee can add the statement on employment reduction in the text. Markets are ready for the appearance of this phrase, as employment is nearly full as of this moment. It is impossible to keep the previous growth rates of new jobs purely statistical. Nevertheless, the previous slowdown can have a negative reaction to the dollar.

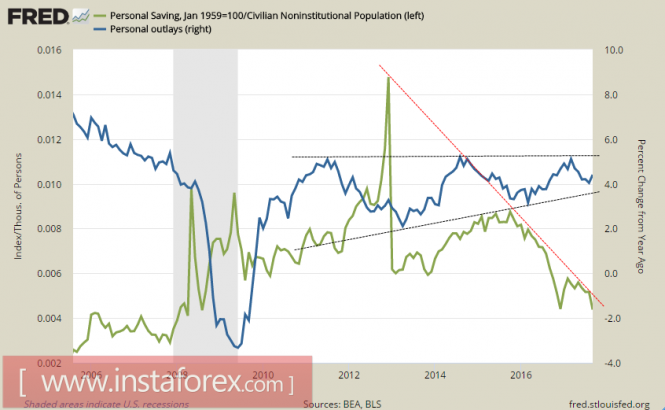

Specific attention will turn to the formulation of prospects for US inflation. A report on personal incomes and expenditures in September leads to mixed conclusions that were published on Monday. On one hand, consumer spending grew by 1% compared to August, which is the maximum monthly growth since August 2009, which clearly indicates high consumer activity. At the same time, the explanation for this spike is trivial due to subsequent hurricanes that led a drastic increase in durable goods expenditures, primarily cars. At the same time, the saving rate continues to decline and reached its lowest level in the past 10 years, while the savings ratio of the able-bodied people is falling sharply from the maximum reached in December 2012.

Thus, the current high levels of consumer activity are threatened to fall already in the short term. According to the plan, the expectations for launching a tax reform should reduce tax pressure on consumers, but can no longer stimulate demand which means that inflation is also under threat.

Also, the market is preparing for the subsequent growth of the dollar despite a number of fears. It is expected that US President Donald Trump will announce his choice for the position as the next Fed chairman on Thursday. According to rumors, the position will be given to Jerome Powell, who is known for his moderately dovish position. Accordingly, the threat of the tightening financial conditions slightly weaken, this could lead to an increase in the dollar as well as to the demand for profitable assets, however, the Japanese yen and the gold will react with a decline.

It is also expected that the ISM index in the manufacturing sector for October will be published today. The large gap between the ISM and the PMI Markit can lead to the ISM leveling at lower levels, which may put a little pressure on the dollar.

On Thursday, preliminary data on labor costs and labor productivity will be published in Q3, experts anticipate for a noticeable excess over Q2, which could provide significant support to the dollar, as it will confirm the trend for stable economic growth.

The key event of the week is the publication of October employment report on Friday. Due to the hurricanes, employment growth in September was negative, and October forecasts show more favorable results, as the number of new jobs had increased for more than 300 thousand, according to experts. This could be regarded as a strong bullish pressure factor on the dollar, otherwise, the growth of the average hourly working fee can slow down to + 0.3% against + 0.5% a month earlier. This parameter can become the key to the development of market reaction towards the publication of the report since it is directly related to inflation outlook and may influence the growth forecasts on interest rates.

Generally, it can be noted that the dollar is slowly but confidently returning to the growth trajectory. The period of uncertainty is over, as investors are waiting for the official presentation of the bill on tax reform in Congress, which is a powerful driver. The dollar will be in demand regardless of the preferred tone by the FOMC for today's meeting. The Japanese yen and Swiss Franc may become outsiders of the week.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com