"Oil will go to the side where the Prince of Saudi Arabia sneezed", this phrase was popular in the market a few years ago, which emphasized the importance of Riyadh for the black gold market. Since then, the situation has changed significantly due to the activity of slate producers in the United States that forced players to reckon with them, but old stories appear now and again. The statement by the Prince of Saudi Arabia Mohammed bin Salman regarding the country's commitment to extend the Vienna OPEC agreements on reducing the production until the end of 2018, became one of the key growth drivers for Brent prices above the psychologically important level of $60 per barrel. In case that the president of Russia and the Saudi Arabia had blue-blood talks about the same thing, the case will clearly burn out.

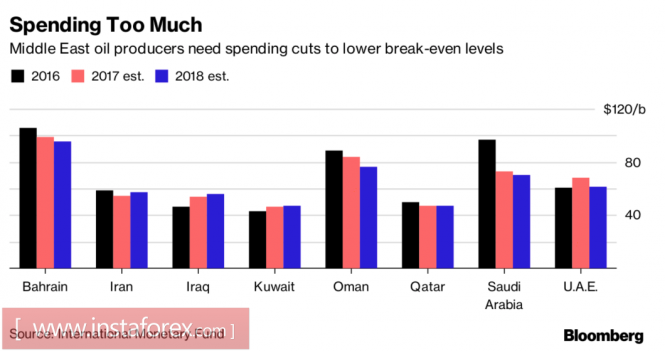

The countries producing black gold in recent years had a hard time. In the conditions of the "bear" markets, Brent and WTI were forced to work in the negative. According to the IMF, the break-even point for Riyadh in 2016 was $96.6 per barrel. In 2018, the figure will drop to $70 per barrel. This talks about the price that supports the fulfillment of spending plans and having a balanced budget. Undoubtedly, the Saudi Arabia is beginning to use rhetoric that supports the "bulls" towards a very little break-even point.

Break-even points of the OPEC countries

Source: Bloomberg.

Commerzbank notes that the public comments of the Princes on oil are rare, indicating the firm intention of the Saudis to reduce global reserves of black gold to the level of 5-year averages. Since the beginning of the year, the deviation between the actual data and the average value of the indicator has decreased by 160 million barrels, which created a solid foundation for the rally of Brent and WTI.

Along with the news about the possible extension of the Vienna OPEC agreements, the increasing geopolitical conflict in the Middle East supports the "bulls". After the attack by the Kurdish federal troops from the province of Kirkuk, the black gold exports from northern Iraq resumed. At the same time, the intense situation remains and Tehran accuses Russia's Rosneft of concluding contracts with the Kurdistan without the consent of the country's official authorities.

Apparently, it is surprising that increase in prices did not bother speculators. By the end of the week, the net longs for Brent were increased by 2.6% to 506737 contracts by October 24. The indicator feels comfortable near the record marks that took place in September. Net lows for WTI grew for the first time in the last four 5-day periods. The present behavior of large players suggests confidence in shifting the trading range to higher levels compared to the current levels. Over the past 16 months, Brent has been reluctant to leave the border of the channel at $ 45-55 per barrel, is it the right time to do it?

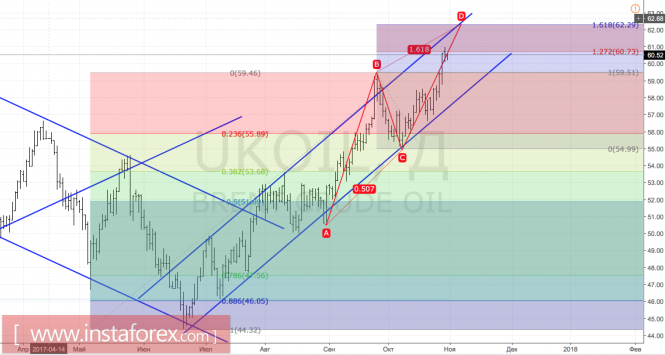

Technically, the North Sea variety managed to achieve an intermediate target of 127.2% for the AB = CD pattern, after which a natural rollback occurred. The situation continues to control the "bulls", and the rebound from the support at $ 59.5 per barrel or the renewal of October high will open the way to $ 62.3.

Brent daily chart