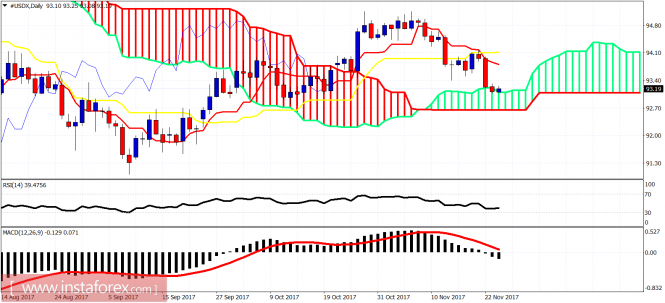

The Dollar index is very close to our short-term bearish targets of 93.10-92.50. The trend remains bearish in the short-term. The Dollar index is could already have completed or is near completion of the downward move from 95. At least a short-term bounce will follow.

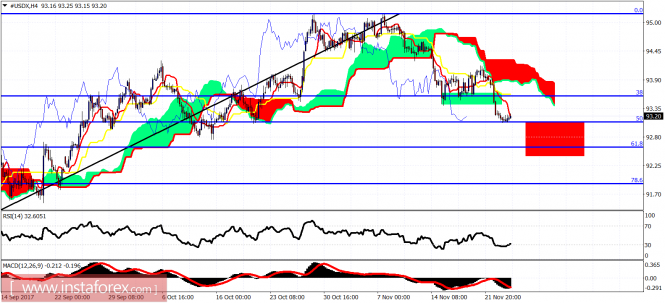

Green rectangle - support area (broken) now resistance

Red rectangle - support area

The Dollar index has broken below the 38% Fibonacci retracement support area shown by the green rectangle. The trend is bearish as the price is making lower lows and lower highs while below both the tenkan- and kijun-sen indicators. Resistance is at 93.40-93.60. Support is at 93-92.50.