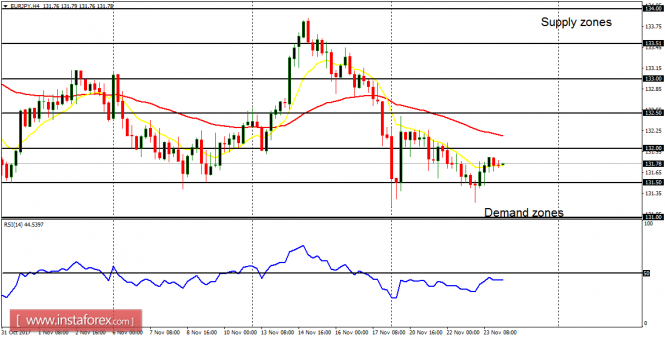

EUR/USD: The EUR/USD pair has continued going upwards, as price has gained 120 pips since Wednesday. The resistance line at 1.1850 is under siege (having been tested several times) and it would soon be breached to the upside as price goes for another resistance line at 1.1900.

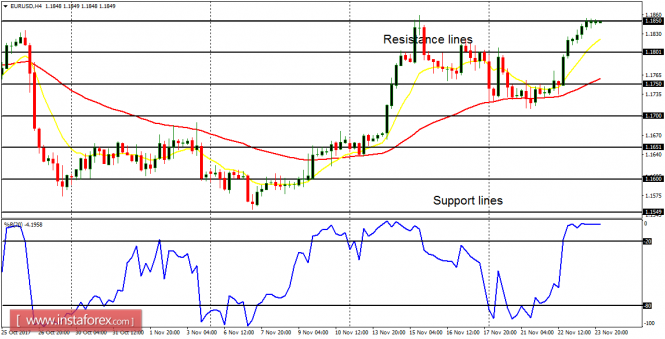

USD/CHF: The USD/CHF pair has continued going downwards, as price has lost 120 pips since Wednesday. The support level at 0.9800 is being besieged by bears (having been tested already) and it would soon be breached to the downside as price goes for another support level at 0.9750.

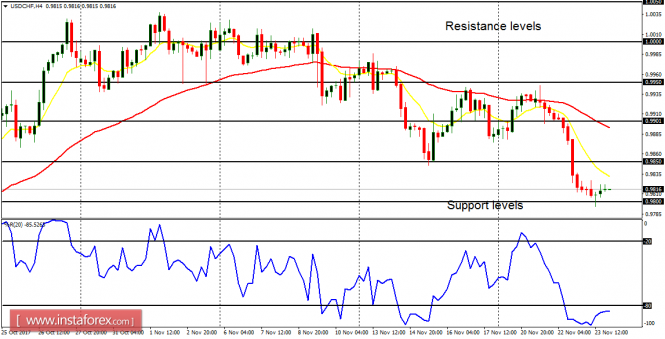

GBP/USD: The GBP/USD pair has had some faint bullish effort, and it is currently consolidating. There is a vivid Bullish Confirmation Pattern in the 4-hour chart, and price is currently above the accumulation territory at 1.3300, going towards the distribution territory at 1.3350 (which would be exceeded this week or next).

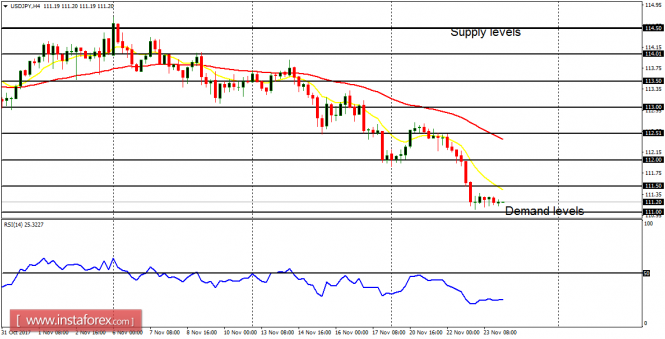

USD/JPY: This currency trading instrument has become bearish since November 6. Price has gone down by more than 330 pips since then. The EMA 11 is below the EMA 56, signaling a continuation of the bearish trend, especially when momentum returns to the market. Price is currently below the supply level at 111.50 and it would reach the demand level at 111.00 any time, even exceeding it.

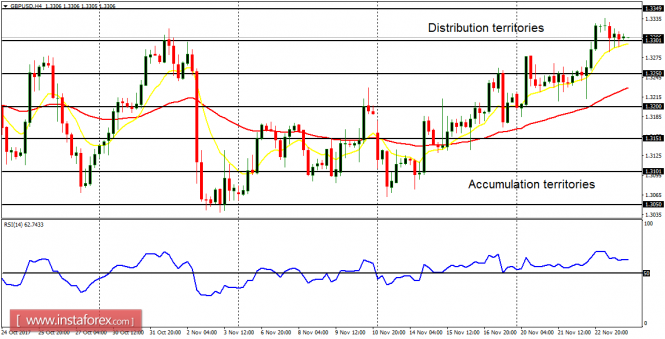

EUR/JPY: There is a clear Bearish Confirmation Pattern on the EUR/JPY cross. However, the cross is kind of consolidating. The bearish movement is expected to be renewed when volatility arises in the market (especially as long as the Yen continues to strengthen). In the next several trading days, the demand zones at 131.50, 130.00 and 129.50 could be attained.