The political crisis in Germany did not prevent the main currency pair from closing the last full week of November in the green territory. The convergence in the monetary policy of the ECB and the Fed has played into the hands of the bulls of the EUR/USD pair. Despite the fact that the European Central Bank left the opportunity to expand its quantitative easing program after September 2018, few people in the market believe that this will be done. No matter how much Mario Draghi wanted to convince investors of the extension of the QE, it is about starting the normalization of monetary policy. And if so, the medium and long-term prospects for the euro are drawn in light colors.

While the eurozone's GDP is expanding by 2.5% y/y in the third quarter, demonstrating the best result in the past 6 years, and the dynamics of business activity fuels hope that in October-December it will be even better, adhering to the cheap money policy is an absolute shortcoming. With a strong labor market, an unrestrained inflation and overheating of the economy is possible, which could lead into a recession. This is the breakdown of the ECB's worldview in the first half of 2018. It is quite possible that the adversity of the US, Japan and Britain will work, where the drop in the unemployment rate to the lowest levels for decades did not lead to an increase in wages and prices. However, if it does not work then speculations of an increase in the refinancing rate and deposit rates will begin to spread in the market.

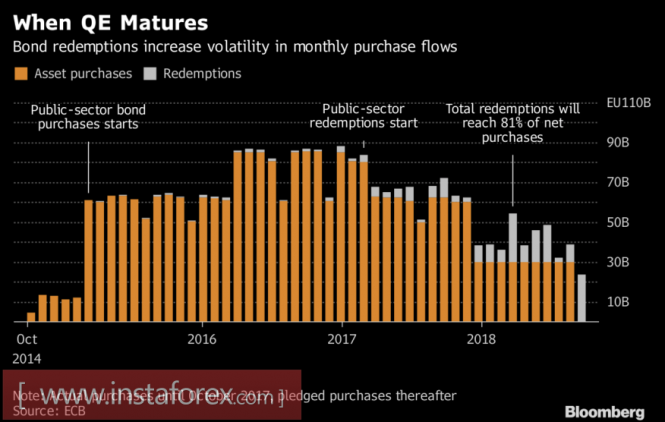

It should be understood that in the first quarter of 2018, the volume of purchases of assets within the European QE, including income reinvestment, will drop sharply. This will lead to an increase in the yield of debt obligations for EU countries and an increase in the prices of the EUR/USD pair.

Dynamics of purchases of assets within the framework of the European QE

Source: Bloomberg.

The Fed, on the contrary, can reduce the rate of normalization of monetary policy and raise rates not thrice, as stipulated in the September FOMC forecast, but only twice, as the futures market expects. In 2016, a similar slowing of the path of the federal funds rate for most of the year led to the selling of the US dollar. Furthermore, if it were not for Donald Trump's victory in the US presidential election, the "Greenback" would have ended the year in the status of an odd one out.

In 2018, it will not be able to use such an important trump card like the divergence in monetary policy. This is because the acceleration of the world economy forces central bank-peers of the Fed to consider options for normalization. Although the "hawks" of the Governing Council of the ECB are in the minority, the continued recovery of the euro-zone economy will force centrists to move to their camp.

The focus of investors on the first week of December will be the policy. The US Senate intends to vote on the draft on tax reform, and Angela Merkel's party is set to negotiate with its main competitors - the Social Democrats. If it turns out, the bulls for the EUR/USD pair will have a new reason to attack.

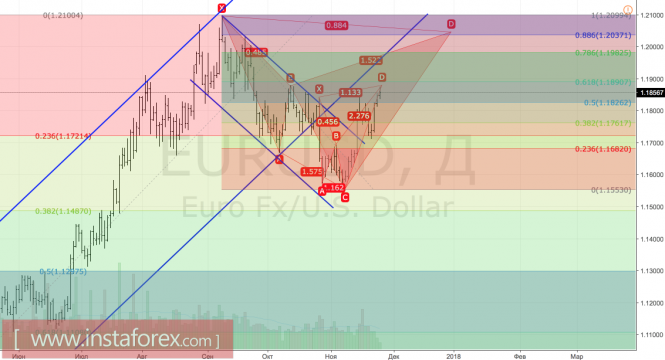

Technically, the target goal of 113% for the "Shark" pattern and the inability of buyers to move the quotes of the pair above the resistance at 1,189 will reinforce the risks of a rollback towards support at 1.1825, 1.176 and 1.172. A rebound from any of these will be the reason for buying.

EUR/USD, daily chart