Eurozone

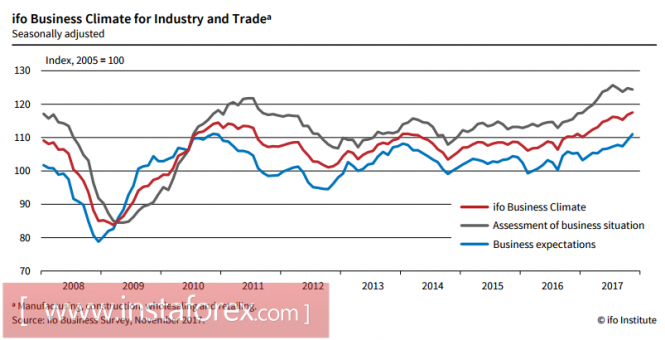

The German business climate index from IFO rose in November to a new record high of 117.5%, provoking a sharp demand for the euro and questioning the market turn in favor of the dollar, which finally began to take shape in recent weeks. A new record is set in the production sector, the trade index is just below the historical record, and expectations in the long term of six months remain confidently positive.

At the same time, it should be noted that this result may not accurately reflect the real picture, since 90% of the responses were received even before the failure of negotiations on the formation of the German coalition became known.

Against the backdrop of positive reports from IFO and PMI Markit, it is logical to expect that consumer activity in the eurozone is also increasing. On Tuesday, the Gfk report will be published, the September 10.7 points is expected to be exceeded, which in the end will support the euro, as it will increase the chances for inflation. On Wednesday, the European Commission will present its outlook for economic optimism, and the culmination of the week may be Friday, when preliminary inflation data will be published in November. Forecasts are more than favorable, growth to 1.6% is forecasted against 1.4% a month earlier, and the release of data, no worse than expectations, will allow the euro to gain a foothold above 1.20 and test the September high for strength.

United Kingdom

Pound positions look weaker. The consumer confidence index from Gfk is close to the four-year lows and on Thursday, the data for November will come out, and according to forecasts the index will drop from -10p to -11p. The volume of mortgage lending at are annual lows, which indicates a low level of income.

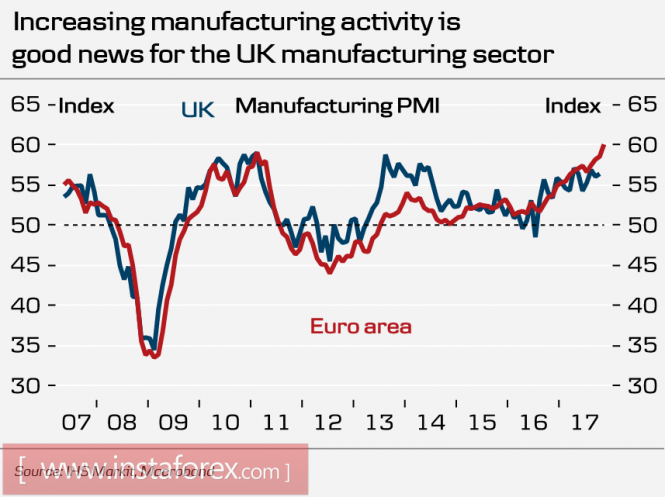

On Friday, the PMI Markit report will be published. Despite the fact that the index is in the confidently positive zone, it still lags behind the similar index for the eurozone, which increases the chances of the euro to rise against the pound.

In fact, the only significant factor supporting the pound is the expectation that the Bank of England will continue to raise rates based on high inflation, but these expectations can gradually disappear, since inflation is unlikely to continue to rise against the backdrop of weak household incomes and a drop in consumer confidence.

The Brexit factor has now come to the back burner, as the parties are holding consultations before the meeting on December 14-15. The pound, despite attempts at growth, does not look like a favorite against the dollar, and the resistance level of 1.3400 has a chance to hold, and by the end of next week there are grounds to expect a turn of GBPUSD to the downward direction with the purpose of the next testing of support 1.30.

Oil

On Wednesday, November 29, the next OPEC meeting will begin, which will have to consolidate the cartel's unified position towards OPEC + startup talks this weekend, which will extend the deal to cut production. By the evening of Friday, oil prices began to rise again, with the Brent was fixed above 63 dollars per barrel on the background of rumors that Russia and Saudi Arabia in general agreed on a plan to extend the agreement until the end of next year, and only technical issues remained.

There were news that Russia was proposing a new formula for calculating production volumes, which would link the size of the reduction to the state of the oil market. If these rumors are confirmed, as a result, they will have a noticeable positive impact on quotes, since they will reduce the subjective factors that are the basis for negotiations each time and translate regulation into an understandable language of figures.

Positive expectations will contribute to the demand for oil, which is able to update the high of November and consolidate above the results of the week above $ 66/bpd.

The material has been provided by InstaForex Company - www.instaforex.com