Trading plan for 02/10/2017:

The US Dollar appreciated in the first hours of the Monday session, which was caused by a slight reshuffle on the debt market. EUR/USD opens a gap lower after the Catalan referendum riots and is currently trading at the level of 1.1754. Exchanges in China and Hong Kong are closed today due to a national holiday. Investors on the Tokyo Stock Exchange are likely to be positive as some modest gains in the Nikkei 225 (0.1%) are being noticed.

On Monday, 2nd of October 2017 we start a new month and a new quarter, but the event calendar is not very busy with important data releases. Early in the morning, Spain, Germany, France, Italy and the UK will release PMI Manufacturing data, and Switzerland will post the Retail Sales data. During the US session, Canada will present RBC Manufacturing PMI (s.a.) data and the US will post ISM Manufacturing PMI data.

EUR/USD analysis for 02/10/2017:

The PMI Manufacturing data from across the Eurozone main economies will be released during the early London session and at 08:30 am GMT the UK will post PMI Manufacturing data as well. In general, market participants do not expect any surprises in the reading and have a positive attitude towards the PMI Manufacturing figures. Moreover, the Unemployment Rate from the whole Eurozone is expected to tick lower from 9.1% to 9.0%, so it can elevate the mood even higher. Nevertheless, the Catalan referendum results and riots might weight on the Euro sentiment during the day. Approximately 2.26 million people voted, 90% of whom voted for the region's independence, the Catalan regional government said. 8% were opposed to the region's independence and other voices were invalid. As reported by the Catalan government spokesman Jordi Turull, about 42.3% of the eligible Catalan voters were present in the referendum. This means that these results were very similar to those of the unofficial poll that was held in November 2014. Jordi Turull stated that the converted ballot papers do not include those that were confiscated by the Spanish police during a forceful intervention at polling stations. He added that during the fight with law enforcement officials, at least 844 people were injured, including two in severe condition. The wounded were also 33 policemen.

No one can predict what will happen if the Catalan authorities, as promised, relying on the results of such a "chaotic" referendum, will accept its results as a basis for proclaiming independence, threatening Spain with the loss of one of its richest and most economically developed regions. Whatever the outcome of this decision will be, it will have an impact on the Euro anyway.

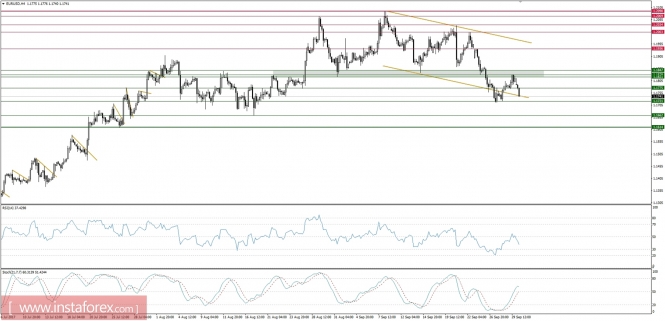

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The technical resistance at the level of 1.1826 was too strong for bulls to be broken, so the price reversed towards the old support at the level of 1.1721. If this support is violated then the next is seen at the level of 1.1662.

Market Snapshot: Gold down below another support

The price of Gold has broken below the technical support at the level of $1,274 and it is heading towards the next support at the level of $1,267. The market conditions are oversold and there is a visible bullish divergence between the price and momentum oscillator, but the downtrend prevails.

Market Snapshot: EUR/GBP in a horizontal correction

The price of EUR/GBP has broken below the golden trend line and now seems to be locked in a narrow horizontal zone between the levels of 0.8742 - 0.8851. On a daily time frame, the market conditions are oversold, but any bounce towards the level of 0.8851 was capped so far. In a case of any breakout lower, the next support is 61%Fibo at the level of 0.8692.