EUR/JPY has been quite volatile recently after bouncing off the 134.40 resistance level. The bullish trend was quite impressive before the price countered with bearish intervention to push the price lower. Today, a series of economic reports was published in the eurozone which helped the currency to gain consistent momentum over JPY throughout the day. Today, Spanish Services PMI report was published with an increased figure at 56.7 from the previous figure of 56.0 which was expected to be at 55.5, Italian Services PMI report was published with a decrease to 53.2 from the previous figure of 55.1 which was expected to be at 54.8, French Final Services PMI was published with a slight decrease to 57.0 which was expected to be unchanged at 57.1, German Final Services PMI report was published as expected with an unchanged figure at 55.6, and the eurozone's Final Services PMI report was published with a slight increase to 55.8 which was expected to be unchanged at 55.6. Along with these economic reports, the eurozone's Retail Sales report was published with a greater deficit of -0.5% from the previous value of -0.3% which was expected to show a positive change to 0.3%. On the JPY side, recent economic reports were quite mixed in nature that did not quite help JPY to gain any momentum over EUR. This Friday, Japan's Average Cash Earnings report is going to be published which is expected to show a positive change to 0.5% from its negative previous value of -0.6% and Leading Indicators report is also expected to show a rise to 107.2% from the previous value of 105.2%. As for the current scenario, EUR is expected to have an upper hand over JPY and the bullish trend is expected to continue further in the coming days. As of Friday, Japan's economic reports are due. If we see any positive outcome of the reports, then the market is expected to be volatile and correct itself before showing any directional move.

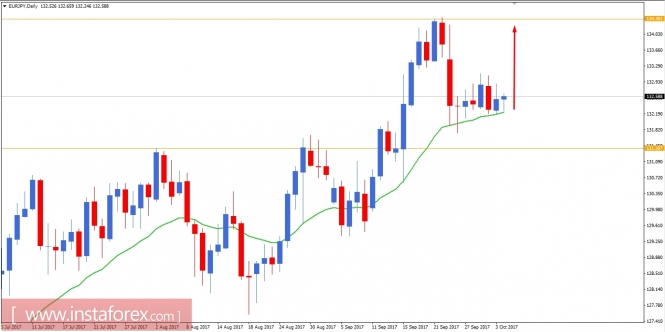

Now let us look at the technical chart. The price is currently residing inside a tight corrective range which is expected to break higher towards 134.40 resistance level again. After the bearish impulsive pressure, the price seems to get some barriers to proceed much downward which is indicating that the strength of bears is not quite strong to push the price much lower. As the price remains above the dynamic level of 20 EMA and 131.40 support level, the bullish bias is expected to continue further.