Trading plan for 07/09/2017:

The market volatility remains limited before the decision on interest rates in the euro area. Among the majors, the change does not exceed 0.2%. The strongest is JPY (+0.17%), then NOK (+0.14%) and NZD (+0.14%). It is distinguished by AUD (-0.11%), which is the only one losing to the US Dollar. The Asian stock market failed to continue its positive sentiment, Hang Seng and Shanghai Composite are down nearly 0.1% under the line. The Nikkei 225 is up 0.2%.

On Thursday 7th of September 2017, the event calendar is busy with important economic releases. During the London session, the main event will be the European Central Bank interest rate decision and Press Conference. Moreover, Germany will post Industrial Production data, France will present Trade Balance data, and the UK will reveal Halifax House Price Index data for last month. During the US session, Canada will post Building Permits and Ivey Purchasing Managers Index data. The US will present Unemployment Claims and Continuing Claims data.

EUR/USD analysis for 07/09/2017:

The ECB Interest Rate Decision, Deposit Facility Rate, Marginal Lending Facility, and Asset Purchase Target data are scheduled for release at 11:45 am GMT. The Press Conference is scheduled at 12:30 pm GMT. Global investors expect the ECB to leave the interest rate unchanged at the level of 0.0% and the other data should not be changed as well. The most important will be Mario Draghi's statement during the press conference. According to yesterday's leaks, it is unlikely that the Governing Council of the ECB will decide on loosening the monetary policy before the October meeting as it is said in an anonymous report. The ECB Technical Committees have simulations containing various combinations of timeframes and asset purchases, suggesting a continuation of the QE in 2018. What's more, the Governing Council will also focus on the legal constraints associated with loosening, ie: the exposure limit. The gloomy outlook of gossip moderates the tention of the planned debate on land preparation for rising interest rates.

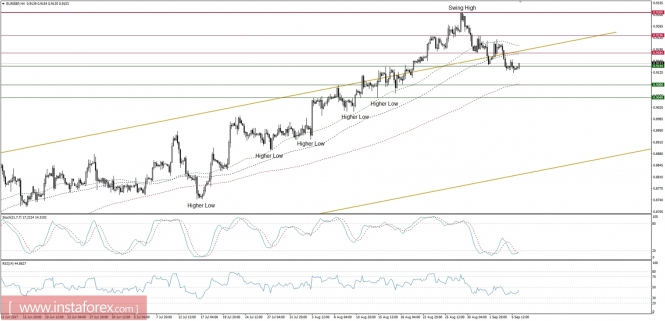

Let's now take a look at the EUR/USD technical picture on the H1 time frame. Yesterday's leaks have made the exchange rate to move higher towards the level of 1.1915, but the bullish enthusiasm was capped very soon and the price got back to the horizontal zone. Currently, the price is trading in a narrow horizontal area between the levels of 1.1910 - 1.1950 as it awaits the ECB rate decision. In case the ECB mentiones sooner-than-expected roll-over of the QE programme, the reaction should be bullish and the level of 1.2000 could be easily hit. Any dovish statements from Mario Draghi will likely result in a deterioration towards the level of 1.1817 and below.

Market Snapshot: DAX breaks above the trend line

The price of German index DAX has broken above the golden trend line around the level of 12,100 and is currently trading just below the technical resistance at the level of 12,319, just at the level of 50 DMA. The market conditions are neutral, but biased to the upside, so the resistance level might be tested soon.

Market Snapshot: EUR/GBP is back to the channel

For a brief moment the price of EUR/GBP broke above the 10-months high at the level of 0.9300, but quickly returned back to the golden channel zone. Despite this behaviour, the larger time frame trend remains bullish, but the price must break out back above the level of 0.9236 in order to test the recent swing high. Otherwise, the deterioration might deepen even more to the level of 0.9088 and below.