Hurricane Harvey did not bring happiness, but this disaster helped the "bulls" in the North Sea and saved them by catching the straw, instead of forcing them to flee the battlefield. The experts of Bloomberg predicted that the US black gold reserves will grow by 2.5 million barrels by the end of the week by 1 September, while the Goldman Sachs announced that it will reach 40 million barrels within a month as the hurricane ends. The oil became a more serious driver of growth which returned refinery to life.

ExxonMobil, Phillips 66, Valero Energy and others reported about the resumption of refining operations. As of September 5, factories with a capacity of 3.8 million b/s (about 20% of the total value for the States) were closed, while at the height of the hurricane it was about 4.2 million b/s capacity. According to the US Energy Information Administration, the continuation process can take several days or weeks. Everything will depend on the damage found at the time of the resumption.

Along with the return to life of the oil refinery, oil has another important hidden driver of growth as the domestic energy increased its demand among the states affected by Harvey. The White House asked the Congress for about $ 7.9 billion in aid to Texas and Louisiana for restoration work, which is regarded as a "bullish" factor for black gold.

However, Goldman Sachs claims that the potential growth of oil is limited, as the current situation is likely to take advantage of mining companies from the States. The possible price hike will increase the hedging of price risks and production volumes, which will affect the global balance of the physical asset market and the futures market. The bank draws attention to the fact that companies have significantly reduced costs in recent years, and the level of revenue showed a growth in profits. This position corresponds to the opinion of the Alexander Novak, Minister of Energy of Russia, saying that in 2018 Brent will cost $45-55 per barrel.

Corrections to the current alignment of forces can make another hurricane. Irma is moving in the direction of Florida, but it is impossible that its impact will be more serious for the US oil industry than Harvey's influence.

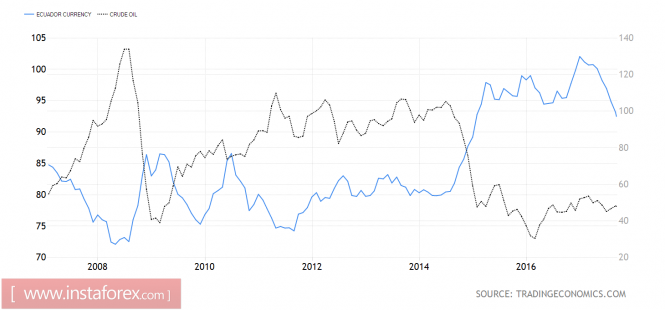

Brent and WTI gained support from the weak dollar. The dovish statement of Lael Brainard and Neel Kashkari reduced the potential increase of the federal funds rate in December to 37%. The growth of geopolitical risks related to North Korea put pressure on the yields of US Treasury bonds by pushing futures for the North Sea grade to the maximum levels since May.

Dynamics of oil and the dollar index

Source: Trading Economics.

Technically, the "bulls" renewed July highs of Brent along with the activation of the AB = CD pattern increase the risks of continuing the northern campaign towards the target at 127.2% and 161.8%. This corresponds to $54.7 and $56 per barrel. On the contrary, the inability of buyers to keep prices above the levels of $53.7 and $52.9 will indicate weakness.

Brent Daily Chart