The administration of Donald Trump presented the long-awaited tax reform plan. The new tax collection structure is designed to dramatically reduce the fiscal burden on business and households and, in the long term, contribute to economic growth. In particular, it is planned to reduce the profit rate from 35% to 20%, introduce a new rate for companies "pass-through businesses" of 25%, and reduce the tax burden "for the rich" from 39.6% to 35%.

In addition, the plan provides for such measures as the cancellation of the tax on the inheritance of the family business, the accelerated depreciation of capital investments and the change in the principle of levying taxes from the international to the territorial. These measures, as the White House hopes, will lead to an accelerated repatriation of capital.

At the same time, the plan does not contain calculations to assess the effectiveness of new measures and therefore is just a call for a broad discussion in Congress. Accordingly, the sharp demand for the dollar on Wednesday may turn out to be temporary.

Eurozone

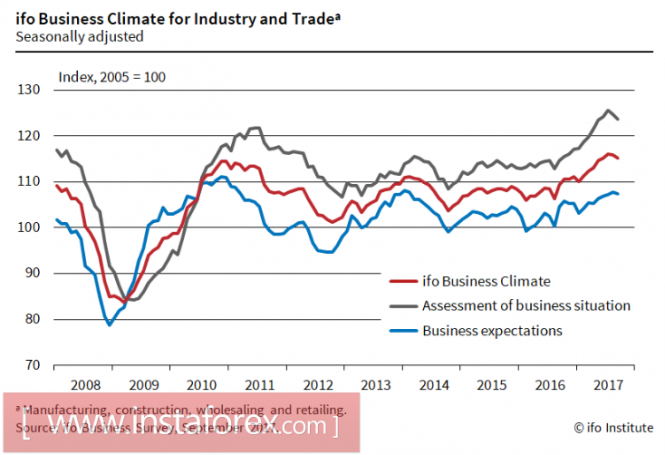

Ifo index, reflecting the state of the business climate, declined in September to 115.2p against 115.7p a month earlier, experts expected small growth. A decrease in the index may indicate that the impulse of activity in the eurozone is slowing, which in turn can serve as a signal for a respite in the euro rally.

ECB spokesman Kere said that the bank was not at all "scared" by the need to roll back the asset repurchase program but intends to carry out this process with caution. ECB President Mario Draghi confirmed on Monday the policy of gradual curtailment of the program, emphasizing that it is necessary to strengthen inflation along with economic recovery and therefore monetary regulation remains in demand to a large extent.

The ECB is trying to bring down the wave of demand for the euro and it seems that he succeeds. Along with the revival of bulls in the dollar, we can expect that the correction will continue, a decrease to 1.16 remains a priority scenario in the short term.

United Kingdom

In view of the lack of significant macroeconomic and political news, the pound took a short breather. The incoming signals are contradictory, the probability of an increase in the rate by the Bank of England remains the dominant idea and plays in favor of bulls but the momentum to growth has clearly slowed.

In favor of the fact that BoE will raise the rate in November, shows an unexpectedly high growth in retail sales. According to the Confederation of British Industrialists (CBI), the retail trade index rose sharply in September to + 42p against -10p in August. It is expected that in October, the strengthening of retail will continue which indicates a high consumer activity and growing inflationary pressures.

At the same time, the volume of consumer lending grew at the slowest pace in at least 5 months in August, growth was 1.5% against 1.9% in July, weak growth reflects the fears of households regarding the financial future.

The pound is likely to continue its technical decline to support 1.2920 / 90. To resume growth, a new driver is needed, which can be a good report on consumer and mortgage lending in August, which will be published on Friday.

Oil and ruble

Oil prices have renewed a two-year high due to fears of a lack of supply amid the global economic recovery. The trend has all chances to get development because the "Trump factor" enters into force, which will contribute to the growth of demand for energy.

Russia's GDP growth in August, according to the Ministry of Economic Development, increased to 2.3%, unemployment at historically low levels, inflation under control. There are no reasons for further weakening of the Russian currency, however, an expensive dollar can play its role. Nevertheless, the ruble forecast remains optimistic, there is no reason for a sharp collapse, the USD/RUR movement to the north will be moderate and slow down near the technical resistance of 58.20 / 58.70.

The material has been provided by InstaForex Company - www.instaforex.com