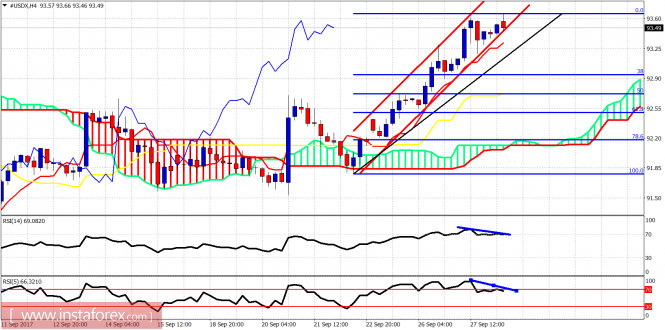

The US dollar index remains in a bullish short-term trend. Price target mentioned in our last analysis has been achieved. There are also signs of bearish divergence providing a warning for dollar bulls.

The US dollar index is inside the bullish channel. Both RSI indicators are diverging. Price could make a pullback towards 92.95 which is the short-term support and the 38% Fibonacci retracement of the latest rise. Cloud support is at 92.20. As long as we trade above it, the short-term trend is bullish.