The strengthening of the US dollar forced the bulls to flee from the battlefield in a panic over the XAU / USD pair. Quotes of gold fell below the psychologically important $ 1,300 per ounce mark against the background of Janet Yellen's "hawkish" rhetoric and the Republican readiness to voice details of the tax reform. The latter can disperse the US economy to 3%, which will strengthen the global appetite for risk and deal a serious blow to reliable assets.

The head of the Federal Reserve urged investors to understand the normalization of monetary policy. If we now rely on the slowing inflation, then in case of recession, the Central Bank will not have enough margin of safety to defeat it. Indeed, it is one thing when the economic recession comes at the time of finding the federal funds rate at the level of 3-3.5%. It's another things if it wanders near the 1% mark. What to do? Do we return to the use of non-traditional measures of monetary policy in the form of QE? After all, the balance of the Fed is already swelling and the risks of its further hike will lead to an increase in side effects.

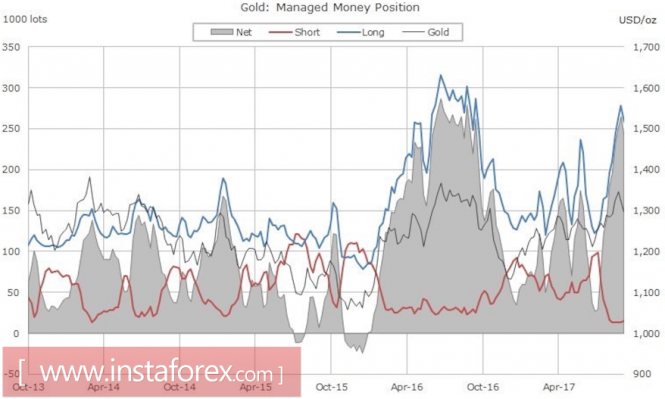

The rise in the probability of the December monetary restriction to 78% became a serious blow to the positions of the supporters of precious metal. In the week of September 19, the reduction in net shorts was because of the closure of long positions. Meanwhile, the value of short ones remained practically unchanged. During the last five days of September, new sellers entered the market.

Dynamics of speculative positions on gold

Source: CFTC, Bloomberg.

However, the "bulls" for XAU / USD still do not intend to fall to their knees. Commerzbank notes that demand for a physical asset remains strong, and central banks, led by Russian and Turkish regulators (+16 tons and +6 tons in August) continue to buy gold. Mitsubishi pays attention to the fact that against the backdrop of the "hawkish" rhetoric of representatives of the Fed, the profitability of the 2-year US Treasury bonds has risen to a maximum since 2008. As a result, the yield curve went down. Investors flee from short-term anti-risk securities into long-term ones, which can be considered as a positive factor for gold.

In my opinion, the analyzed asset will find support from time to time thanks to the geopolitical factor. Moreover, the potential for lowering the XAU / USD quotations is limited due to the ceiling of indicators such as the probability of the Fed's monetary policy tightening in December. Indeed, it is unlikely that the chances for an increase in the rate for federal funds will rise above 94-96% before the last meeting of the FOMC this year. That means that for more than 2 months they will go a little way more than in the last couple of decades.

Having accused the US of declaring war, North Korea is capable of launching a missile at any moment. This will immediately return investors' interest to safe havens. Not to mention that the beginning of full-scale military operations and the implementation of the promise of Donald Trump to erase a dangerous regime from the face of the earth can also boost gold.

Technically, the breakthrough of the lower border of the upward trading channel with the subsequent retest indicates that the initiative is in the hands of the "bears". If they manage to storm the support at $ 1280 per ounce, the risks of developing a correction in the direction of $ 1260 and $ 1,250 will significantly increase.