Eurozone

The following week after the ECB meeting on Thursday, the euro was able to increase, despite the fact that ECB President Mario Draghi did his best to bring down the wave of purchases.

The decision for monetary policy changes is postponed and most likely will resume in October. Draghi mentioned thrice in his speech the appreciation for the euro, but avoided clear reasons for this growth and he referred this to only as one of the factors saying "uncertainty that requires further monitoring." On Friday, the euro continued to rise on the wave of rumors about the possible situation next year. In one scenario, QE can continue for 6 or 9 months with a decrease in purchases to 20 or 40 billion euros. Obviously, when this scenario is implemented, then the reduction in the volume of purchases will be smooth and the euro has a chance to resume its growth.

Conclusions from the ECB meeting can determine the following.

- 1. The strong growth momentum of the euro increases the ECB's confidence regarding the potential economic growth. In 2017, the forecast for GDP will increase from 1.9% to 2.2%, and this is one of the reasons for the growth in demand for the European currency.

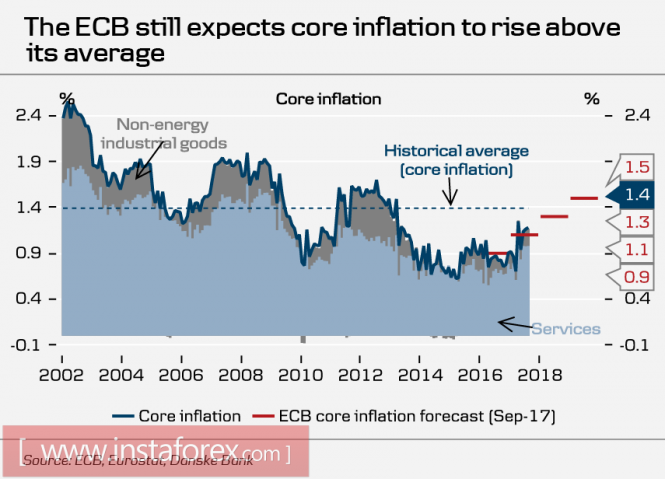

- 2. When it comes to inflation, the prospects remain unclear with a slight revision downward for 2018 and 2019 and rather a technical one.

In general for the euro, we can assume that the strengthening of the trend will continue. The ECB was unable to influence the investors' mood, and the idea about the need to curtail incentives against the background of economic growth remains dominant.

The second most important reason for the growth of euro is the continuous disappointment of investors in the US dollar. The completion of the interim agreement regarding the increase in national debt until December 15, reflects the fact that a long-term solution is not easy to find, and the next meeting will feature a confrontation in the power elite of the United States again. Rate forecasts virtually exclude another increase this year, and the upcoming rotation in the Fed leadership raise doubts that the previously announced target can be implemented.

Technically, the euro may go into correction due to a pronounced short-term overbought, but a decline below 1.16 is unlikely and will be used for new purchases.

United Kingdom

For the British pound, the week will be quite busy. On Tuesday, inflation data will be published. On Wednesday, the labor market and unemployment will be released, and the main event of the week will be held on Thursday, which is the regular meeting on monetary policy held by the Bank of England.

Players do not expect any changes since the meeting will not be accompanied by the publication of updated macroeconomic forecasts. The rate is likely to remain at 0.25%, and the number of votes is in favor of the current monetary policy and projected to be 7/2.

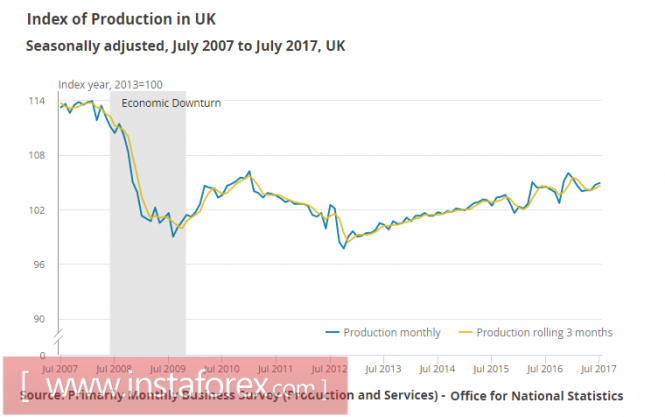

The NIESR Institute published a forecast for GDP growth, the estimate shows that the economic growth in the last three months was 0.4%, which is much better than the previous 0.2%, the growth is due to the development of the services sector and the strong growth in the manufacturing sector.

NIESR, whose opinion is heard by the Bank of England in the development of monetary policy, recommends raising the rate by 0.25% in the first quarter of 2018, provided that the economy continues to grow. This is a bullish signal for the pound which could reduce the spread of yields to its advantage, amid adjustments on the Fed's plans. The pound would likely update the maximum reached in August and will try to reach 1.36 in the next month.

Oil and Ruble

The prices for Brent continue to hold above $53/bbl and did not pay attention to any bearish signals. One of the reasons is the growth in demand amid fears of a possible increase in US gasoline consumption due to the struggle with the consequences of hurricanes "Harvey" and "Irma". Price support has noticeably weakened the dollar.

The market awaits for news from the camp of OPEC. Saudi Arabia intends to reduce exports in October by 350 thousand barrels per day. Moreover, the agreement on limiting production can be extended after six months which is the next schedule of OPEC meeting, according to rumors. While the initiative is with bulls, oil can already test $ 55 / bbl this week.

The Ruble will hold the week near the highs reached during the evening, while strong movements are not expected. The market will wait for the rate decision of the Central Bank of Russia.

The material has been provided by InstaForex Company - www.instaforex.com