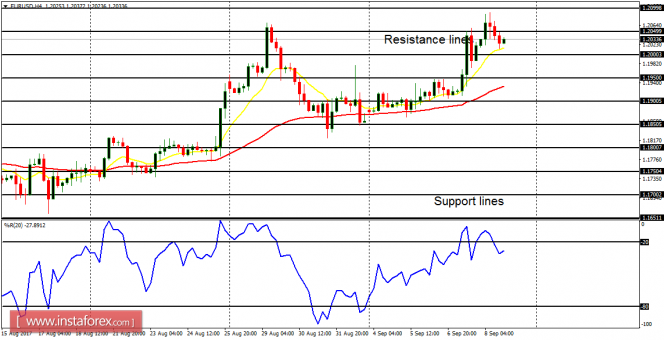

EUR/USD: This pair is bullish – and there is a bullish outlook on the market this week. This is also true of EUR pairs, for they are expected to go upwards this (in most cases). Price would reach the resistance lines at 1.2050, 1.3000 and 1.3050 (which is the ultimate target for the week).

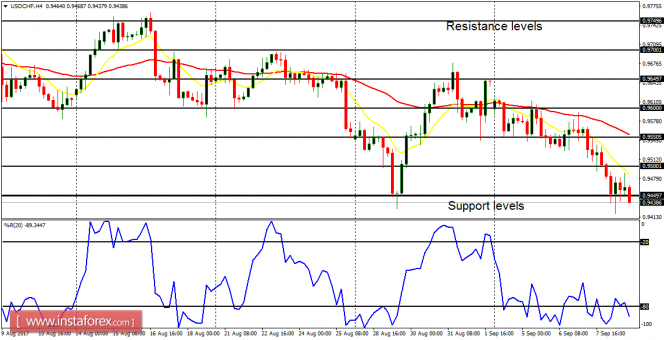

USD/CHF: The USD/CHF pair trended downward last week, went briefly below the support level at 0.9450 and then closed above it on Friday. Further bearish movement is anticipated this week, and price would test the support levels at 0.9450, 0.9400, and 0.9350. As long as EUR/USD is weak, a meaningful rally on USD/CHF cannot be expected.

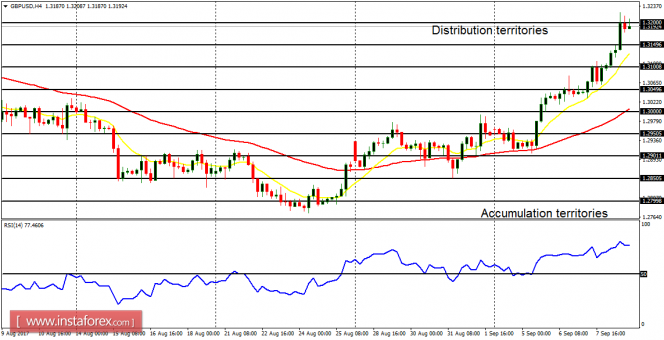

GBP/USD: This pair gained a minimum of 270 pips last week, rising in the beginning of the week and testing the distribution territory at 1.3200. That distribution territory has been tested a few times and it would eventually be breached to the upside, as price targets another distribution territories at 1.3250, 1.3300, and 1.3350.

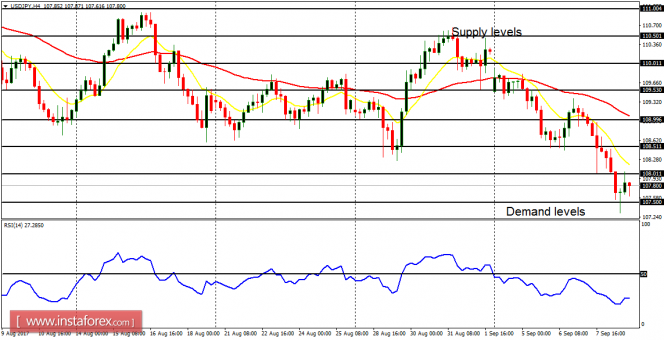

USD/JPY: The USD/JPY pair dropped about 250 pips last week, having dropped about 660 pips since July 11, 2017. There is a huge Bearish Confirmation Pattern in the market, which points to more southwards movement. However, the outlook on JPY pairs is bullish this week, which means that, while further southwards movement is possible, the market would reverse and rally before the end of the week.

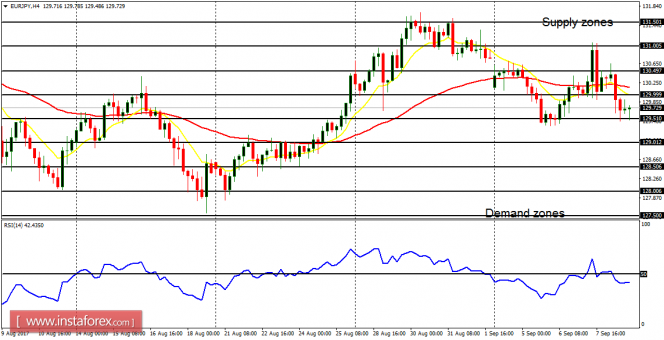

EUR/JPY: This currency trading instrument has become essentially neutral – for there was no directional movement in the market last week. This week, price is expected to go either above the supply zone at 131.00 (staying above it) or to go below the demand zone at 129.50, (staying below it). Except one of these conditions are met, the market cannot be said to be trending in the short term.