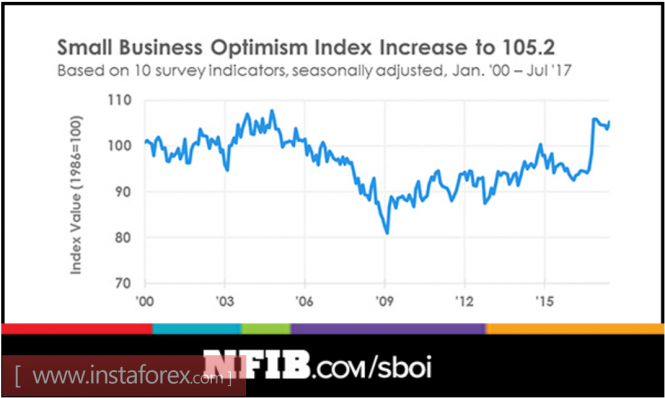

The US dollar against the backdrop of growing risks begins a long-awaited turn. The NFIB index of business optimism in small businesses rose in July to 105.2p against 103.6p a month earlier, positive expectations clearly outweighed, with the index currently at 10-year highs.

The consumer optimism index from IBD / TIPP shows similar data. The growth from August to 52.2p against July 50.2p also turned out to be a surprise for experts who are expecting a more modest result. Also in favor of the rise in optimism, the growth of open vacancies in the US labor market in June is higher than expected, which is confirmed by forecasts of a steady increase in employment.

However, economic indicators did not play a major role in the growth of the demand for the dollar. Instead, in the foreground was the comments on the leadership of the Fed.

The head of the Federal Reserve Bank of St. Louis, James Bullard, said on Monday that the current level of short-term rates is quite suitable to expectations, their increase is not yet appropriate, and it might seem that Bullard's position looks too soft. However, for a number of other key parameters, he gave a very aggressive remark. In particular, he confirmed the policy of further reducing unemployment, and also announced the improvement of the dollar's position as the world reserve currency. In fact, Bullard's words implied that the depreciation of the dollar is not based on objective factors of the state of the US economy, but instead on expectations of the tightening of monetary policy from the ECB.

Bullard's colleague Neil Kashkari, head of the Federal Reserve Bank of Minneapolis, gave a similar comment - the current rate is quite appropriate, inflation is low, but it does not cause concern, and the Fed should begin a quantitative tightening program in September. A week earlier, a similar position was expressed by the president of the Federal Reserve Bank of San Francisco, John Williams. In his opinion, we should begin the program to reduce the Fed's balance sheet this fall.

In this manner, there are three voting members of the Fed, with two being the most evident "doves", who have expressed their readiness to launch a program to reduce the balance sheet. The message is completely clear - there will be no rate reduction in September, but a quantitative tightening will begin.

It should be noted that the Fed's sale of the assets will not lead to a reduction in the balance sheet. Since it is necessary to simultaneously reduce the liabilities. It is apparent that in order to reduce the amount of cash in the economy or weaken the requirements for mandatory reserves of commercial banks, the Fed would choose not to. Therefore, the only way to achieve the desired result is to reduce the volume of deposits of commercial banks. In other words, along with the launch of the asset reduction program, the Fed must also submit a method for trimming the rate on surplus funds of commercial banks, which currently accounts for half of all the liabilities of the Fed.

The announcement of the launch of this process could bring about serious movements in the financial markets and heightened tension. To prevent negative developments, an alternative to "parking" more than $ 2.2 trillion from the accounts of the Fed is needed, and such an alternative may well be the launch of a reindustrialization program. Hence, a simple conclusion, along with the decision of the FRS, Trump will submit to the Congress a draft tax reform, which will be adopted. To which, as a result, according to the idea, will then create a powerful mechanism for inflow of investments from around the world.

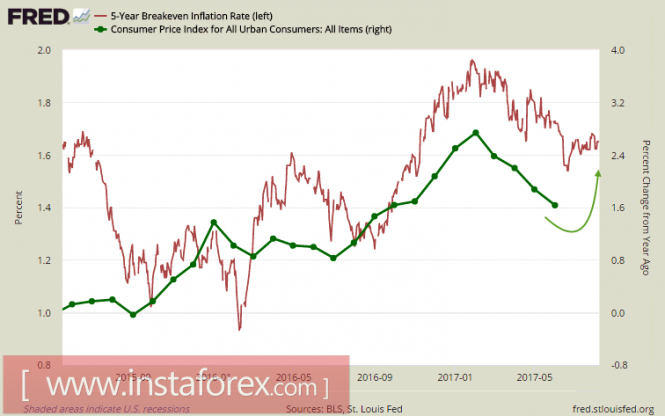

On Thursday, there will be data on producer prices, while on Friday - on consumer inflation in July. Judging by the dynamics of the yields of TIPS bonds, the fall in prices is suspended and investors can expect inflation to rise.

The negative might occur on Thursday, when the report on the state of the budget in July will be published. However, investors apparently no longer want to pay attention to such trifles. The US is preparing to include a "dollar vacuum cleaner" - a mechanism for returning money to the country. What it will lead to, would be easy to predict - towards a strong growth of risks, especially in developing countries, demand for defensive assets and the US dollar.

The trend to strengthen the commodity currencies will be completed, the yen, the franc and the dollar will appear in the favorites.

The material has been provided by InstaForex Company - www.instaforex.com