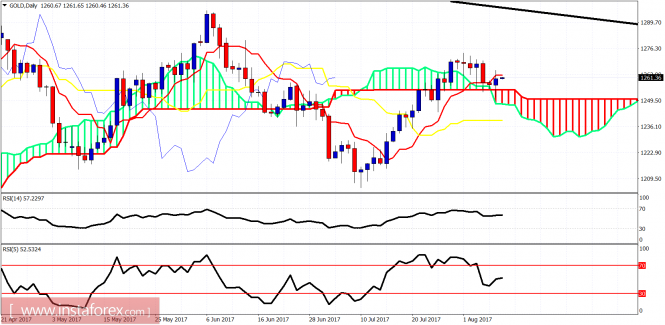

Gold price has reached very close to our minimum pull back to target and daily Kumo (cloud) support at $1,250 as expected and is bouncing. Price remains trapped inside the short-term bearish channel and short term trend remains neutral or slightly bearish. The longer-term view remains bullish.

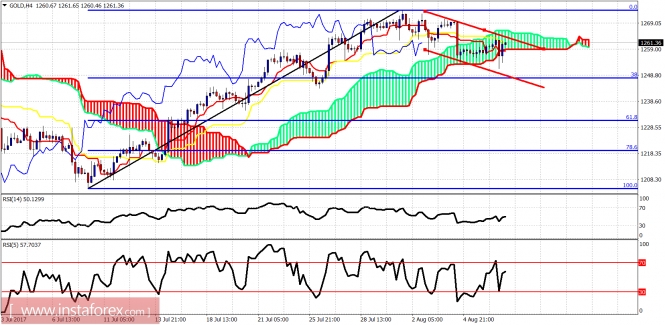

Red lines - bearish channel

Gold price is trading inside the Kumo. The trend is neutral. Short-term support is at $1,249 (38% Fibonacci retracement). Resistance is at $1,257.