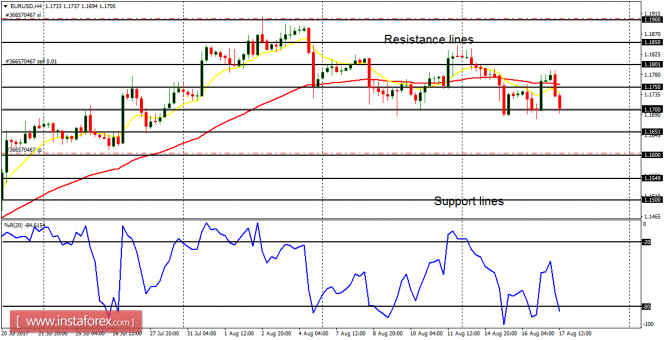

EUR/USD: Bears have made a commendable effort to push the price southwards, but the effort now and then is being scuttled by the bulls' machination. The market is quite choppy right now, and it would make sense to stay away from it, until price goes above the resistance line at 1.1800 or below the support line at 1.1700.

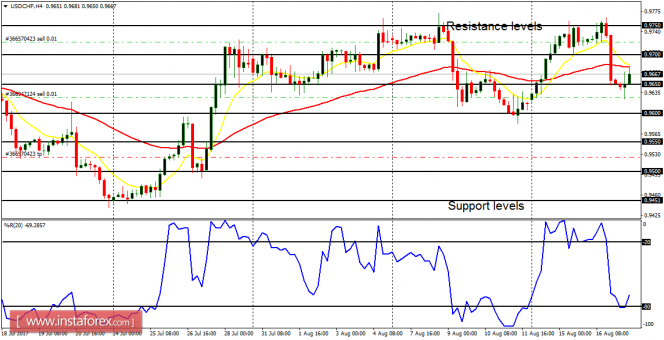

USD/CHF: Bulls have made a commendable effort to push the price northwards, but the effort now and then is being scuttled by the bears' machination. The market is quite choppy right now, and it would make sense to stay away from it, until the price goes above the resistance level at 1.9750 or below the support level at 0.9600. Some fundamental figures are expected today and they may have impact on the market.

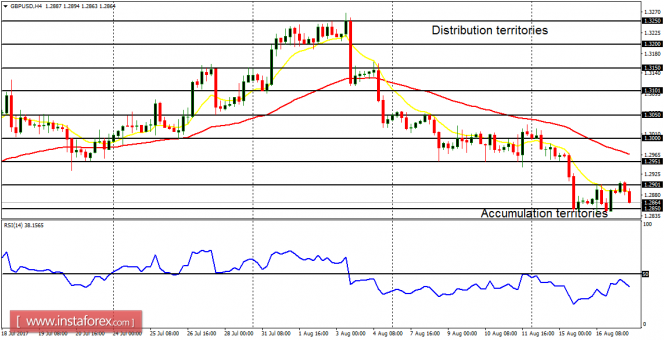

GBP/USD: This is a bear market, which has gone downward by about 130 pips, and it has tested the accumulation territory at 1.2850 several times. The EMA 11 is below the EMA 56 and the RSI with period 14 is below the level 50. Since there is a Bearish Confirmation Pattern in the market, it is expected that the accumulation territory would eventually be breached to the downside as the price journeys further south.

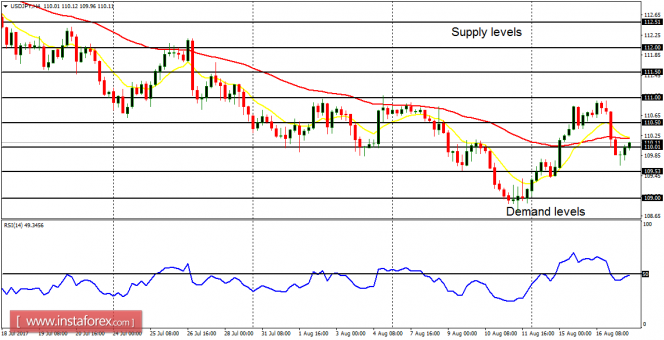

USD/JPY: The bullish effort that was seen in the last few days on the USD/JPY is currently being threatened. The price has gone up by 180 pips, almost reaching the supply level at 111.00, prior to the pullback that was witnessed last week. The pullback has become a threat to the extant bullish outlook, but it has not overridden it. A movement below the demand level at 109.50 would render the bullish effort completely invalid, while a movement of about 150 pips to the upside would help restore the short-term bullishness in the market.

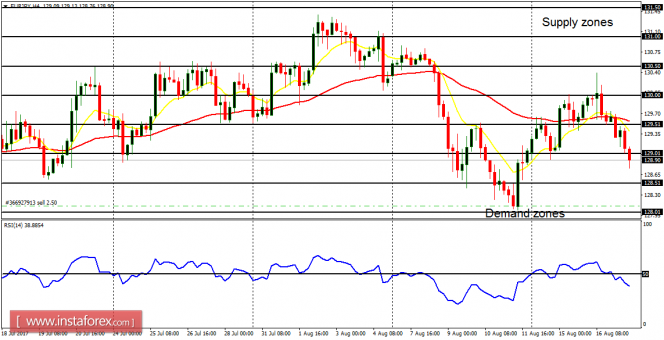

EUR/JPY: This pair has just generated a bearish signal, nullifying the bullish effort that was witnessed a few days ago. The price is now below the supply zone at 129.00, going towards the demand zones at 128.50 and 128.00. These are the ultimate targets for the week.