Trading plan for 26/07/2017:

The night session was dominated by Australian CPI inflation surprising data. In Q2 the strength of inflationary processes clearly disappointed the expectations of the market participants, as the price index jumped only 0.2% (consensus: 0.4 percent). The inflow of not optimistic data clearly weakens the Australian dollar, which is currently losing 0.5% to his American counterpart. The US Dollar is under pressure not because of today's FOMC decision, but also plans for the future of Obamacare. EUR/USD trades at the level of 1.6330, GBP/USD trades at the level of 1.3015. The strongest gains are seen in the Tokyo Stock Exchange, where the Nikkei 225 0.6% rally is driven by the industrial companies. The Shanghai Composite Index gains 0.06%, close to day open.

On Wednesday 26th of July, the event calendar is busy with the important economic releases. At the beginning, Switzerland will release Credit Suisse ZEW Survey (Expectations) index data, then the UK will post Preliminary GDP. Nevertheless, the main event of the day is the FOMC Interest Rate Decision and Statement that will be published later on the day.

GBP/USD analysis for 26/07/2017:

The UK Preliminary GDP for the second quarter is scheduled for release at 08:30 am GMT and the market participants expect an increase in the second quarter from 0.2% to 0.3% and an overall decrease from 2.0% to 1.7% on yearly basis. The prediction matches the National Institute of Economic and Social Research's projection. Given the uncertainty of the result of the Brexit negotiations, there is no reason to increase the UK GDP expectations for this year. Moreover, some economists are expecting even slower growth this year, for example, the Centre for Economics and Business Research is looking for output to rise just 1.3% this year. Today's data does not look like they are about to change this outlook and if the data will disappoint, then the British Pound might feel pressure across the board.

Let's now take a look at the GBP/USD technical picture at the H4 timeframe. The market keeps trading sideways between the levels of 1.2931 - 1.3125, but any attempt to rally is quickly capped above 1.3100 area. The market conditions are starting to look overbought again, so the odds for a downside breakout will increase if the UK data will be worse than anticipated. The next most important support is 61%Fibo at the level of 1.2931, so any breakout below this level will open the road towards the technical support at the level of 1.2861.

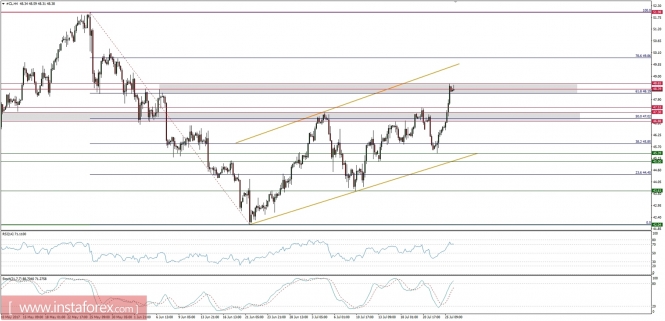

Market Snapshot: Crude Oil rally after the data

The price of Crude Oil spiked up above $48.00 level after the latest American Petroleum Institute (API) inventory data for the week ending July 21st, which recorded a draw of 10.23 million barrels. In the result., the price has broken above the technical resistance zone and touched the 61%Fibo at the level of $48.19, with a high at the level of $48.65. Currently, the market conditions are starting to look overbought, but there is no visible divergence yet. The level of $47.53 will act as a technical support now.

Market Snapshot: GBP/JPY retraced 50% of the last swing down

The price of GBP/JPY has retraced 50% of the recent down swing and was capped at the level of 145.86 so far. The next technical resistance is at the level of 146.03, which is just below the 615Fibo at the level of 146.32. There is still a chance that this level will be hit before the overbought market conditions will result in another leg down on this pair.