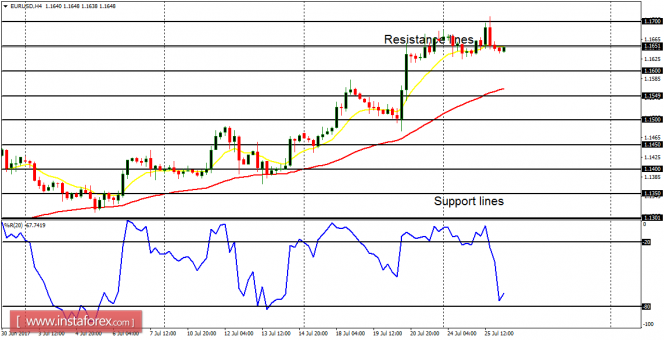

EUR/USD: The bullish bias on this market remains intact – though the price is currently consolidating. The EMA 11 is above the EMA 56, but the Williams' % Range period 20 is in the oversold region. This could be a bullish signal, especially when the Williams' % Range rises from the oversold region.

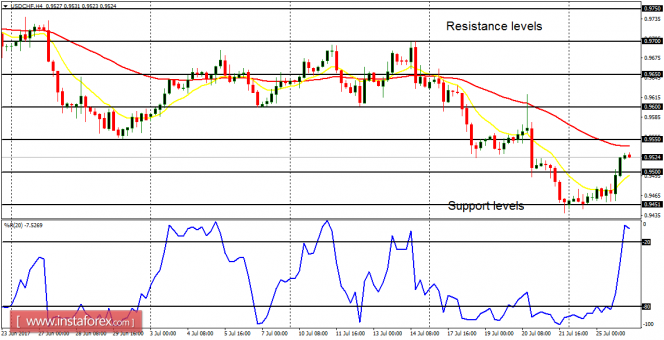

USD/CHF: The USD/CHF is currently experiencing a short-term rally in the context of a downtrend. The price has risen 70 pips this week, now above the support level at 0.9500. A movement above the resistance level at 0.9650 would result in a bullish bias; while a movement below the support level at 0.9450 would act to emphasize the recent bearish bias.

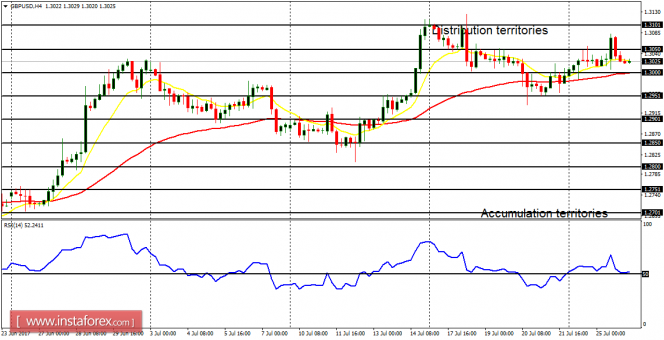

GBP/USD: Despite the consolidation on the Cable, the Bullish Confirmation Pattern in the 4-chart is still existing (though threatened). The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. There is supposed to be a rise in momentum before the end of this week, or early next week, which would most probably favor bulls.

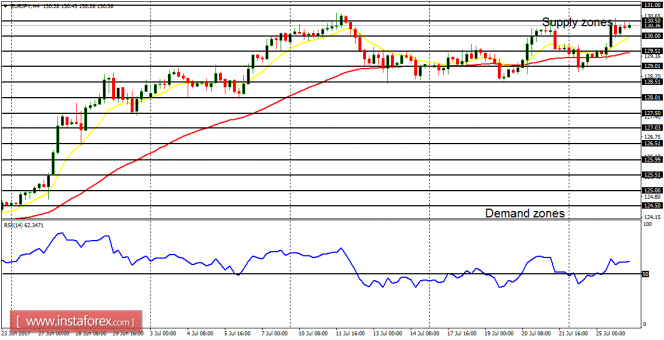

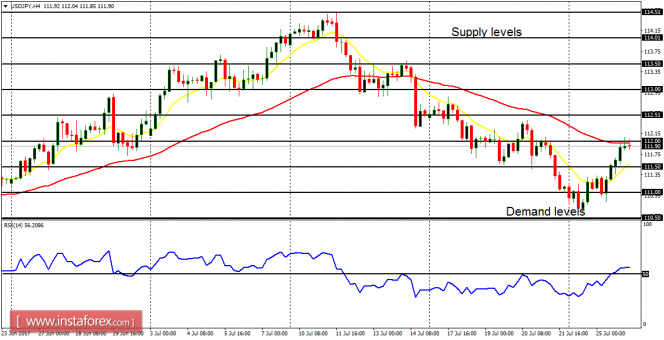

USD/JPY: The USD/JPY is currently experiencing a short-term rally in the context of a downtrend. Price has risen by 100 pips this week, now close to the supply level at 112.00. A movement above the supply level at 113.00 would result in a bullish bias; while a movement below the demand level at 111.00 would act to emphasize the recent bearish bias.

EUR/JPY: This cross has held out its bullishness so far, in spite of the short-term consolidation being witnessed. One reason the cross is able to remain bullish till now is the strength in the EUR itself, and things would begin to drop once the EUR loses strength. There could be a reversal within the next several trading days.