Today, the US Federal Open Market Committee will hold a regular meeting on monetary policy. Despite the fact that the incoming signals about the slowdown in economic activity reduces the FOMC's ability to implement previously stated goals, we should not expect surprises from today's meeting since macroeconomic forecasts will not be adjusted because of it.

The Fed will most likely postpone any active actions until the fall. The market is currently inclined to the fact that the announcement of the beginning of a "quantitative tightening" will be on September 15. This includes the procedure for the reduction of balance sheets followed by a rate increase in December.

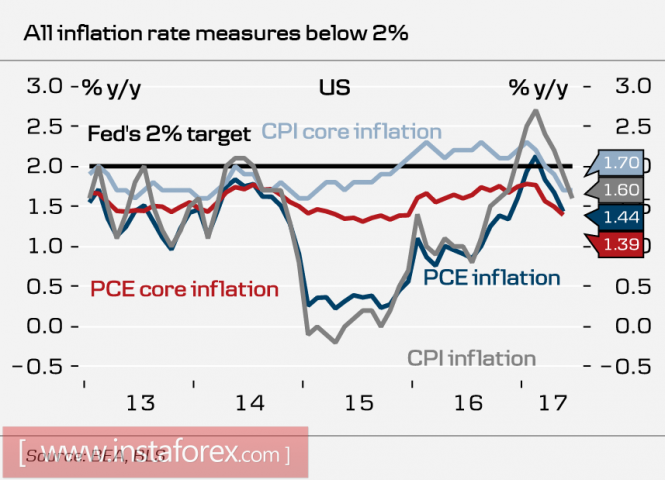

The only intrigue is whether or not the accompanying text of the statement will be changed. One of the key parameters guiding the Fed in its decisions is inflation which has been slowing down for four consecutive months. This has always been expressed in the market's growing concerns. If the Fed reflects the slowdown in inflation in their statement, then the markets will perceive this change as a bearish signal.

At the moment, there is no reason to expect that the Fed will change comments. The basic principle that governs the regulator is the improvement in the labor market which is contributing to wage growth. This in turn contributes to core inflation growth. The last employment report for June can be considered positive as the pace of growth of new jobs is not slowing down. This is a confirmation that the Fed will not change the wording of the accompanying statement.

The dollar, therefore, is unlikely to react to the results of the FOMC meeting. The players will instead focus on other criteria. Macroeconomic data, published earlier this week, is still contradictory and does not give any new drivers. Preliminary PMI Markit values for July came out somewhat better than expected at 53.2p in the manufacturing sector and 54.2p in the service sector against expectations of 52.0p and 54.0p respectively. However, the housing market has brought a solid negative. Sales in the secondary market slowed in June. Meanwhile, the housing price index in May was also slightly below expectations according to Standard & Poor's. This indicates a decrease in inflation expectations.

Political risks are also growing. The US Congress House of Representatives voted to adopt a wide package of sanctions directed against Russia, Iran, and the DPRK. The streamlined and unconvincing wording cannot hide the main conclusion from the current situation namely the significant deterioration of the US and European relations, especially in Germany. This is because Germany is the main beneficiary of the "Nord Stream-2" gas pipeline which is currently under construction. The new sanctions are aimed mostly against European companies. Because of this the adoption of the law may cause retaliatory actions from the EU leaders. A new round of war sanctions can inflict significant damage to US and European relations because it does not stand up in terms of feasibility of pursuing a coherent policy. This can give the EU leaders limited access to US financial companies on the European market. The likelihood of such a step is in favor of the euro, since it will reduce demand for the dollar in European companies.

On Friday, the first preliminary estimate of the US GDP growth for the second quarter will be published. Expectations are positive with experts predicting a 2.6% growth, slightly higher than the average in recent years. At the same time, forecasts for spending in personal consumption are extremely weak which already puts pressure on the dollar.

The euro, in its current situation, still looks stronger than the dollar. Reaching 1.19 in the short-term is likely.

The material has been provided by InstaForex Company - www.instaforex.com